How i trade it right now Euro and Cable slowly going stronger to the cautiously bullish,(but my Ea disagrees) USD very strongly bearish except aganist Yen.

If QE3 Is Really Imminent, Why Are Commodity Prices Trading So Poorly?

There was some recovery in the commodity index values yesterday, but this is after a sell-off of over 20% in the last four months has tamed some of the adventuresome animal spirits in the commodity markets. And, if traders are going to conclude the US inflation is going to perk up, weakening the USD, this might result in a healthy bout of USD long liquidation.

Markets traditionally are supposed to look forward and discount future prices, but yesterday the market action seemed subdued. It is interesting to note that in Bernanke's testimony, he said risk from the European bank and debt crises presents a severe threat to the US economy, and must be monitored closely.

The immediate threats to economic disruptions come from Europe, and not the US.

European solutions do not seem to be forthcoming. Spain did peddle €2.07B bonds, but at higher rates. It is amusing (at least, I think that's the word I'm looking for...) to see the ECB holding the bank rate at 1%, but maybe they think this will help contain the inflationary price of Brent crude.

In the EURUSD, I feel more comfortable when I am short. The trouble is that trade is overloaded. Looking at the weekly chart, there is a double weekly high at the 1.2625 area. Should the market take this level out tomorrow, remaining above the 1.2625 high, we are inclined to go home long the EURUSD.

Chances are there will be a continuation of the rally next week.

EURUSD Call in Run Up to Euro Summit

You would think after twenty or so major and mini summits over the period since the Greek saga commenced, the European leaders would have enough experience to have successful productive summits. We are headed for another important gathering in Brussels on Thursday and Friday and, unlike the pre summit optimism at the early meetings, there is now apprehension this meeting will fail to provide an answer.

The troubled reality of Europe and the single currency, unlike prior summit weeks, is under pressure. So far the break has been contained in an area of minor support around 1.2440. Failing this level, a return to the 1.23 handle looks like a target for the bears. As we noted in our COT Report, the specs reduced their long positions by 49K contracts in the futures markets; however, they remain a net short of 176K contracts.

Market action differs from that prior to other pre summit trading sessions. Then it was generally brimming with optimism, often taking the market higher and anticipating the best. It then seemed like the euro would sell off after the meetings. Will the market take the other tact this time? We sell off this week and rally next?

There have been more stories about the pending demise of the euro. Usually when there is a dynamic change such as this, it is preceded with a dynamic political or financial event, and a wash out in markets. Such has yet to happen.

We prefer the short side of the EURUSD with a target in the 1.23 area.

Markets Digesting an Abundance of News - Sell the Canadian Dollar?

With the US Supreme Court decision on Obamacare expected to dominate the (US) news cycle, major corporations chose yesterday to unload some bad news.

For JP Morgan Chase, it now appears the London whale's loss will tally up to $9B. Some of these derivative trades are like Hotel California: you can check out anytime you like, but you can never leave. It is a mystery how a trader with such big positions was allowed to continue with no supervision.

Global equities markets were soft ahead of the JP Morgan Chase bombshell, fearful of another 'do-nothing' summit in Brussels and additional debt problems in the Eurozone (Merkel remains silent on EU bailout - markets surge. 'Nuff said.) The announcement that Obamacare had been upheld (in the Supreme Court) has added to the pressure on equities in the early part of the New York session.

Analysts are combing the details of the court rulings, trying to find new details in the complicated law. What we do know is that the Supreme Court has determined that tax is another name for mandate when used by Congress.

Congratulations should be given to the Supreme Court because this decision today deftly removed the court from the health care debate. Instead, this massive law will now be examined in detail and the debate will continue as the major issue in the forthcoming US election.

Markets do not perform well with uncertainty, and we now have a lot more uncertainty.

Partisan victory speeches aside, I doubt small business will be less reluctant to hire new employees because of the rulings until after the elections. Combine this with the inability of the Europeans to find a solution for their debt mess, and economies and markets seem vulnerable.

