Thanks xard777, just what I am looking for.

I am looking for an indicator I can use to filter out trades in the direction of the overall trend.

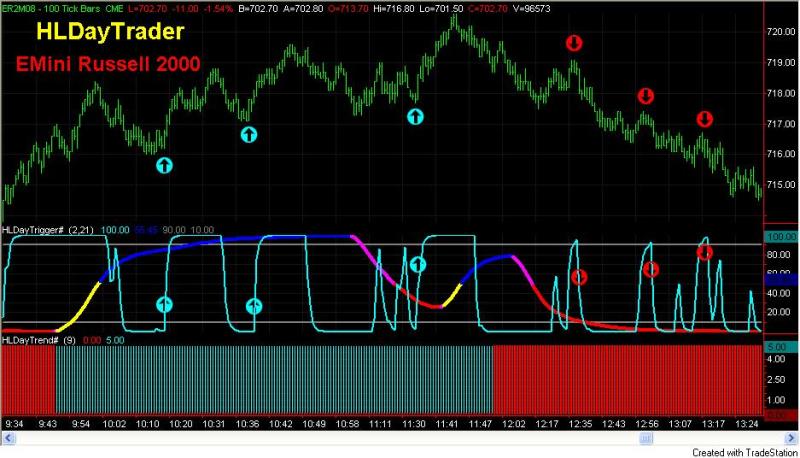

Something like the HLDaytrend here...

Most of the bar type trend filters I have found like the above changes too fast too quickly.

It would be great to use an overbought/oversold oscillator and only take trades in the pullbacks of a longer term trend.

Just by taking trades in only the direction of a higher time frame trend can be much more profitable but it is easy to forget this when visually backtesting a potential strategy.İt looks like to me there is no clear concise entry-exit in this system.Thoose arrows have been put on randomly, please correct me f I am wrong.

Hi There, Xard777

Do you have the code for those two, I tried them and they hung MT4?

Hi There,

Try this...

Using a 4hr chart with a nonlagma set to 50 and a hma set to 9.

Enclosed files...just change settings to suit.

Hope this is of help

Xard777Do you have the .mq4 files for these two files. Actually while changing the timeframe... the width of the lines revert back to Very thick lines. I just need to make the width to be 2 for both of them. That's all.

Thank you for making these available.

I am looking for an indicator I can use to filter out trades in the direction of the overall trend.

Hi There,

Try this...

Using a 4hr chart with a nonlagma set to 50 and a hma set to 9.

Enclosed files...just change settings to suit.

Hope this is of help

Xard777

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I am looking for an indicator I can use to filter out trades in the direction of the overall trend.

Something like the HLDaytrend here...

Most of the bar type trend filters I have found like the above changes too fast too quickly.

It would be great to use an overbought/oversold oscillator and only take trades in the pullbacks of a longer term trend.

Just by taking trades in only the direction of a higher time frame trend can be much more profitable but it is easy to forget this when visually backtesting a potential strategy.