I agree that forex or e-mini trading for that matter is not for everyone. In that sense, the market is an effective filtering mechanism. When I started to learn about trading at my first job, the retail market did not exist. Charts were done on rolls of paper and we used phones and telex machines. It was strictly bank to bank. Technology changed everything and we are now where we are for better or for worse.

I don't think institutions are responsible for the chaos and I don't think they pay much attention to the retail market. Markets have become chaotic for everyone. You can blame millisecond transactions and a zero interest rate world for that.

Alex

Doc

50 lots is peanuts for some "systems" that have been "presented" : some people think that with 500:1 leverage they can trade 5 digit lot sizes. And they sincerely think that it is possible. In my opinion the biggest problem is "information filtering" : people tend to hear and "know" only what conforms with their hopes and thus they simply ignore any other information. Is it good or bad I don't know. For trading it is bad, but in real life that allows people to live in a perpetual dream and that might even prove to be good.

After all, isn't that what we all dream of

Some may wonder why I decided to open this thread in a place so close like mt5 section of this forum is.

It's because I would like to talk to you my impression about new features of the evolution of the forex.

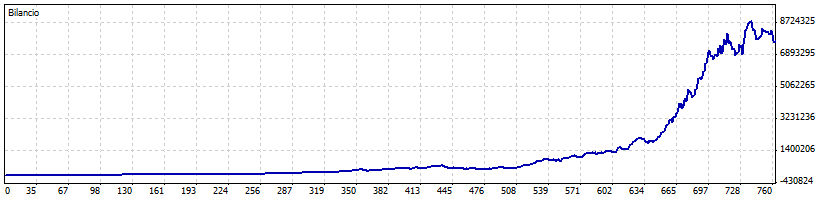

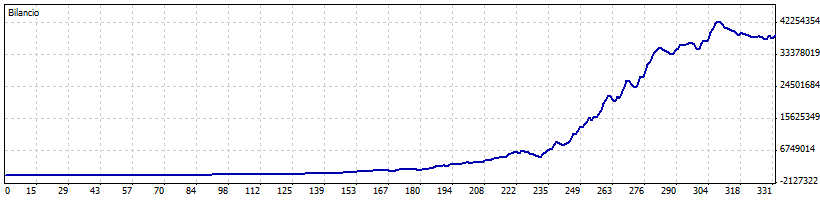

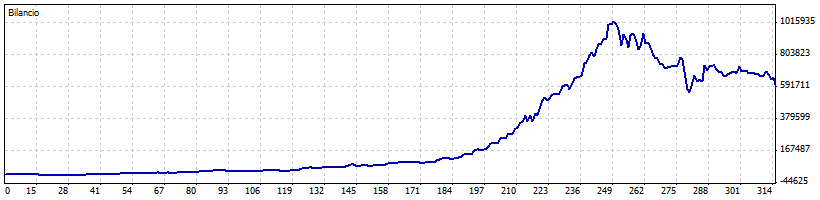

Which feature is the best for make the chaos? The ability to backtest at the same time more cross with different timeframe in a single ea...take a look

(I'm using the demo of some ea took from the market place --- Frankly I'm terrified thinking that there are people who actually use this service)

Look at this:

SUPER G EA

PROFESSOR FX PLATINUM EA

RELOAD MAXIMUM EA

What can I say? OMG

At first sight it's incredible, with one of these ea, just in few years, can become a millionaire

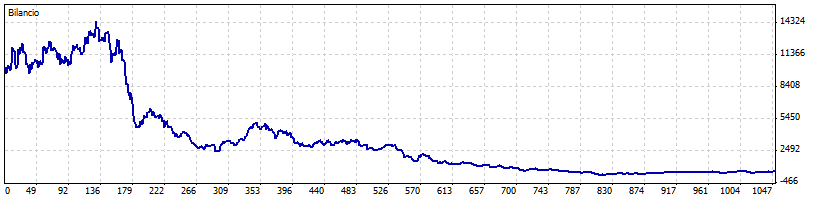

But if you backtest something more you can see this:

This ea (super-g) is sold at 2000 credits (ca 2000$) in the market place, the money spent are a certainty, everything else is a gamble, and for a person with responsibility is not acceptable.

