You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EURUSD - bat 20pips, gartley 40pips, cypher 30pips, crab -35pips and just a short 70pips.

EURGBP - butterfly 25pips and butterfly 20pips.

EURAUD - cypher 90pips.

EURCAD - butterfly + Demark9 30pips.

GBPUSD - crab 50pips.

AUDUSD - white swan + Demark9 30pips.

NZDUSD - N200 70pips, cypher 25pips.

USDCHF - bat -25pips.

USDCAD - gartley 70pips.

USDJPY - bat -35pips.

GBPJPY - butterfly 113 + demark9 40pips, bat 35pips, gartley 40pips.

EURJPY - gartley 30pips, cypher -20pips, cypher -35pips, gartley 45pips.

CHFJPY - bat 50pips.Thank you, that is really encouraging! :) Is it just this week?

:) Is it just this week?

It is even a benchmark result for HP traders I think. (please do not misunderstand this comment! It is a benchmark! I had previously a 300 pip average from HP traders, and my past showed weeks possible with 600-1300 sometimes, and my worst loosing week was around a -70 pips but it is just depending on the week and personal conditions I think).

I am glad for you!

Just remembered one more question- on which deal you took the biggest SL pips at entry and how big that was? ( I understand R/R concept, I just want to have the size of risk pips for my reference). Tnx

Thank you, that is really encouraging!

It is even a benchmark result for HP traders I think. (please do not misunderstand this comment! It is a benchmark! I had previously a 300 pip average from HP traders, and my past showed weeks possible with 600-1300 sometimes, and my worst loosing week was around a -70 pips but it is just depending on the week and personal conditions I think).

I am glad for you!

Just remembered one more question- on which deal you took the biggest SL pips at entry and how big that was? ( I understand R/R concept, I just want to have the size of risk pips for my reference). TnxYes that's for only this week from October 28th - November 1st. My biggest loss was -100pips. When there's over 100pips gap between X and D of a pattern, I tend not to trade but it applies on daily chart.

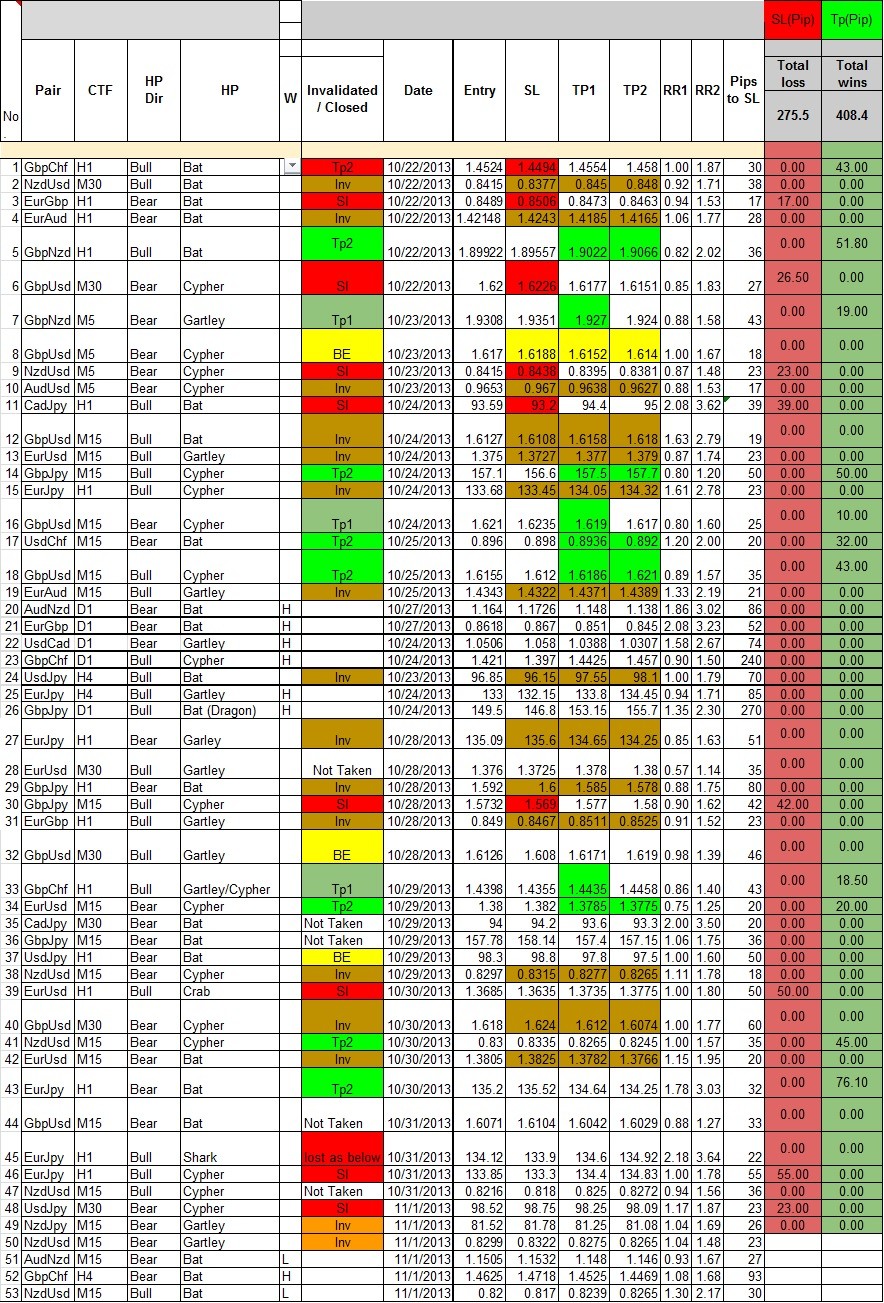

Yes that's for only this week from October 28th - November 1st. My biggest loss was -100pips. When there's over 100pips gap between X and D of a pattern, I tend not to trade but it applies on daily chart.

