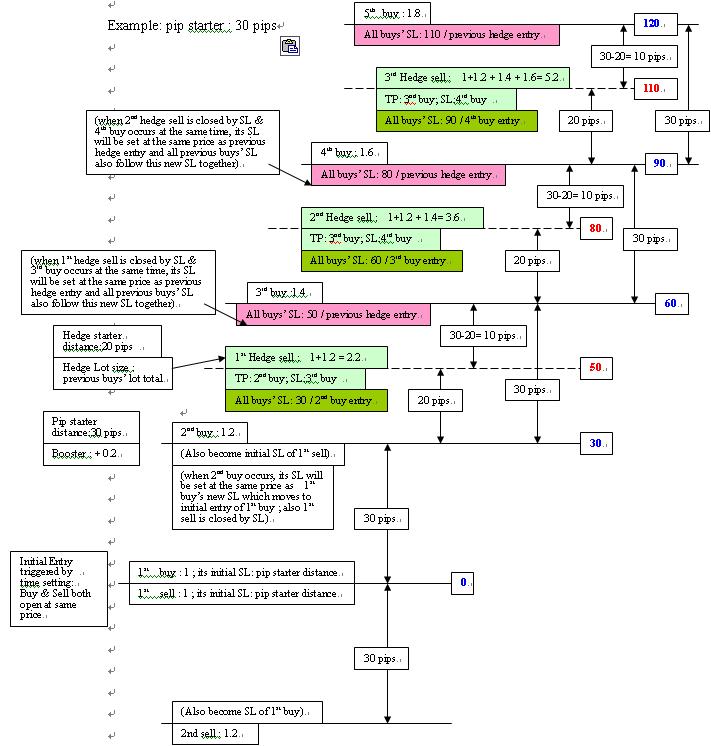

please refer to the attached jpg file to read the following explanation.

1. -30 pips + -36 pips = -66 pips

When the price movement triggers the 2nd trade (in either direction), then traces back to SL of 2nd trade. ( Initial entry in such Sideway condition: price movement does not go beyond 50 pips in one direction; 30 pips = < The price movement < 50 pips ; trace back to SL:0)

Once 2nd Trade is triggered, SLs for 1st& 2nd buys move to 1st buy’s entry.

For instance: 2nd buy triggered, then trace back to SL.

1st sell closed by initial SL (2nd buy’s entry) (-30 pips)

1st buy closed by new SL (1st buy’s entry)( break even)

2nd buy closed by SL(1st buy’s entry) (-30pips x 1.2 lot = -36pips)

Total profit: -66 pips

2. -30 pips + 30 pips + 0 pip + 44 pips = 44 pips

When the price movement triggers the 2nd trade and lacks enough momentum to trigger the 3rd trade, but hits 1st hedge entry between 2nd & 3rd trade entries, then trace back to SL. (50 pips= < The price movement < 60 pips ; trace back to SL: 30)

Once 1st hedge between 2nd& 3rd entries is triggered, SLs for 1st& 2nd buys move to 2nd buy’s entry.

For instance: 2nd buy and the Hedge both triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips x 1 lot = -30 pips)

1st buy closed by new SL ( 2nd buy entry) (30 pips x 1 lot = 30 pips)

2nd buy closed by new SL ( 2nd buy entry) ( breakeven)

1st Hedge closed by TP ( 2nd buy entry) (20pips x 2.2 lot = 44 pips)

Total profit: +44 pips

3. -30 pips + -22 pips + -14 pips + 24 pips + 50 pips = 8 pips

When the price movement triggers the 3rd trade (which also means that 1st Hedge would closed by its SL) and then traces back to all existing trades’ new SL (previous Hedge entry) ( 60 pips = < The price movement < 80 pips ; trace back to SL:50)

Once 3rd trade is triggered, SLs for 1st& 2nd buys move to 1st hedge entry.

