You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Which complex indicator are you using? There are two.

I think you are using this one. If yes, so File UEGCJ.h is going to \MetaTrader 4\experts\include\ and all 11 indicators to \MetaTrader 4\experts\indicators\

Don't forget to compile. EURUSD indicator (mq4) and all the other indicators are here.was that...compile. but why these indicator need to compile and many other don't?

well, the problem now is again the scale. how can i see two in the same window?

and, the complex indicator is the same that all separated indicators in 1 window?

and more: i like a strategy like that: if the correlation between eurusd and usdchf is X, then buy both and waits it turns to profit.

what you think?

many thanks.

I'm testing 4 correlators.

They are based on correlation and price movement.

I'm not using indicators.

Here are my resultes for 2 hours.

I used only 2 correlators,

one EUR/USD and EUR/JPY.

Here are my resultes for 2 hours.

I used only 2 correlators,

one EUR/USD and EUR/JPY.Bongo, where is the EA for these results? Can you post it here?

Trading on Mirrored Pairs

Greetings,

I was trying to find out (did a search) on mirrored pairs (couldn't find anything yet)- pairs that mimic each other to the opposite ends of support/resistance. For example, the GPB/CHF and EUR/GBP are usually within 15-30 pips of support/resistance and when you look at an H1 chart of each, they are pretty much opposite of each other in practically every manner, but not exact though (within 15-30 pips is pretty dang close though ). I've even traded these pairs for a while now entering a strong support (buy) and resistance (sell) with a TP of at least 100 to 150 pips for each of the pairs and a trailing stop of 55-65 pips (usually not even necessary, but added as a precaution) and following an exponential moving average, one short (6) and long (15) on both charts. I've only entered the trades when I know for sure (when the indicators are starting to go wide on both charts), not right at the cross to make absolutely sure I'm either buying/selling at the maximum support or resistance. If anyone knows of another mirrored pair to use that are within a tolerable pip range, please include it in this thread along with your trading ideas and/or tips on using mirrored pairs. Also, ideas for using an EA for this are welcomed as well. Thank you and I'm looking forward to some interesting conversations here.

). I've even traded these pairs for a while now entering a strong support (buy) and resistance (sell) with a TP of at least 100 to 150 pips for each of the pairs and a trailing stop of 55-65 pips (usually not even necessary, but added as a precaution) and following an exponential moving average, one short (6) and long (15) on both charts. I've only entered the trades when I know for sure (when the indicators are starting to go wide on both charts), not right at the cross to make absolutely sure I'm either buying/selling at the maximum support or resistance. If anyone knows of another mirrored pair to use that are within a tolerable pip range, please include it in this thread along with your trading ideas and/or tips on using mirrored pairs. Also, ideas for using an EA for this are welcomed as well. Thank you and I'm looking forward to some interesting conversations here.

-David

P.S.- Should Pivots be used in these situations to determine the best possible points of resistance/support to help determine better entry/exit points for these mirrored pairs? (I haven't used Pivots yet...needs relp!)

eurusd & usdchf are mirrors too i guess

trading with the correlation

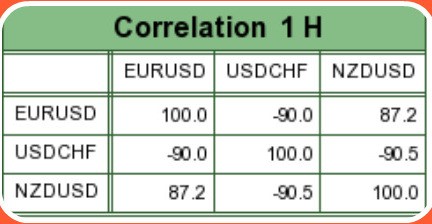

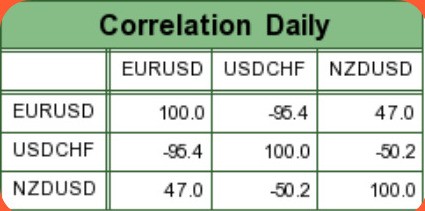

ur-Usd correlation with both pairs USD/CHF and NZD/USD is very strong as you can see from the figures 1 and 2 below.

EUR/USD holds positive correlation with NZD/USD in an hourly time frameONLY while it establishes strong negative correlation with USD/CHF pair both in an hourly and daily time frame.

From figure 1, one can see Eur-Usd holds a strong negative correlation both in an hourly and daily time frames with USD/CHF pair.

The correlations between these pairs hold at -90% and -95.4% in an hourly and daily time frames respectively.

So how can I make use of these correlation information in making a profitable trading decision?

That's a million dollar question I want to address here.

The correlation number in the figure 1 translate to - when EUR/USD moves up then USD/CHF moves down and vice versa.

If I've taken a long position on EUR/USD taking another long position on USD/CHF will nearly eat away all my profit should the market move in my favor.

Taking a EUR/USD long position and a short position on USD/CHF simultaneously translates to doubling the EUR/USD long position.

The only difference will be the difference in pip amount between these two pairs.

For a standard account (=100K per lot) these pip differences stand at $10/pip for EUR/USD and $9.67/pip for USD/CHF.

Also from figure 1, one can see the correlation of Eur-Usd with NZD/USD pair is a strong positive correlation of 87% in an hourly time frame whereas on a daily time frame a weak correlation of 47% holds between these two pairs.

hese percentages translate to - when EUR/USD moves up then NZD/USD will likely move up in an hourly time frame and vice-versa.

For instance, in an hourly time frame, if I am long on EUR/USD pair then taking another long position on NZD/USD pair would equate to adding another EUR/USD long position.

However,in a daily time frame, since the correlation between the pair is weak, I can not predict anything with confidence as with an hourly time frame.

I hope responsible traders will invest enough time and energy to understand this quick and easycurrency correlationconcept.