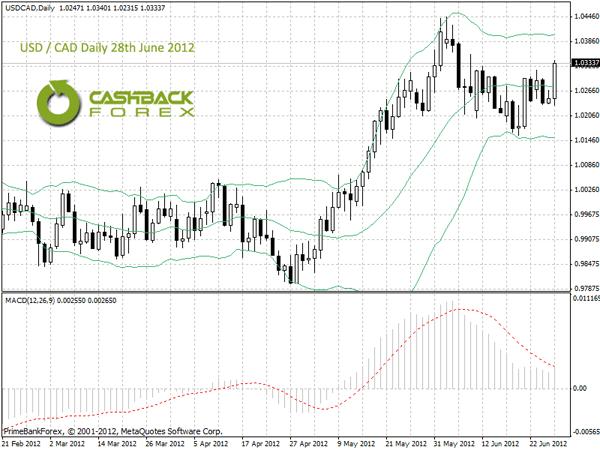

Should global economies slide further, as we suspect they will, we're looking into the possibility of buying the USD and selling the C$.

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Written by CashBackForex.com

Years ago, when working as a grain analyst for Merrill Lynch in Chicago, we had a meat analyst whose trading recommendations were almost always wrong.

Noting his inaccurate calls, we would then take the opposite side of his trades. As long as Ben the analyst picked the losing trades, everything worked out profitably, but when he got a trade right, fading him would painfully cost some money.

In a fashion, this week's Euro Summit was similar to the Merrill analyst. The euro had been selling off in anticipation of another failed attempt to find a fix to the debt problems. To the market's surprise, there was some positive action taken, and the euro has rallied accordingly, taking the EURUSD from a low of 1.2407 yesterday to a high of 1.2692.

Accordingly Bruno Waterfield writing in the Telegraph said:

"On Thursday night, Italy and Spain plunged an EU summit into disarray by threatening to block "everything" unless Germany and other eurozone countries backed their demands for help.

Mario Monti, the Italian Prime Minister, celebrated the agreement, reached in the early hours of Friday, as a "very important deal for the future of the EU and the eurozone".

He could not resist reminding Angela Merkel, the German Chancellor, that Italy had also won on the football pitch, by defeating Germany two goals to one for a place in the finals of the European Championship."

Under the new agreement, the monies being used by the Spanish government to recapitalize their banks will become a direct loan to the banks, rather than a loan to Spain who has been loaning the money to the banks. Further, this money will not be a priority claim ahead of other investors, should there be a default. This reduces the amount of government debt, and might better enable banks to raise private capital.

For Italy, EU bail out funds will be used to buy Italian debt which will attempt to bring down Italian borrowing rates. The ECB is going to be given the expanded role of supervising these new programs. We wonder if there will really be enough money to make a dent in the massive problems.

While these actions can be viewed as positive progress, there are many major unresolved issues for the single currency. When you combine zero growth with 5/7% interest rates, the economy will contract. When the dust settles we suspect this rally will be short lived.

The positive news from Brussels has given us a healthy bounce in global equities, and has helped the Aussie and the Canadian Dollar. We noted yesterday that we were looking for a spot to buy the USD versus the C$. From the previous day's high of 1.0362 the USD has sold off, currently trading at 1.0180.

The Canadian economy is a blend of manufacturing, mostly traded with the US, and commodities. Going forward into the 2H of 2012 we are concerned the US economy will slow at a growth rate less than the 1.9% in the first half. Should that happen, the Canadian monthly GDP number, released last Thurday at a 0.3 gain for the month, will contract going forward.

Yesterday, oil and other commodities are enjoying a rally, but this comes after a prolonged sell off. West Texas Intermediate Crude was up 4.47 per barrel, to 82.16. Much of the Canadian oil comes from the Athabaska sands which is deep in the interior and trades at a discount to the WTI. Equally, the Bloomberg Bakken Crude Spot Price, also tucked in the interior of Minnesota, was only 67.97. With the cost of the oil sands production higher than many fields, what is the price that slows development of those fields. Oil, Canada's major export is still being exported, but it is fetching a lower price.

We are hopeful yesterday''s market euphoria will carry until early next week. Should it do so we wish to buy the USD and sell the CAD in the 1.01 area.

In Europe, the market will figure out problems remain, and it will take a lot more than several hundred billion to solve their debt problems. This is a longer term trade with an objective of 1.06.

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Written by CashBackForex.com

Will This Week's Reports Cause Euro Bears To Reduce Their Positions?

The market's initial reaction from last week's European Summit was a victory for the debit nations as they stood up to Merkel and her diminishing band of creditors.

Well, perhaps 'victory' is an overreach, implying a decisive change which is not the case.

