You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

now remember!!

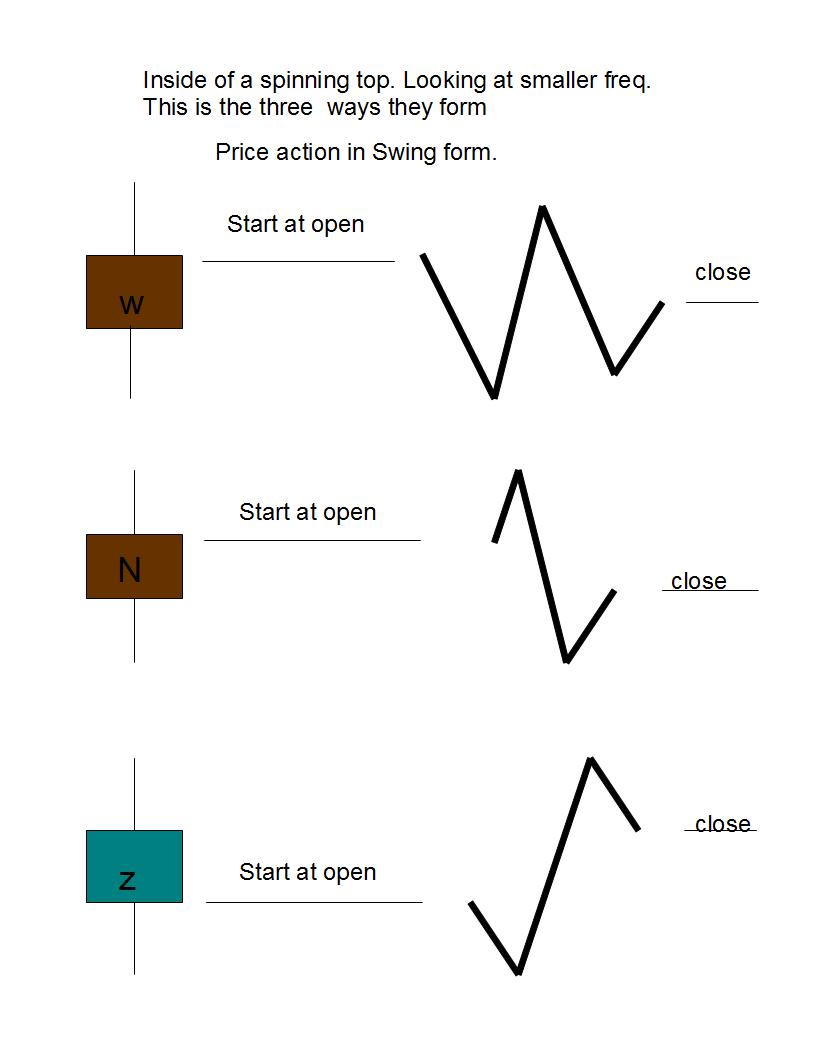

remember earlier when i said: when a spinning top closes on you time frame that is

a trap on a lower time frame.

those traps are N or W's. that's it.

so when finding knowing what freq. your trap is on (that's money in the bank.)

we will get to that part later.

for now v patterns traps.

trendchangetrader's hay my friend how are you?

ok lets look at this last shot again only edited'

ok in down trend the n pattern the first swing starts against the trend.

in a W pattern the first swing starts with the trend.

trendchangetrader's Avatar trendchangetrader

i hope that makes things clearer to you? let me know.

if not we will look at it from another angle!

cool

good to talk to ya. i will be back in a few. have to take a break.

there is also the backwords z

the back words z is a positive pin bar in a downtrend, i was saving that till after

the v pattern so we will get to that soon.

the N - W - V- and Z

that's all of them.

learning the patterns is impotent.

knowing what freq. or time frame they are going to occur on is impotent.

ok break time.

the back words z is a positive pin bar in a downtrend, i was saving that till after

the v pattern so we will get to that soon.

the N - W - V- and Z

that's all of them.

learning the patterns is impotent.

knowing what freq. or time frame they are going to occur on is impotent.

ok break time.don't understand

xx i will do this

i am gong to do this:

i am going to hand drawn diagrams so every one is clear.

this will help. it may take time but i must make this clear.

xx. try this

the z formation is backwards, rather then call it a back words N. or back words z

i just call in z that way it's easy to remember and say.

this shot is identifying the price action inside spinning tops. this is impotent.

next we will look at the V pattern spinning top.

note

note: the backwards z , or z can be bearish also, but majority bullish.

the other two can be either way at any time. bullish or bearish, the formation

is what counts.

xx

i hope this more clear?