Thank you! Do you have a similar X-D max limit in your mind for an H1 chart, when you rather skip a pattern?

Can you comment your view on why the bat trades came out this week behind the rest? Anything special about the week or the pairs where you took the bats? Also the cypher data looks lower than claimed by the T2T team. Are you using the same definition as they gave for a cypher, or is there any difference?

One last one sorry: are you using pending orders, or entering at market or does it depend on something?

sorry: are you using pending orders, or entering at market or does it depend on something?

Thank you! Do you have a similar X-D max limit in your mind for an H1 chart, when you rather skip a pattern?

Can you comment your view on why the bat trades came out this week behind the rest? Anything special about the week or the pairs where you took the bats? Also the cypher data looks lower than claimed by the T2T team. Are you using the same definition as they gave for a cypher, or is there any difference?

One last oneI don't usually skip patterns unless I have bad feelings or something. Like I said before, I skip patterns found on lower time frame like 1m or 5m. PRZ is within 100pips, that's my preference. If there's a bullish pattern that has 150pips in its PRZ, I wait and see if price keeps going down and see if price reaches another support and then that time if my risk is under 100pips, I open a long position. If that doesn't happen, I just skip it.

Thank you! Do you have a similar X-D max limit in your mind for an H1 chart, when you rather skip a pattern?

Can you comment your view on why the bat trades came out this week behind the rest? Anything special about the week or the pairs where you took the bats? Also the cypher data looks lower than claimed by the T2T team. Are you using the same definition as they gave for a cypher, or is there any difference?

One last oneI don't know whose data it is so I can't tell why those bats came out behind the rest. I'd like to see those bats they took. I think it's just the way cookie crumbles. Nothing special about the bats I took actually. The one I took on USDCHF, I could've closed in profit cuz it grabbed about 30pips but didn't reach my target which was 38.2 CD retracement. I use almost the same definition as they do. They use 78.6 XC retracement for D but I use 78.6 XD retracement for D almost always. There was a bearish cypher on EURUSD 30m this week, Akil Stokes found that to but X of his cypher was different from the one I found, look at pics below. Blue cypher is the one Akil found and the red one is what I found. Also look at the third pic, DR1 and DR2 were nicely sitting in the PRZ of my cypher. Akil's cypher ended up in profit but I'm sure it took some pain. Also I need you to know that the way they place targets is different from me. For instance, they take XD of a pattern to determine targets but I take CD of a pattern. Sometimes it depends on targets to tell whether if a pattern has worked out or not.

I don't know whose data it is so I can't tell why those bats came out behind the rest. I'd like to see those bats they took. I think it's just the way cookie crumbles. Nothing special about the bats I took actually. The one I took on USDCHF, I could've closed in profit cuz it grabbed about 30pips but didn't reach my target which was 38.2 CD retracement. I use almost the same definition as they do. They use 78.6 XC retracement for D but I use 78.6 XD retracement for D almost always. There was a bearish cypher on EURUSD 30m this week, Akil Stokes found that to but X of his cypher was different from the one I found, look at pics below. Blue cypher is the one Akil found and the red one is what I found. Also look at the third pic, DR1 and DR2 were nicely sitting in the PRZ of my cypher. Akil's cypher ended up in profit but I'm sure it took some pain. Also I need you to know that the way they place targets is different from me. For instance, they take XD of a pattern to determine targets but I take CD of a pattern. Sometimes it depends on targets to tell whether if a pattern has worked out or not.

Thank RyuShin you are great!

The data is from your list, so these must be your bats, that is why I was asking your opinion, whether you can draw any conclusion for our benefit.

Thank RyuShin you are great! The data is from your list, so these must be your bats, that is why I was asking your opinion, whether you can draw any conclusion for our benefit.

Oh my list lol. Well thank you for making the data. It's good to see my data since I don't make it. What about your data?

Oh my list lol. Well thank you for making the data. It's good to see my data since I don't make it. What about your data?

Done but will take a while, still the CAs to be reviwed.

but will take a while, still the CAs to be reviwed.

-10 pips this week, total in past 2 weeks over 100 pips positive.

Mainly low TF H1 and M15

This is why I started benchmarking your data, I see you are doing great, and just to learn to improve .

.

Done

-10 pips this week, total in past 2 weeks over 100 pips positive.

Mainly low TF H1 and M15

This is why I started benchmarking your data, I see you are doing great, and just to learn to improveI think I see you getting better and better and I think we're getting better and better together

Sometimes I miss simple things. Check out this simple AB=CD on EURUSD daily. C is 50 retracement of AB and D is 200 BC inversion which is perfectly right ratio. ABCD and AB=CD are simple, yet very powerful.