Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.11 14:01

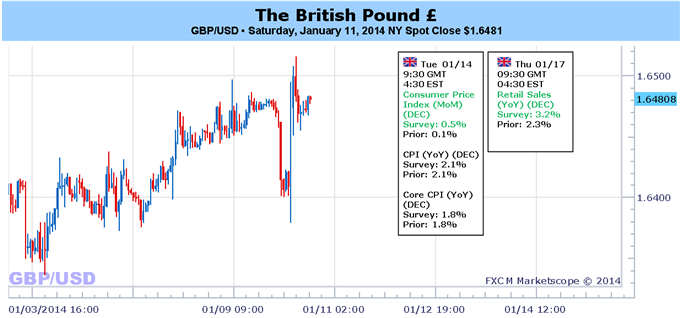

Analysis for GBPUSD for the next coming week (adapted from this article).

Fundamental Forecast for the British Pound: Bearish

- Over the past 20 years, January has typically been a poor month for the GBPUSD.

- The British Pound looked set to decline after NFPs, but the weak report put the selloff on hold.

- Ultimately, we still want to buy dips in the British Pound.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.13 07:40

GBPAUD is on the verge of deeper correction (based on fxstreet.com article)

GBP/AUD

started the trading week on a softer note and moved below the

resistance area of 1.8300 right from the start, as the bears are eager

to show who is running the show here.

Watch out for Head-and-Shoulders

From the

technical point of view the GBP/AUD is on the verge of deeper correction

as the cross has formed the head and shoulder pattern on the daily

charts. The break below 1.8256 is needed to confirm the model

completion. GBP/AUD has come vary close to this level today morning as

the current intraday low is 1.8261. The upside dynamics is likely to be

contained below 1.8300. Australian home loans and investment lending

data came out slightly better than expected, though it is hardly the

factor behind the move. It is all about post-Non Farm Payrolls reaction

and stops, triggered below 1.8300. No fundamental data of interest is

published today so keep an eye on the above mentioned technical levels

level, if the crosse breaks the resistance level at 1.8300, we may spend

still more time in the range.

What are today’s key GBP/AUD levels?

Today's

central pivot point can be found at 1.8395, with support below at

1.8229, 1.8135 and 1.7969, with resistance above at 1.8489, 1.8655, and

1.8749. Hourly Moving Averages are bearish, with the 200SMA at 1.8446

and the daily 20EMA at 1.8346. Hourly RSI is neutral at 27.06.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.14 08:29

After NFPs, Focus Turns to Potential Tops for GBPAUD (adapted from this article)

- Pound continues to struggle as investors unwind bullish bets.

- Australian Dollar, Japanese Yen might offer clearest opportunities.

In light of last week’s data and the softening yield environment, the British Pound enters the coming period with a more uncertain future. Central to Sterling weakness has been budding expectations for a dovish shifting in the Bank of England’s forward guidance policy - the Unemployment Rate threshold would be lowered to 6.5% from 7.0%.

Ironically, this is a result of recent economic momentum, as it looks like the UK Unemployment Rate will hit 7.0% sometime in early-2014. The BoE is worried that higher rates resulting from a stronger economy will be self-defeating; right or wrong, it is attempting to front-run an accelerated tightening cycle.

Accordingly, because the BoE needs a soft price environment in order to justify a dovish shift in policy – the desire to keep rates low so as to not choke off growth - we are watching this Tuesday’s December UK Consumer Price Index release with great anticipation.

Confirmation that inflation remains pinned below the BoE’s +2.5% (y/y) forward guidance circuit may bethe signal for a dovish shift at the February meeting – and that may be setting up the GBPAUD and GBPJPY for technical corrections in the coming days.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Week 3 - 8H Time Frame: new Bearish Trend starting?