You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I could wait for it to fill the gap.

Hi RyuShin,

Thanks for your great template and posts.

Can you say about StopLoss rules and values you will use too?

Hi RyuShin, Thanks for your great template and posts. Can you say about StopLoss rules and values you will use too?

You're very welcome. Hope my contributions can give you some useful idea to enhance your trading. Speaking of stoploss, my stoploss is usually when a pattern disappears. Patterns that are formed by ZUP_v135 ALL NEXT, ALL HL 113 and v113wsv51 disappear when the price break the structure of patterns while patterns formed by FxGround Harmonics don't disappear unless the indicator forms another pattern. Stoploss with FxGround Harmonics is when the price penetrates the D box. When a pattern is formed, I draw fibo and see what fibo levels are within the D box (or around D if there's no box). When the price penetrates fibo levels I draw (that time a pattern usually disappears), I close a position for stoploss (or if I'm greedy, I wait but usually I end up losing more lol so I try not to be greedy). Speaking of values, what do you mean by that?

Thanks.

For TP you consider 61.8%? or 127%?

For values, I mean about Fibo or other price you set.

Hello RyuShin, thanks for sharing your template and your strategy..

Some questions :

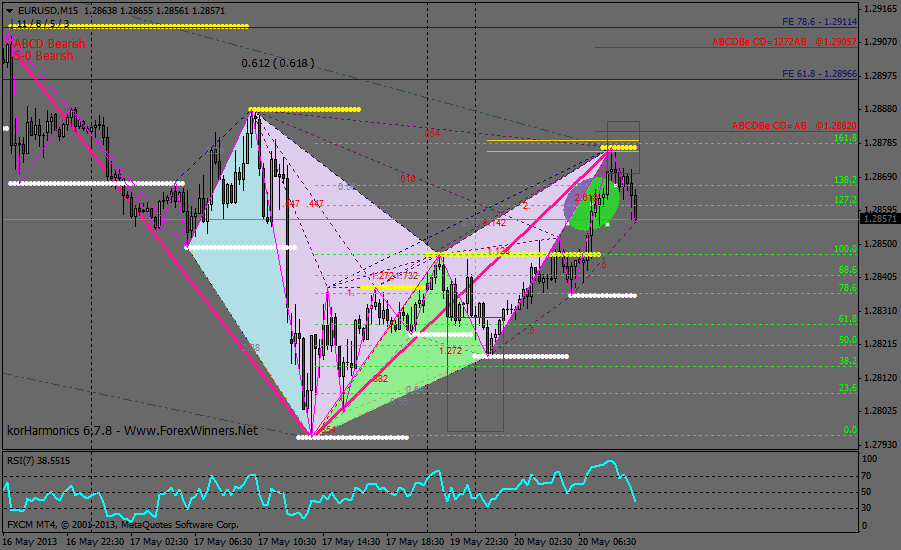

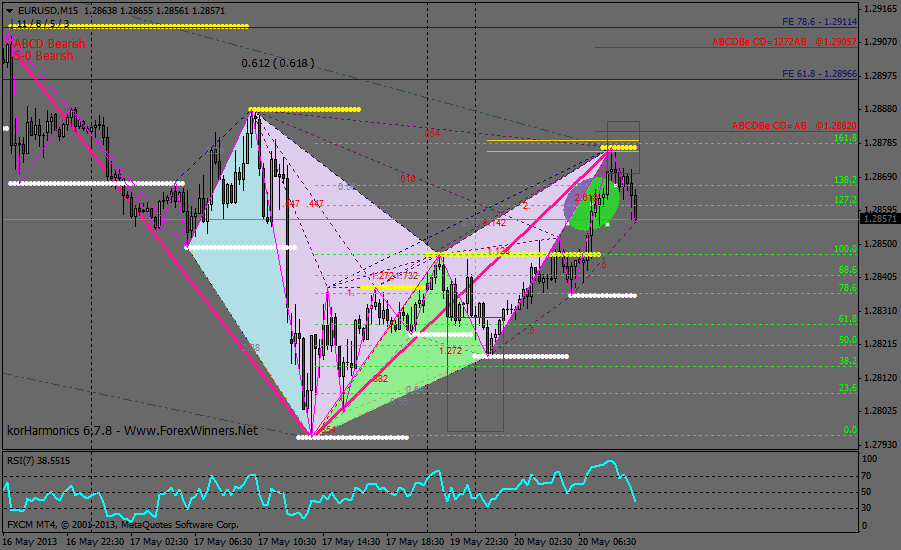

On this graph, EUR/USD M15 :