For instance: 3rd buy triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

3rd buy closed by SL (previous Hedge sell entry) (-10pips x 1.4 lot = -14 pips)

2nd buy closed by new SL (previous Hedge sell entry) (20pips x 1.2 lot = 24pips)

1st buy closed by new SL (previous Hedge sell entry) (50pips x 1 lot = 50pips)

Total profit: 8 pips

4. -30 pips + -22 pips + 0 pip + 36 pips + 60 pips + 72 pips = 116 pips

When the price movement triggers the 3rd trade and lacks enough momentum to trigger the 4th trade, but hits 2nd hedge entry between 3rd & 4th trade entries, then trace back to SL. (80 pips = < The price movement < 90 pips ; trace back to SL:60)

Once 2nd hedge between 3rd & 4th entries is triggered, SLs for 1st & 2nd & 3rd buys move to 3nd buy’s entry.

For instance: 3rd buy and the Hedge both triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

3rd buy closed by new SL (3rd buy entry) (breakeven)

2nd buy closed by new SL (3rd buy entry) (30pips x 1.2 lot = 36pips)

1st buy closed by new SL (3rd buy entry) (60pips x 1 lot = 60pips)

2nd Hedge sell closed by TP( 3rd buy entry ) (20pips x 3.6 lot = 72 pips)

Total profit: 116 pips

5. -30 pips + -22 pips + -36 pips + -16 pips + 28 pips + 60 pips + 80 pips = 64 pips

When the price movement triggers the 4th trade (which also means that 2nd Hedge would closed by its SL) and then traces back to all existing trades’ new SL (previous Hedge entry) ( 90 pips = < The price movement < 110 pips ; trace back to SL:80)

Once 4th trade is triggered, SLs for 1st & 2nd & 3rd buys move to 2nd hedge entry.

For instance: 4th buy triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

2nd Hedge sell closed by SL(4th buy entry) (-10pips x 3.6 lot = -36 pips)

4th buy closed by SL(previous Hedge sell entry) (-10pips x 1.6 lot = -16 pips)

3rd buy closed by new SL ((previous Hedge sell entry) (20pips x 1.4 lot = 28 pips)

2nd buy closed by new SL (previous Hedge sell entry) (50pips x 1.2 lot = 60 pips)

1st buy closed by new SL (previous Hedge sell entry) (80pips x 1 lot = 80pips)

Total profit: 64 pips

6. -30 pips + -22 pips + -36 pips + 0 pip + 42 pips + 72 pips + 90 pips + 104 pips = 220 pips

When the price movement triggers the 4th trade and lacks enough momentum to trigger the 5th trade, but hits 3rd hedge entry between 4rd & 5th trade entries, then trace back to SL. ( 110 pips= < The price movement < 120 pips ; trace back to SL: 90)

Once 3rd hedge between 4th & 5th entries is triggered, SLs for 1st & 2nd & 3rd & 4th buys move to 4th buy’s entry.

For instance: 4th buy and the Hedge both triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

2nd Hedge sell closed by SL(4th buy entry) (-10pips x 3.6 lot = -36 pips)

4th buy closed by SL(4th buy entry) ( breakeven)

3rd buy closed by new SL ((4th buy entry) (30pips x 1.4 lot = 42 pips)

2nd buy closed by new SL (4th buy entry) (60pips x 1.2 lot = 72 pips)

1st buy closed by new SL (4th buy entry) (90pips x 1 lot = 90 pips)

3rd Hedge sell closed by TP (4th buy entry) (20pips x 5.2 lot = 104 pips)

Total profit: 220 pips

7. If the trend goes short( sell direction), the logic & principle is the same.

8. Once the trades are all closed by SL(TP), at exact moment repeats the initial entry process (again, both buy& sell orders enter at the same price at the same time.)

From above explanation, once the price movement = > 50 pips, the results of this method can become definitely positive. However, the risk still exists when every time initial entry process starts and repeats. It could suffer from the -66 SL in rows. Therefore it might be more profitable to enter during the Market open session or one or two hour later that time in which the volatility starts bigger. ---maybe also good for the time when news released. Otherwise, The EA might need the SL pct control once it got three SL from initial entry in row (-198 pips), the EA stops opening any new trade during the rest time until next day market open time comes.

If anyone thinks it is worth to code this method into an EA and has interested, it would be highly appreciated. We wants to test this method (as EA) to see how it works in all market conditions and find different parameter combination for each currency pairs.

