15 May 2013 Daily review by myfxpedia.com

Project Summary ( click here to update online ):

Duration:10 Months , 03 WeeksNumber of Closed Trades Total | This Month:300 | 23

Winning Trades Total | This Month:240 | 16Pip Gain/Loss Total | This Month:+11,209.7 | 1,680.9

15 May 2013 Daily review by myfxpedia.com:

What will drive the market today is the growth numbers (GDP) from Germany, Euro Zone, Frances and Italy and also the Inflation report from Great Britain and Canada Manufacturing number.

What has been happening over the last month or so is that we are witnessing a change in market condition in which we have to get use to and adapt. What we seen in the past 3 years was the inverse relation between the Equities market and the USD and the prices action of the last few weeks this relationship isn’t hold true anymore. If you follow the market with commentary of such “risk on” “risk off” you will know what the likely direction is for the USD if we have a “risk on” day, right? Well, if we have a “risk on” day then risk currency were likely went north while USD head south and vice versa.

Nearly the last few weeks this wasn’t the case anymore, what has been happening now is that we have Equities market go up and so is the USD while the risk currency such as GBP, AUD, Euro are all heading south. Why is this sudden change of sentiment or condition in the market? We suppose that traders are now seeing genuine recovery in the US economy and with the rumour of FED might cut short its printing program and so there is a genuine strength in the USD going forward. So, basically traders will now look out to see who will be the first the stop the QE, is it Great Britain or US or Japan which is a long way off so that left us with Great Britain and US and base on the recent data coming from US and Great Britain we would have to say it is more likely the US will be the first to exit its QE program.

Base on that sentiment as well as recent economic data we will look to be buyer of USD on weakness.

Impact News today:

02:00am (NY) EUR – German Prelim GDP

04:30am (NY) GBP – Claimant Count Change

05:00am (NY) EUR – Flash GDP

05:30am (NY) GBP – BOE Inflation Report; BOE Governor King Speaks

08:30am (NY) CAD – Manufacturing Sales

08:30am (NY) USD - PPI

Technical Analysis:

Last night we went short on EURAUD base on H4 chart of continuous bearish divergence and after 10 hrs past the pair did not make any significant move to the downside and base on H1 price action it seems that this pair still have another leg up, possibly, retest of previous high or even go a tad higher and run stops on the short before retrace to the downside. Note, with the current weakness in the AUD this pair can still actually push as high as 1.3500 -1.4000 even though, on Daily it is overbought and a bit extreme. It has been going north for the last 7 weeks without any meaningful pullback. With this pair is about to enter our Terminal Zone we will look for Shorts play only.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on author’s analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, you should carefully consider your financial objectives, level of experience and risk appetite.

16 May 2013 Daily review by myfxpedia.com

Project Summary ( click here to update online ):

Duration:10 Months , 03 WeeksNumber of Closed Trades Total | This Month:300 | 23

Winning Trades Total | This Month:240 | 16Pip Gain/Loss Total | This Month:+11,209.7 | 1,680.9

16 May 2013 Daily review by myfxpedia.com:

The Equities market again set a new high last night while the USD is also pulling back from its intraday high yesterday due to Industrial Production declined in April but noted that its Home Builder survey is rosy beating market expectation. Later today we will have US building Permit numbers and Unemployment Claims and if the number stack up we will probably see the USD resume the uptrend.

It seems that the strength in the Aussie has now give way to the bear with many leading economics and Funds are seeing the weakening AUD ahead. The view is that Australia economy is in real trouble with the accumulative debt, terrible manufacturing numbers, commodities prices getting soft and so the curtail in mining investments, add on to that we are now seeing slow in China.

In saying that do not expect a straight drop on the AUD, what we are looking for the bounce back up and any retrace higher is an opportunity to short. In the mean time we see that the AUD has been oversold and will not be surprise to see a short squeeze back up higher before a meaning downtrend resume on AUDUSD.

On the other hand we also see the NZD is still overrated and Australia is the biggest trading partner of New Zealand so higher NZD will do New Zealand no favour in term of trade with Australia. Last week the New Zealand did not hesitate to directly intervene with currency market when AUDNZD went below 1.2000 and we are of the opinion that it’s likely they will do it again in a very near furture.

Impact News today:

08:30am (NY) USD – Building Permits; Core CPI; Unemployment Claims

10:00am (NY) USD Philly Fed Manufacturing Index

Technical Analysis:

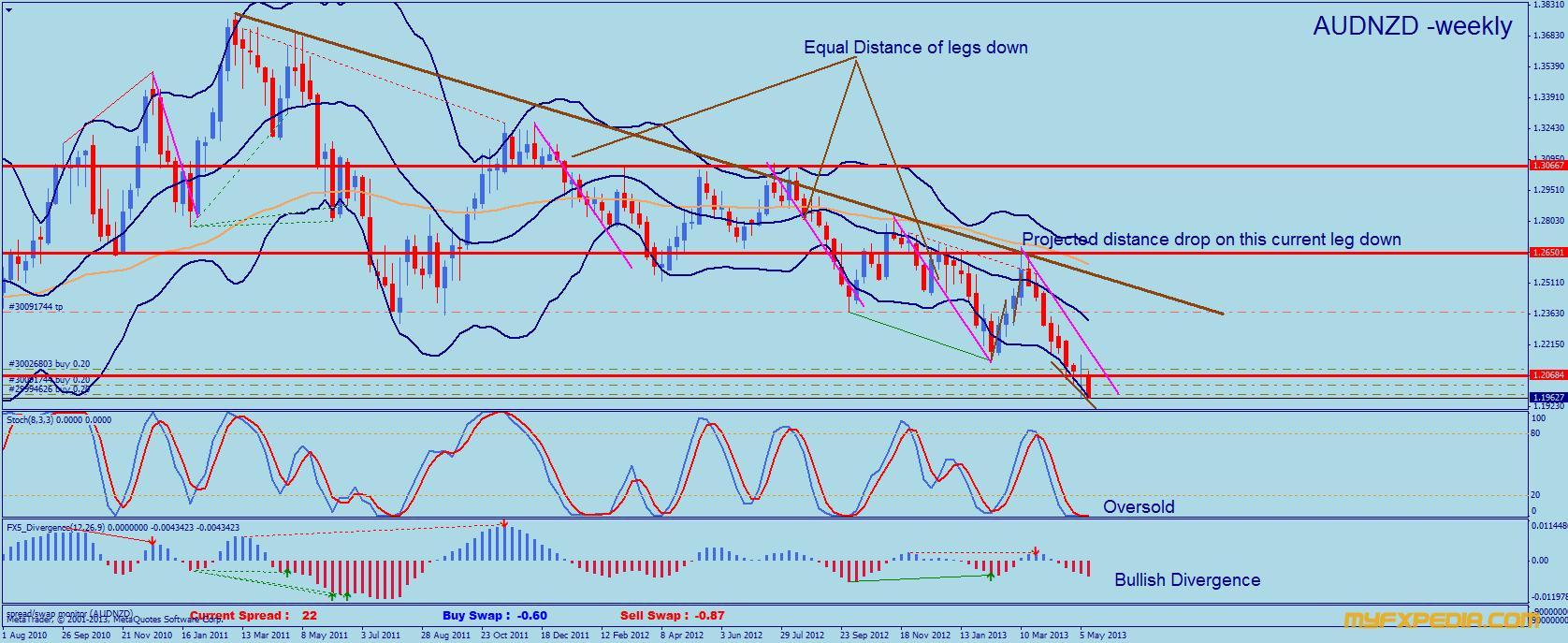

AUDNZD – we are starting to accumulate on this pair due to the nature of its repeated pattern. Also, on a monthly chart it’s in the process of creating a bullish divergence while on Weekly it’s in the process of creating a Continuous Bullish Divergence plus extreme oversold and it’s now entering our Terminal Zone, currently prices has reaches our downside projection for this leg down.

On Daily, we are likely see a monster Bullish Divergence going to be created. We will accumulate on this pair with maximum stop stands at 1.1620. Our positions held currently is less than 1% Drawn Down so no panic. Weekly and Daily Chart below.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on author’s analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, you should carefully consider your financial objectives, level of experience and risk appetite.

Thanks for sharing this useful information with us!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I post a new daily signal and strategy thread to share our experience with everyone. Hope it be useful to all forum members.

Thank you and as always

Happy Trading,

10 May 2013 Daily review:

Overnight the market bulls blinked for the first time this week after rumours that the FED might considering winding up the QE. Commodities, Bonds, Equities and all major risk currencies that peg against USD took a dive. This is exactly what we have been saying it all along over the last 2 months if you have follow our update regularly. This bull market at this stage is very fragile and it has been soldier on by Central Banks cranking up the printing press to support the economy. They have been doing this for the last few years and now or very soon they will face another problem that they themselves created. They have create prices bubbles and if this problem is not to be address soon this bubble burst is going to be too big to fix. This prices bubble and the state of the current bull run is becoming very fragile as evidence by overnight rumour.

Elsewhere, the talk of Currency War is slowly emerge as being real although they all denying it and always come up with reason for their action in driving down their currency. Lately we have the RBA lower interest rate at record low and South Korea also cut their interest rate to offset Japan aggressive devaluation of the Yen and the RBNZ also joins in to directly intervene in the FX market to lower the Kiwi. So, now we are having 3 Central Banks that is willing to do direct intervention to devalue its currency, Japan is one that has been famous for this and the SNB which openly stated that they are committed to defend the 1.2000 level of the cross EURCHF and now we have the RBNZ. It looks as though the RBNZ will follow what the Swiss National Bank and defend the Kiwi peg against the AUD at 1.2000 level also. If one noticed prices action of the cross AUDNZD the day before such that as soon as price went below 1.2000 mark the RBNZ quickly step up and push the pair above it. Their action is understandable since Australia is its biggest trading partner and high Kiwi will definitely favour the Aussie on international trading scale: why do you have to buy goods from NZ for when you can get the same thing from Australia and on international scale, it is cheaper to ship goods from Australia than from New Zealand.

Impact News today:

08:30am (NY) CAD – Employment Change; Unemployment Rate

09:30am (NY) USD – FED Chairman Bernanke Speaks.Technical Analysis:Yesterday we cut short EURUSD, in hindsight it was a wrong decision because 3 hours later the pair dropped another 100 pips. We exit the pair just 1 hour prior to impact new release from the US and looks for re-entry at the optimal higher prices. We did not get the push up that we were looking for instead we left 100 pips on the table. Sorry folks.

We also exited USDCAD long for 53 pips profit and look for re-entry on retest of yesterday low. Today is the last day of the first week of May and we have so already bank 1516 pips. Only another 310 pips away from setting another monthly records. Well done team.

We are currently in 2 pairs AUDNZD Long and GBPUSD Short and is in positive territory, zero Draw Down.

GBPUSD – on Daily chart below you can see prices has formed a 3 waves down and a 5 wave sub-wave to make up Wave4 and prices is trading within a channel. So, if the wave is playing out then we should start to have wave 5 down. Our target 1 is at the duplication of the channel break down and TP2 is the retest of previous low.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on author’s analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, you should carefully consider your financial objectives, level of experience and risk appetite.