most likely the A) option will become true. but why do you think stock market could have crash?

Why a crash could happen

most likely the A) option will become true. but why do you think stock market could have crash?

For the past ten years wall street has been creating mortgage backed securities without recording these mortgages in all the counties across America (all mortgage transactions must be recorded in the county of origin). Trillions of dollars of mortgage backed securities are in fact nothing backed securities. As this becomes common knowledge and all those who were sold these worthless securities cry "fraud" and demand put backs, investors could decide to take profits in a flurry of sell offs. It may not happen but, is definitely something to watch. If that happens I am curious as to what the dollar will do.

Dollar?

"Will history repeat??? Makes you think???"

If it were to happen, what do you think the dollar would do?

regards,

gcgman

Interesting discussion. I wonder what'll happen to the dollar now that the Fed decided to implement more easing measures. Have you guys heard of the Dollar Smile Theory?

In my opinion, it wouldn't be so dramatically. But China is the next leader of the world and this situation drives dollar in crash.

Interesting discussion. I wonder what'll happen to the dollar now that the Fed decided to implement more easing measures. Have you guys heard of the Dollar Smile Theory?

Please explain this theory and share your opinion as to what would happen to the dollar in the event of a crash.

Thanks,

gcgman

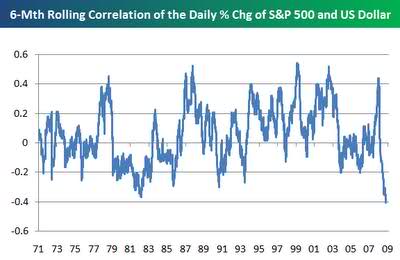

The chart shows the correlation between the S&P500 and the dollar.

The more the line it is above the zero line the more correlation there is between the stock markets and the dollar and the more bellow the zero line the more inversed correlation the 2 instruments have.

If people speak about stock markets then I prefer to look to the S&P 500 because 500 companys are in that index where most other stock indexes have only 20-30 companys in the index. Meaning it gives a bigger representation of the "stock" markets.

Some analyst say that a strong stock markets goes together with a weak dollar. That would mean that one can then say the opposite, when there is a weak stock market there should be strong dollar. But I have a feeling that those analyst just graduated from university and only look for a couple of years to their charts.

As you can see the chart I posted can not be a better text book example of randomness. If one wanted to claim that their is correlation between the dollar and stock markets then we should see at least that the chart line needs to be most of the time above the zero line ( correlation) or most of the time bellow the zero line (inversed correlation) Which is defeniatly not the case. Again pure randomness. And severall crashes have happened during that 40 year period.

The conclusion one can make on the question: what will the dollar do when stockmarkets crash is as important or valuable as asking what will the price of platinum do when the grain market would crash....

Friendly regards... iGoR

Thanks

iGoR, thanks for the education.

Interesting discussion. I wonder what'll happen to the dollar now that the Fed decided to implement more easing measures. Have you guys heard of the Dollar Smile Theory?

The measures the FED take is nothing more nothing less then printing more money or creating more money in an artificial way..

Printing more money should or will lead to the devalution of the dollar.

What they do now is a very dangerous plan. (I have sometimes the feeling that they take decissions like some people do from a 100$ MT4 account).

If they print that money which should help the economie and if it helps the economie then their is no problem at all because then the growing economie will give counter weight to the money they artificialy created.

But if they create more money and IF economie would not be helped by it or in other words can not give any counter weight to that printing trick then they will be in a HUGE problem and not only "them" but also other countries and continents.

Because it will artificialy create a bigger discrepancy between the euro and other currencys and the dollar where Europe and Japan will have even more problems to export to the US.

What they do now can lead to a hyper inflation and that is even a more dangerous situation then what we had with the financial crisis 2 years ago.

Lets cross our fingers.

And to all you americans, buy buy buy, borrow borrrow borrow, lend lend lend

Friendly regards...iGoR

PS. For those who are interested look to this video (it is going to scare you as hell how capitalistic systems operate). But only the first 1h15min because the rest is futuristic crap: Zeitgeist: Addendum

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Question for you veteran traders who have seen it all:

If the stock market were to have a major crash in the near future what would happen to the dollar? Would it:

A) Dramatically rise because of a world wide chain reaction and investors would seek the dollar as a safe haven?

B) Dramatically drop because everyone would view the dollar as worthless?

C) First B then A as a deflationary depression set in?

D) First A then B as the Fed prints money like crazy to avoid or get out of a depression?

E) None of the above, something else?

I would love to know your opinions.

gcgman