Remember, these bail-out mechanisms are largely unfunded, a promise of money forthcoming at a later date, once approved by the Germans. The Germans may have given the Italians a victory on the football field, but there are more battles looming in the future.

Today we will get a clue how effective the effort has been to reduce interest rates for the borrowers. France and Spain both intend to auction 10 year bonds. Later in the day the ECB will hold a conference where it is expected they will reduce the central bank rate .25% to .75%.

These reports would be enough to jolt the market but the data flow continues the balance of the week, primarily from the US.

In addition to the Thursday US unemployment numbers which have been creeping higher, we also get the ADP Non-Farm Employment Change, and the ISM Non-Manufacturing PMI; these reports will be followed Friday by the US Unemployment Rate and the unpredictable Non-Farm Payroll Report.

Recently there has been a revival of economic pessimism in the US; however, the late week projections do not reflect this. An increase in 92K on the NFP and 8.2% unemployment does not imply we are on the cusp of a consumer led recovery, but they are not terrible. The USD market action might prove bearish should the number be poor. There would be expectations helicopter pilot Ben Bernanke, with co-pilot Yellen, would be starting the engine to disperse the newly-printed money.

Is there a trade here?

Well, as our latest COT Currency analysis reveals, it is a very popular position to be short the euro. Should you get a bearish euro number today, selling the euro lower seems very risky in front of the pending US reports. Further, I am very apprehensive about politically-sensitive labor numbers coming from Washington prior to the pending election.

The Euro bears had a party yesterday, as we are currently flirting with the 1.25 handle. Should we get some bear news and a further break today, it is tempting to take a small contrarian buy in the euro, but what do you sell?

The USD is a very popular long in the futures markets. Perhaps this is the sell. We calculated the total dollar longs in our report was a massive 312.5K contracts. Still, and in the same report, we noted the specs in the Australian Dollar, which had been big shorts four weeks ago, had covered most of those shorts. During this time frame the A$ ran from .97 up to the 1.03 handle.

EURAUD

The EURAUD chart is also interesting. During the period from May 18, 2012 until today, the EUR sold off from 1.3029 to 1.2170. The pair is revisiting the area where it traded earlier this year in February. The 14 day RSI is currently oversold at around 25. We are inclined to take a minor long position in the EUR versus the AUD around current levels.

The economy of Australia has been vibrant over the past several years, supplying commodities to China and the booming Far East markets. However, there are some who think the Chinese boom is over, perhaps due for a hard landing, as their export markets contract.

This will hurt the Australians, and they are imposing self-inflicted economic wounds with their new taxes.

Effective July 1st, Australia has imposed a mineral resources rent tax (MRRT) and a new carbon tax. The MRRT will impose a 30% tax on iron ore and coal profits exceeding A$ 50M per year. This is on top of the existing taxes and royalties already paid. In 2010/11 the industry paid A$20B.

The Australians have also imposed a A$23/t carbon tax. When running for election in 2010, PM Julia Gillard vowed she would never sign a carbon tax law. She did and the new tax is steep. The Minerals Council of Australia estimates the carbon tax will generate A$77.3M per week. This compares to the European carbon scheme which generates A$23M per week for the entire 30 countries.

Granted the impact on the economy and the currency is longer term, but meanwhile solicitors are thriving and politicians are trying to better their situation in the run-up to next year's federal elections... no change there then.

I have no positions in any stocks or currencies mentioned, and no plans to initiate any positions within the next 72 hours.

Written by CashBackForex.com

Late Week Economic Data Keeps Currency Markets On Edge

The markets are being bombarded with an abundance of late week data, and there is more to come today (Friday).

In the UK, the Central Bank Rate remained unchanged at .50% and the Bank of England did increase what they call their "Asset Purchase Facility" by £50B. There is no surprise here.

The European Central Bank did reduce their bank rate by .25% to .75%. Again this was as expected, though the euro, confronted with the realization that the era of the Jean-Claude Trichet inflation-fighting rate was over, may have helped the slide.

The results of the Spanish auction did not help the euro. They did sell their target of 3.3B but the rate was 6.43%, an increase from 6.04% at the last auction. How much of this debt was purchased by the troubled Spanish banks? Help promised at the Brussels meeting last week was not forthcoming.

This moved the EURUSD to the down side, and once the 1.24 handle was captured by the bears, the market gained some momentum.