Possible EA Key features allowed to adjust parameter:

Lot size

Start time (hour & minute)

End time (hour & minute)

Start trade day

End trade day

Max sell orders

Max buy orders

Pips starter distance: pips range to open next same direction order

Booster: constant for arithmetic progression

(I don’t know whether geometric progression would be better to use.)

Hedge distance: pips range to open opposite direction order (should smaller than given pips starter distance)

Method Weakness:

1. The worst case is that initial entry loss (-66 pips) happens in row during side way market conditions.

2. No entry judgement by any indicators or analysis. (first initial enter normally start at Asian market open time or 00:00 server time --- also 1 or 2 hour later after Asian market opens )

If any good suggestions regarding the entry judgement or this method, please kindly provide feedbacks.[lang=pl]Hi, am new here and because of only 6 post i cant PM.

I've a few questions.

Please contact me g.pociejewski@luktom.biz

rgds,

G.[/lang]

thanks for your reply.

already sent you an email.

regards

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

please refer to the attached jpg file to read the following explanation.

1. -30 pips + -36 pips = -66 pips

When the price movement triggers the 2nd trade (in either direction), then traces back to SL of 2nd trade. ( Initial entry in such Sideway condition: price movement does not go beyond 50 pips in one direction; 30 pips = < The price movement < 50 pips ; trace back to SL:0)

Once 2nd Trade is triggered, SLs for 1st& 2nd buys move to 1st buy’s entry.

For instance: 2nd buy triggered, then trace back to SL.

1st sell closed by initial SL (2nd buy’s entry) (-30 pips)

1st buy closed by new SL (1st buy’s entry)( break even)

2nd buy closed by SL(1st buy’s entry) (-30pips x 1.2 lot = -36pips)

Total profit: -66 pips

2. -30 pips + 30 pips + 0 pip + 44 pips = 44 pips

When the price movement triggers the 2nd trade and lacks enough momentum to trigger the 3rd trade, but hits 1st hedge entry between 2nd & 3rd trade entries, then trace back to SL. (50 pips= < The price movement < 60 pips ; trace back to SL: 30)

Once 1st hedge between 2nd& 3rd entries is triggered, SLs for 1st& 2nd buys move to 2nd buy’s entry.

For instance: 2nd buy and the Hedge both triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips x 1 lot = -30 pips)

1st buy closed by new SL ( 2nd buy entry) (30 pips x 1 lot = 30 pips)

2nd buy closed by new SL ( 2nd buy entry) ( breakeven)

1st Hedge closed by TP ( 2nd buy entry) (20pips x 2.2 lot = 44 pips)

Total profit: +44 pips

3. -30 pips + -22 pips + -14 pips + 24 pips + 50 pips = 8 pips

When the price movement triggers the 3rd trade (which also means that 1st Hedge would closed by its SL) and then traces back to all existing trades’ new SL (previous Hedge entry) ( 60 pips = < The price movement < 80 pips ; trace back to SL:50)

Once 3rd trade is triggered, SLs for 1st& 2nd buys move to 1st hedge entry.

For instance: 3rd buy triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

3rd buy closed by SL (previous Hedge sell entry) (-10pips x 1.4 lot = -14 pips)

2nd buy closed by new SL (previous Hedge sell entry) (20pips x 1.2 lot = 24pips)

1st buy closed by new SL (previous Hedge sell entry) (50pips x 1 lot = 50pips)

Total profit: 8 pips

4. -30 pips + -22 pips + 0 pip + 36 pips + 60 pips + 72 pips = 116 pips

When the price movement triggers the 3rd trade and lacks enough momentum to trigger the 4th trade, but hits 2nd hedge entry between 3rd & 4th trade entries, then trace back to SL. (80 pips = < The price movement < 90 pips ; trace back to SL:60)

Once 2nd hedge between 3rd & 4th entries is triggered, SLs for 1st & 2nd & 3rd buys move to 3nd buy’s entry.

