You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

These guys are always short Euro

funny thing is though they have been right about 9 times out of 10

even in an uptrend

These guys are always short Euro

funny thing is though they have been right about 9 times out of 10

even in an uptrendWhat I do not know is the total accounts size and number

Of being always short : I think it is logical. If we take into account that majority quietly exits the market on Friday with some profit collecting, it is no wonder that Sunday positions are usually somewhat counter trend

uptrends often seem to pullback end of the wk and sometimes early in the next wk, before the next upmove and these guys don't seem to mind a bit of counter trend trading in between - but when i try i always get my ass kicked

think i'll just follow the ratios in future - beats looking at the charts all day

No gap, thin volume, one more boring Asian session (unless the Chinese declare a war)

Waiting the London session to trade

No gap, thin volume, one more boring Asian session (unless the Chinese declare a war) Waiting the London session to trade

Don't forget that we are going to have FOMC statement this week

Week no. are signals buy/ sell,trade week no. same no. all the week,every day ,24-h,5-days,trade with the trend -no indictors ,only week no.enter on week no.posted once a week on monday for all the week. use week no. as enter trade point.,news is just event that can speed up or down the price movment

rules:enter olso( +-)6-9p,or week no.

week no.(10/28/2013)

have a nice green week! ()

()

week no. gu--6126, 6145, 6150, 6205, 6210, 6186, eu---3769, 3771, 3787, 3831, 3829, 3847

Don't forget that we are going to have FOMC statement this week

Yep, you are right. This week is going to be dominated with the FOMC statement specualtions

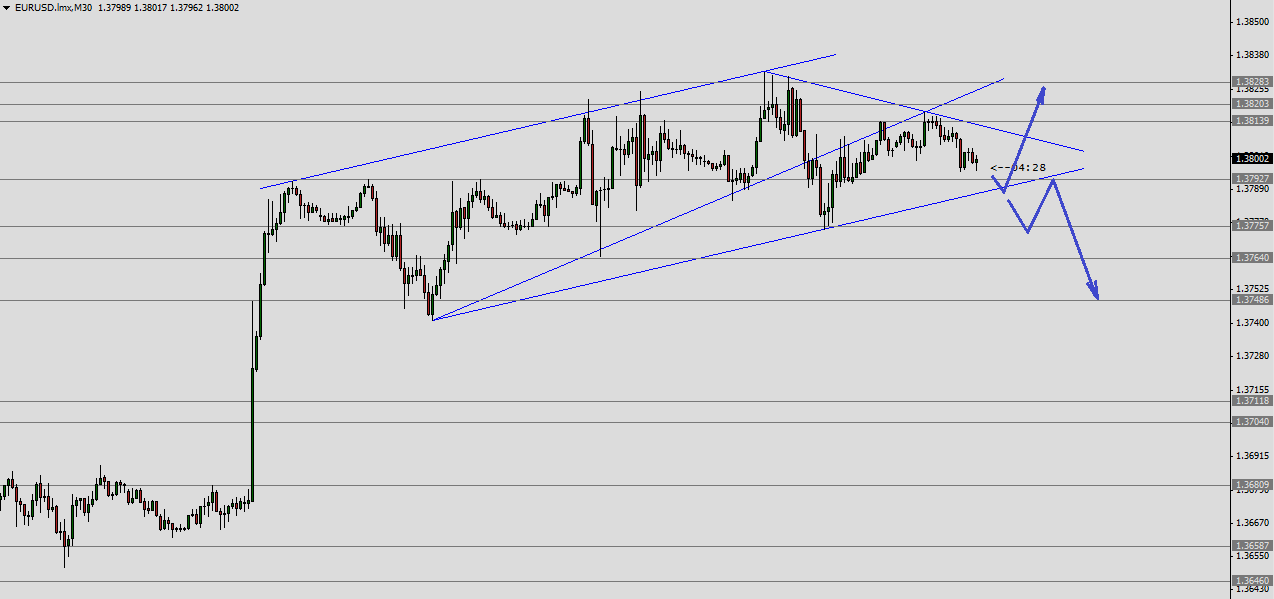

Level 1.3790 on EURUSD seems to be in play right now and if defeated we should see move at least towards 1.3750. We’ve seen lower high on the pair on Friday and early Monday, so unless longer consolidation seen around 1.3790, that corresponds to defending that level, we would search for good spot to join upmove towards tops (1.3830).

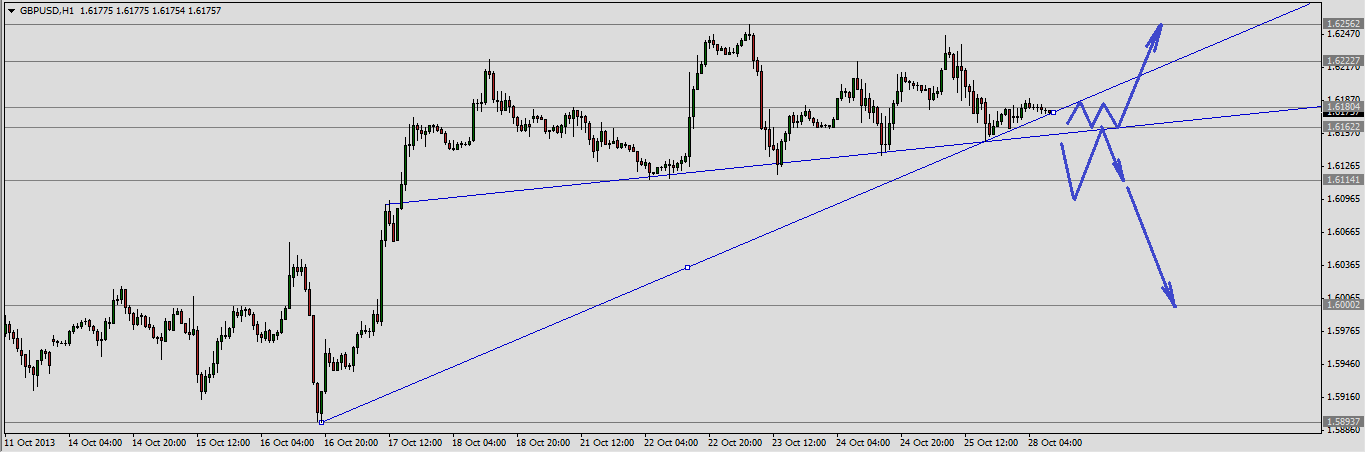

Looking at the potential head and shoulders formation some interaction can be expected around 1.6160-1.6155 level, depending how the situation developes we will be looking for a short position at this level. If the level gets defended we will look for a long position to joint the up trend.

Yep, you are right. This week is going to be dominated with the FOMC statement specualtions

I think that it is going to range till the FOMC statement (nobody knows what the heck is going to happen then) and that people learned their lesson the last time - nobody is going to take a serious position when all 3 options are in game (to taper the QE, to leave it as is or even to increase the QE)

I think that it is going to range till the FOMC statement (nobody knows what the heck is going to happen then) and that people learned their lesson the last time - nobody is going to take a serious position when all 3 options are in game (to taper the QE, to leave it as is or even to increase the QE)

I agree

There will be no major change till FOMC