The US employment data was not as bad as anticipated and might have added some pressure to the market. Both the ADP Non-Farm Payroll and the weekly report of the initial unemployment claims were better than the guesses. At 10 a.m. NY time (yesterday), the ISM Non-Manufacturing PMI came out at 52.1 worse than 53.7 a month earlier.

Today we get the US unemployment rate and the always volatile Non-Farm Employment Change Reports. As previously mentioned, we are skeptical of the accuracy of employment reports during an election season. It is very easy to report a number and then revise it six months later, after everyone has forgotten. However, if we receive a weak number this may spook the USD bulls who will then fear QE 3. Expansion of the USD supply by the Fed is feared because it usually weakens the currency.

Usually it is best to get the numbers from the NFP Report, and then see how the market responds, looking for trades at that time. We intend to do that today.

I have no positions in any stocks or currencies mentioned, and no plans to initiate any positions within the next 72 hours.

Written by CashBackForex.com

Economic Numbers Continue Bearish

Continuing last Thursday’s trend when the Europeans and the Chinese cut their bank rates, and the Brits commenced another £50B of quantitative easing, Friday’s numbers continued bearish. Most significant were the US employment numbers.

The US total unemployment number remained unchanged at 8.2% as expected. There was a .1% increase in the U 6 number that measures the under-employed (part- timers and those employed in situations, but are beneath their calling.) Of greater importance to the markets is the Non-Farm Employment Change report. The guesstimates had been for a small number, only 100K new jobs, but the 80K was even weaker than had been estimated. There was an 84K increase in the private sector, professional services (47K) health care (13K) and manufacturing (11K) which meant there had to be a small reduction in public sector jobs.

The job growth, though poor and the worst quarter since the recovery began, is still positive. Consequently, some of the pundits think the number is too good for the Fed to resume their QE. This is contributing to the weakness in commodities, and probably resulting in selling of the risk currencies like the Aussie and the Kiwi.

Euro

Pressure remained on the Euro last Friday. The poor economic news is certainly part of the weakness but Spanish 10 year bonds trading close to 7% are a reminder the euphoria over last week's summit was unwarranted. We have been bearish on the euro, with 1.23 as a target. Now at 1.23, a two year low of the euro versus the USD, is there more to go or are we due for a little consolidation? With many of the Central Bank meetings and some major reports behind us our vote is for a quieter week, though the FOMC Meeting Minutes this Wednesday may prove an exception.

Written by CashBackForex.com

More Euro Difficulties Seem Likely

Yesterday in Madrid Spanish Prime Minister Mariano Rajoy, bending to the wishes of Berlin and Brussels, announced the next dose of austerity, intended to produce €65B in savings. The previous austerity measures have sent unemployment soaring, 24% overall and up 50% for the young, and has resulted in contraction of economic activity and reduced tax receipts.

The additional austerity will include an increase in the VAT to 21%, (still less than the 23% here in Ireland) a cut in jobless benefits, a salary cut for state employees, and local government reforms, including the elimination of year-end bonuses to civil servants. Granted some of these reforms are needed. Decades of prosperity have elevated the salaries and fringe benefits of the public sector to levels higher than the private sector they theoretically serve, in many countries.

But these changes will not be well received. In Madrid there was violence as the riot police clashed with protests by coal miners.

When PM Rajoy returned from the most recent summit, he claimed that the ECB would help keep lower rates, and the European Stability Mechanism (ESM) would be in place later in the year, which would allow a direct rescue of ailing banks.

It took less than a week after the meeting for the Spanish 10-year rate to go back above 7%. Recently, the Spanish auctions have been small, between €2/3B, and it is estimated most of the bond buyers are the Spanish Banks, and a few pension funds. The current auctions are based on the assumption the current budget target deficit of -5.3% will be achieved.

From a Credit Suisse source, this means there is only €34B debt left to issue for the year. The debt, however, is going to exceed the target, since the austerity contracts the economy. There are also regional deficits, so the size of the Spanish auctions for the balance of the year will be increasing, perhaps to as much as €5.0B per auction.

Where will the Government find the buyers for the additional debt? The ECB has recently changed rules and may no longer accept bank-issued government bonds as collateral. Who will step forward to buy the coming expanded supply of Spanish debt?

As for the ESM which will be providing funds for the direct rescue of banks later this year, news from Germanydoes not sound promising. It was reported by Ambrose Evans-Pritchard that Merkel does not have authority from the Bundestag to lend money directly to banks. Further, the constitutional court ruled last September that there must be pre-approval of any future bail outs.