A pattern appears and there is a contact price with fibo level 127.2 138.2(i add ellipse on graph) and price continue to climb until fibo 161.8

With your strategy, could you explain me (us) when did you enter in this case ?

Other question : When did you enter with Bullish/Bearish Next and for Black Swan (can we draw fibo again even if these figures are not 'usual')?

Thanks again

Thanks. For TP you consider 61.8%? or 127%? For values, I mean about Fibo or other price you set.

You're very welcome. Yes, usually 61.8 is my first target. If the price, no wait, I should say candle I think. So if the candle penetrates 61.8 level, I consider 78.6 or 88.6 levels as second target. I pay attention to support and resistance too. Around 61.8 is often previous support and resistance. If the price moves like crazy and penetrates 61.8, 78.6 and 88.6, I consider 127.2 or 138.2 levels as third target and 161.8 as ultimate target. It depends on how the price goes too. You mean my fibo level setting? Well it's 261.8, 224.0, 161.8, 138.2, 127.2, 100, 88.6, 78.6, 61.8, 50, 38.2 0.0, -38.2, -50, -61.8, -78.6, -88.6, -100, -127.2, -138.2, -161.8, -224.0 and -261.8.

Hello RyuShin, thanks for sharing your template and your strategy.. Some questions : On this graph, EUR/USD M15 :

A pattern appears and there is a contact price with fibo level 127.2 138.2(i add ellipse on graph) and price continue to climb until fibo 161.8 With your strategy, could you explain me (us) when did you enter in this case ? Other question : When did you enter with Bullish/Bearish Next and for Black Swan (can we draw fibo again even if these figures are not 'usual')? Thanks againHello Twan, the pattern is on M30 too. When a pattern is formed, I usually check if there's the same pattern on another time frame. Anyways, I didn't enter a position with the pattern which I regret. I didn't enter because when I saw it on M30, it was kinda iffy to me. On M30, it touched 127.2 and then penetrated 127.2 then it penetrated 138.2. I kinda waited for it to touch 161.8. If it did, I would enter a position for sure. Another reason is I have a long position from previous pattern on M30. The price penetrated 61.8 level so I'm expecting the price to go higher.

Hello RyuShin, thanks for sharing your template and your strategy.. Some questions : On this graph, EUR/USD M15 :

A pattern appears and there is a contact price with fibo level 127.2 138.2(i add ellipse on graph) and price continue to climb until fibo 161.8 With your strategy, could you explain me (us) when did you enter in this case ? Other question : When did you enter with Bullish/Bearish Next and for Black Swan (can we draw fibo again even if these figures are not 'usual')? Thanks againI don't trade with black/white swan pattern yet. Because I haven't studied the pattern yet lol. Speaking of bullish/bearish Next. It depends on shapes but in this case of pattern, I'd draw fibo and use 61.8, 78.6 and 88.6 as bounce levels for an enter. The levels are usually within the D box when such pattern is formed. I'd enter a long position around 61.8 cuz the price was kinda testing that level. It penetrated 61.8 and got close to 78.6 level and bounced, went north. Then the bat pattern was formed which could be a chance to close the position and enter another position (in this case short). It would've been long 30-40pips and short 15-20+pips maybe. I was sleeping when the bullish next was formed anyways lol..

USDJPY M5 two longs 50pips. I was skeptical about this because of the bullish black swan but I gave a shot. After the bullish black swan was formed, the bullish next showed up so I figured there might be more probability to go up. Closed at the resistance.

HOLA,

THANK YOU VERY MUCH Ryu Shin

WONDERFUL EXPLANATIONS.