You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

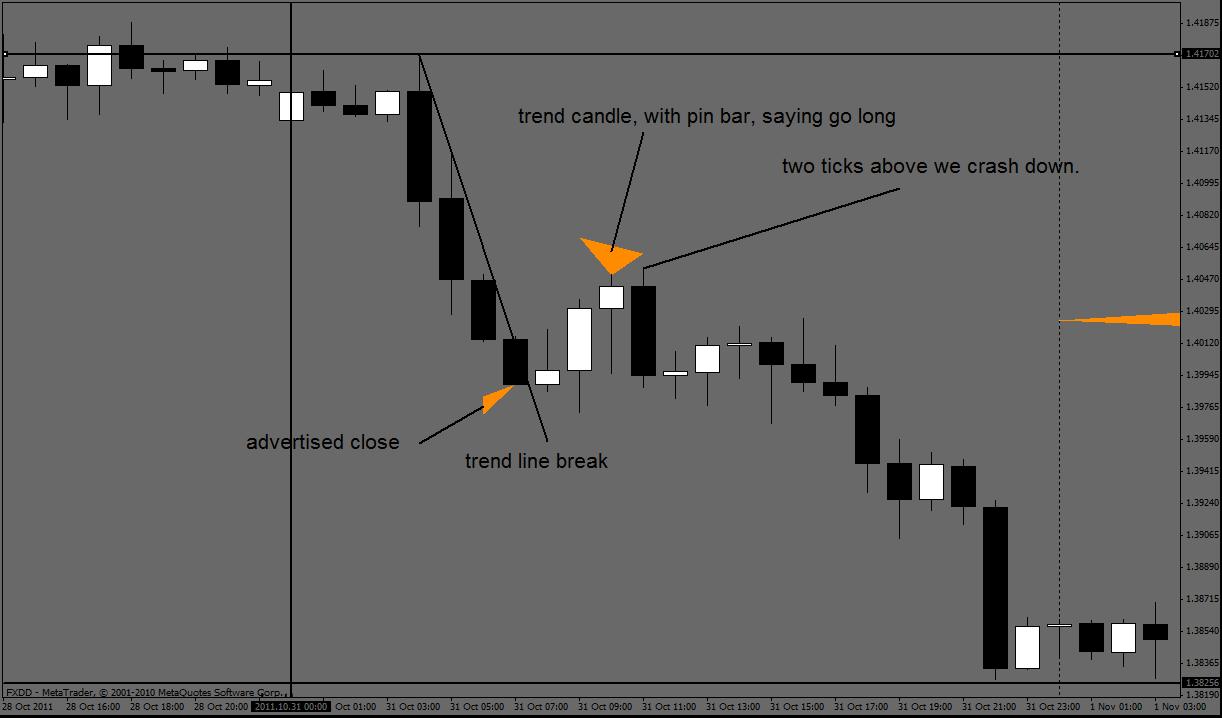

now take a look.

now lets go down to the one hour time frame.

what you see is the trap the fuel.

this is only the beginning.

theirs more...... you see a trap to make daily, is 4 hour spinners, or pin, one hour traps,

but the range of the traps are one and half hours, to one and 3/4 hour range.

that's s 4 hour low range, not average, but low. that's what the fuel will be most every time.

now as to the weekly. you will see 4 hour fuel, and a small daily range spinning top or pins.

as to the monthly daily fuel, weekly spinning tops, or pin bars.

note. some time it takes stepping down an additional time frame from time to time.

but most of the time it's two down to find the fuel.

but even lower

as you go down lower in time frames you will see fuel.

what i like to call quick fuel, pin bars against the trend all the way down the spectrum!

some pin bars are temperately true, but still they are no reversal, some are simply

failures.

this goes against all the crap every one is taught at the beginning of trading.

not all pins fail, but learning where they happen in the market is key to knowing.

but most do fail!!

how does this help?

well it sets your mind strait.

it lets you know on what time frame, what type of range to expect to enter a trade.

a good place to take a risk. you won't win them all. but you will win more than ever before.

if there is no trend line break and trap, i don't enter!! this takes guts. and you have to know

where your at with the big picture you want to be inside a larger time frame Trend line, but

break a smaller freq. Trend line while still inside the larger time frames umbrella.

that's what i will cover tomorrow.

have good knight.

one more note;

now lets say your comparing the weekly to the 4 hr time frame and you get daily range

strong candle, that tells you this will be nasty for at least another week before joining the trend.

so when you get a trap candle against the trend on the frequency right next door , or one step

down then that's a clue. the freq. you are on will not trend for at least another candle, or two.

i was going to save this for tomorrow but here it is i will talk more tomorrow.

iGor

I guess my understanding of your explanation collapses when you suggest you can make money knowing that the markets are 100% random ANDyou pay then spread and commission each trade. In addition you do not use martingale or a variation. (By the way, I do not agree with Martingale in any way shape or form)

So logic suggests you have some kind of mathematical formula which defies our current understanding, or you do use some kind of technical/fundamental analysis.

For clarification, I am not saying I don't believe you, I'm just trying to figure it out.

I'm going to put my money on longer term fundamentals, i.e. interest rate changes with a system that ensures profit once price has in fact moved in the anticipated direction after the announcement. You'll trade in such a manner that it does not matter if price moves there straight away or after a while, just that the interest rate will be a fundamental change for overall price direction.

Close?

Ryan

sorry

i was busy with the wife today, delivering food to people of need.

that makes us feel good.

Range

remember i said range calculators are junk. that's true.

but later this after noon i will talk about ranges, and time.

and i will show you how ranges really work! how to use them.

how to make them actually beneficial to traders.

looking at range over lap. or tail ranges as i call them.

also expected price action inside the ranges.

later this after noon.

iGor I guess my understanding of your explanation collapses when you suggest you can make money knowing that the markets are 100% random ANDyou pay then spread and commission each trade.

Hi Rick,

Read this interview Interview with Ge Senlin (yyy999) - Automated Trading Championship 2011

This guy is currently on the 3rd place in the metaquotes EA championship. His EA took in 101 trades. 98 winners and 3 losing trades.

This is one of his answers on a question they asked him:

Q: What results did you Expert Advisor have during testing? What results do you expect from your EA in the Championship?

A: During back-testing, it was profitable of course. As for this Championship, if I hope I can finally stay in the top 10, which will be quite a satisfying result. Of course, it all depends on luck. Because the market is unpredictable and random,the current equity has exceeded my expectation before Championship.........

Would he not look a lot smarter is he would claim that he develloped an EA that can predict the market moves ?...Yes but he does not. He is awere that markets are random and that being profitable and randomness are 2 completaly different things.

Friendly regards... FXiGoR

Igore check this out

range is has been an allusive and confusing issue to any traders who looks into the subject.

new traders find it simple and easy, but can never make use of it.

experienced traders dive into the subject trying to find actual use for average range calculators etc.

and as they look into making true sense of it, and becoming over whelmed, with a complicated issue that

they at first did not know was the case. but find out in short order theirs a lot more than meets the eye.

there is: ( one candle ranges) , and there is the subject of actually ( ranging) on a time frame, there is

(adjusting ranges) into positioning on the charts.

there is also the (comparisons of ranges from time frame to time frame).

realizing that an average daily range calculator, suggests that all candles are average size is no help.

especially when the calculator actually can be changed and effected by the change of the market.

so how do we sort all of this out? how do we make ranges useful to us? well this section is going

to take time, because some how i lost my range folder holding all the answers. i know all the answers by hart, but i am going to have to make new charts for each explanation before posting.

i will start slowly then.