The Euro sell-off has been severe, but we are unable to even get the proverbial dead cat bounce. With the market as short as it has been, this is amazing. We did notice in our last COT report, the specs were coming out of their short positions. If you are a Euro bear, and no longer short the chances, are you are anxious to reinstate your position? Failure to rally to the top side of 1.03 is discouraging. Granted the FOMC notes, coming this afternoon might be USD bearish, and give us a rally, but that rally had best be sold.

I have no positions in any stocks or currencies mentioned, and no plans to initiate any positions within the next 72 hours.

Written by CashBackForex.com

More Euro Difficulties Seem Likely

Yesterday in Madrid Spanish Prime Minister Mariano Rajoy, bending to the wishes of Berlin and Brussels, announced the next dose of austerity, intended to produce €65B in savings. The previous austerity measures have sent unemployment soaring, 24% overall and up 50% for the young, and has resulted in contraction of economic activity and reduced tax receipts.

The additional austerity will include an increase in the VAT to 21%, (still less than the 23% here in Ireland) a cut in jobless benefits, a salary cut for state employees, and local government reforms, including the elimination of year-end bonuses to civil servants. Granted some of these reforms are needed. Decades of prosperity have elevated the salaries and fringe benefits of the public sector to levels higher than the private sector they theoretically serve, in many countries.

But these changes will not be well received. In Madrid there was violence as the riot police clashed with protests by coal miners.

When PM Rajoy returned from the most recent summit, he claimed that the ECB would help keep lower rates, and the European Stability Mechanism (ESM) would be in place later in the year, which would allow a direct rescue of ailing banks.

It took less than a week after the meeting for the Spanish 10-year rate to go back above 7%. Recently, the Spanish auctions have been small, between €2/3B, and it is estimated most of the bond buyers are the Spanish Banks, and a few pension funds. The current auctions are based on the assumption the current budget target deficit of -5.3% will be achieved.

From a Credit Suisse source, this means there is only €34B debt left to issue for the year. The debt, however, is going to exceed the target, since the austerity contracts the economy. There are also regional deficits, so the size of the Spanish auctions for the balance of the year will be increasing, perhaps to as much as €5.0B per auction.

Where will the Government find the buyers for the additional debt? The ECB has recently changed rules and may no longer accept bank-issued government bonds as collateral. Who will step forward to buy the coming expanded supply of Spanish debt?

As for the ESM which will be providing funds for the direct rescue of banks later this year, news from Germanydoes not sound promising. It was reported by Ambrose Evans-Pritchard that Merkel does not have authority from the Bundestag to lend money directly to banks. Further, the constitutional court ruled last September that there must be pre-approval of any future bail outs.

The Euro sell-off has been severe, but we are unable to even get the proverbial dead cat bounce. With the market as short as it has been, this is amazing. We did notice in our last COT report, the specs were coming out of their short positions. If you are a Euro bear, and no longer short the chances, are you are anxious to reinstate your position? Failure to rally to the top side of 1.03 is discouraging. Granted the FOMC notes might be USD bearish, and give us a rally, but that rally had best be sold.

I have no positions in any stocks or currencies mentioned, and no plans to initiate any positions within the next 72 hours.

Written by CashBackForex

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Conventional economics is now largely useless in trying to analyze the twists and turns of the unfolding euro crisis: It has long since left behind any rational calculation of what is good and bad for the continent. Instead, it is best understood as a branch of game theory. And the game being played right now? Chicken.

The markets take the euro zone to the brink of collapse. Asset prices plunge. As they peer over the edge of the abyss, the leaders of the euro zone and the European Central Bank take fright, and come up with whatever is necessary to keep the system from collapsing.

The can gets kicked down the road — until the whole crisis blows up again in a few months’ time. It’s happened a couple of time already and it’s about to happen again.

If you think the euro boys can put together a few more kicks, or 'tricks', then you can prepare to sell the next successful can kick. Then, when the euro world is about to end, and it looks like Frau Merkel will never say yes again, go the other way.

If you are nimble, this might be a busy, active Summer,

Remember not all your money goes in one trade. A weak euro is probably a great time to buy German, Dutch or French retailing companies which will benefit immensely from the weak euro.

In nervous volatile markets you need to mind your money. Not all trades will be winners, so just don't take it personally, when you occasionally get entangled on the wrong side of the market.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.