For instance: 3rd buy and the Hedge both triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

3rd buy closed by new SL (3rd buy entry) (breakeven)

2nd buy closed by new SL (3rd buy entry) (30pips x 1.2 lot = 36pips)

1st buy closed by new SL (3rd buy entry) (60pips x 1 lot = 60pips)

2nd Hedge sell closed by TP( 3rd buy entry ) (20pips x 3.6 lot = 72 pips)

Total profit: 116 pips

5. -30 pips + -22 pips + -36 pips + -16 pips + 28 pips + 60 pips + 80 pips = 64 pips

When the price movement triggers the 4th trade (which also means that 2nd Hedge would closed by its SL) and then traces back to all existing trades’ new SL (previous Hedge entry) ( 90 pips = < The price movement < 110 pips ; trace back to SL:80)

Once 4th trade is triggered, SLs for 1st & 2nd & 3rd buys move to 2nd hedge entry.

For instance: 4th buy triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

2nd Hedge sell closed by SL(4th buy entry) (-10pips x 3.6 lot = -36 pips)

4th buy closed by SL(previous Hedge sell entry) (-10pips x 1.6 lot = -16 pips)

3rd buy closed by new SL ((previous Hedge sell entry) (20pips x 1.4 lot = 28 pips)

2nd buy closed by new SL (previous Hedge sell entry) (50pips x 1.2 lot = 60 pips)

1st buy closed by new SL (previous Hedge sell entry) (80pips x 1 lot = 80pips)

Total profit: 64 pips

6. -30 pips + -22 pips + -36 pips + 0 pip + 42 pips + 72 pips + 90 pips + 104 pips = 220 pips

When the price movement triggers the 4th trade and lacks enough momentum to trigger the 5th trade, but hits 3rd hedge entry between 4rd & 5th trade entries, then trace back to SL. ( 110 pips= < The price movement < 120 pips ; trace back to SL: 90)

Once 3rd hedge between 4th & 5th entries is triggered, SLs for 1st & 2nd & 3rd & 4th buys move to 4th buy’s entry.

For instance: 4th buy and the Hedge both triggered, then trace back to SL.

1st sell closed by initial SL. (-30 pips)

1st Hedge sell closed by SL (3rd buy entry) (-10pips x 2.2 lot = -22 pips)

2nd Hedge sell closed by SL(4th buy entry) (-10pips x 3.6 lot = -36 pips)

4th buy closed by SL(4th buy entry) ( breakeven)

3rd buy closed by new SL ((4th buy entry) (30pips x 1.4 lot = 42 pips)

2nd buy closed by new SL (4th buy entry) (60pips x 1.2 lot = 72 pips)

1st buy closed by new SL (4th buy entry) (90pips x 1 lot = 90 pips)

3rd Hedge sell closed by TP (4th buy entry) (20pips x 5.2 lot = 104 pips)

Total profit: 220 pips

7. If the trend goes short( sell direction), the logic & principle is the same.

8. Once the trades are all closed by SL(TP), at exact moment repeats the initial entry process (again, both buy& sell orders enter at the same price at the same time.)

From above explanation, once the price movement = > 50 pips, the results of this method can become definitely positive. However, the risk still exists when every time initial entry process starts and repeats. It could suffer from the -66 SL in rows. Therefore it might be more profitable to enter during the Market open session or one or two hour later that time in which the volatility starts bigger. ---maybe also good for the time when news released. Otherwise, The EA might need the SL pct control once it got three SL from initial entry in row (-198 pips), the EA stops opening any new trade during the rest time until next day market open time comes.

If anyone thinks it is worth to code this method into an EA and has interested, it would be highly appreciated. We wants to test this method (as EA) to see how it works in all market conditions and find different parameter combination for each currency pairs.

Possible EA Key features allowed to adjust parameter:

Lot size

Start time (hour & minute)

End time (hour & minute)

Start trade day

End trade day

Max sell orders

Max buy orders

Pips starter distance: pips range to open next same direction order

Booster: constant for arithmetic progression

(I don’t know whether geometric progression would be better to use.)

Hedge distance: pips range to open opposite direction order (should smaller than given pips starter distance)

Method Weakness:

1. The worst case is that initial entry loss (-66 pips) happens in row during side way market conditions.

2. No entry judgement by any indicators or analysis. (first initial enter normally start at Asian market open time or 00:00 server time --- also 1 or 2 hour later after Asian market opens )

If any good suggestions regarding the entry judgement or this method, please kindly provide feedbacks.