The truth is that the chances of losing everything, even if you are not able to quantify, they are always greater than those of winning, and winning do not mean millions.

And the other truth is that these programmers are seller, that trying to sell you their stuff in all ways, so you will only ever see what THEY want.

attached, all documented backtest of this post

doc

I agree that forex or e-mini trading for that matter is not for everyone. In that sense, the market is an effective filtering mechanism. When I started to learn about trading at my first job, the retail market did not exist. Charts were done on rolls of paper and we used phones and telex machines. It was strictly bank to bank. Technology changed everything and we are now where we are for better or for worse.

I don't think institutions are responsible for the chaos and I don't think they pay much attention to the retail market. Markets have become chaotic for everyone. You can blame millisecond transactions and a zero interest rate world for that.

AlexThe banks always got to do

yes you're right

forex trading is a game of banks

The banks always got to do

Unfortunately banks are allowed (and supported) in what they are doing and that just might become one of the biggest problems in the future : politicians at least have to go through some election process (however good or bad the process itself is), but bankers don't. And we are witnessing that they are ruling on most fields of a society. Who gave them the power to do so?

I don't think institutions are responsible for the chaos and I don't think they pay much attention to the retail market. Markets have become chaotic for everyone. You can blame millisecond transactions and a zero interest rate world for that.

AlexTake a look here:

Traders Said to Rig Currency Rates to Profit Off Clients - Bloomberg

Maybe your idea about banks could change a bit

“The FX market is like the Wild West,” said James McGeehan, who spent 12 years at banks“It’s buyer beware.”

The $4.7-trillion-a-day currency market, the biggest in the financial system, is one of the least regulated. The inherent conflict banks face between executing client orders and profiting from their own trades is exacerbated because most currency trading takes place away from exchanges.

just one story:

Price Differences

One trader with more than a decade of experience said that if he received an order at 3:30 p.m. to sell 1 billion euros ($1.3 billion) in exchange for Swiss francs at the 4 p.m. fix, he would have two objectives: to sell his own euros at the highest price and also to move the rate lower so that at 4 p.m. he could buy the currency from his client at a lower price.

He would profit from the difference between the reference rate and the higher price at which he sold his own euros, he said. A move in the benchmark of 2 basis points, or 0.02 percent, would be worth 200,000 francs ($216,000), he said.

To maximize profit, dealers would buy or sell client orders in installments during the 60-second window to exert the most pressure possible on the published rate, three traders said. Because the benchmark is based on the median of transactions during the period, placing a number of smaller trades could have a greater impact than one big deal, one dealer said.

Traders would share details of orders with brokers and counterparts at banks through instant messages to align their strategies, two of them said. They also would seek to glean information about impending trades to improve their chances of getting the desired move in the benchmark, they said.

Take a look here:

Traders Said to Rig Currency Rates to Profit Off Clients - Bloomberg

Maybe your idea about banks could change a bit

Actually, my opinion remains the same. In the end, the games that the banks play with their clients has nothing to do with the overall volatility in FX markets. It should have no effect at all on trading.

Actually, my opinion remains the same. In the end, the games that the banks play with their clients has nothing to do with the overall volatility in FX markets. It should have no effect at all on trading.

This might be interesting to post in this thread : these are the biggest FX participants and their share if market in percentages. I think that what central banks do has more impact on a long run. In a shorter terms, it seems that much more impact comes from "regular" banks

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I see lot of people who enter the forex thinking of making easy and fast money... it seems almost unnecessary to say this, but there is nothing more wrong.

The forex market is difficult to understand, unlike the shares, hence the price moves up factors are difficult to interpret, and not always a wide knowledge of the market and its movements and interpret news can save your ass in front of the speculations of the various institutional.

I see many systems that create and playing with more than 50 lots at a time, as if this were possible in the real market.

The truth is that to ensure that the institutional continue to bleed the market they need your money, so they create chaos everywhere in such a way as to create false expectations among ordinary mortals.

How many systems that promised great gains have you tried? And how many of these will have dried up your account? Then the excuses are always the same, but the truth is one, is that we all need a HOPE, and on this the institutional play us like a cat with a mouse.

That being said I give you my advice, keep your money and use them to build real things.

If you're able, invest a part of your money in big companies with caution and make accumulation, NEVER invest in toxic assets.

doc