You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I love when there is a predictor in the name of something. Almost like secret

I love when there is a predictor in the name of something. Almost like secret

SEO rules : the more they mention such words, the more the search engines will hit it. It is just showing what are people looking for

thx stelore,

i've made detrend oscillator predictor which is also missing here

didnt know which ob/os levels i should use

i simply took an average of the last x bars, which can be changed as you want

its also includes a prediction for the upcoming bar

Deorn,

I hope you are still interested in this. I think there is a part of the logic that will improve the detrend O/P. Use fractals to define reversals. Now note the detrend level at the highest bar that makes each fractal. Make a moving average of these Detrend...the value thereof is what you are after for the DOP and not the values of so many bars. Hope you can incorporate this and release another DOP. Anyways thanks for your help to all.

Cheers.

Dinapoli preferred stochastic and Dinapoli preferred stochastic bar

dinapoli_preferred_stochastic_bar.mq4 dinapoli_preferred_stochastic.mq4

Dinapoli targets indicator

dinapolitargets.mq4

Hello atiyya,

I was reading the book the past few days and I am trying to put it together

in a way I can use it.

What I came up with so far is this:

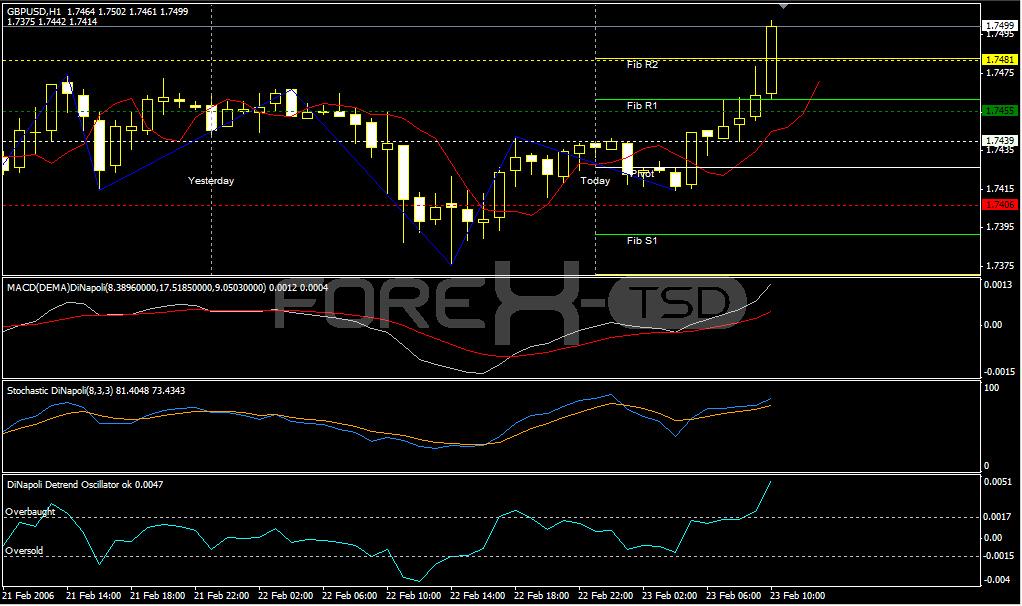

1. I determine the "trend" as explained by Dinapoli on the daily chart.

A close above the 3x3 and fast line over slow line on the DEMA = Long Trend. And vice versa for short.

2. Down to the 1 hour chart.

I determine the OB/OS levels for the 1 hour chart bases on the past few extremes on the detrend.

3. If the daily trend is long, I look for buy opportunities on retracements (dips).

Buy signal if after a dip:

a) close above 3x3, and

b) DEMA fast above slow, and

c) detrend not in overbaught but rising between the zero line and 65% of the average extreme, and

d) dinapoli targets indicator is signaling a buy

4. Stop and Profit Targets

Stop Loss is calculated below a fib resistance, as far as I can see.

Profit Targets are calculated too, depending how much space detrend has left to travel one could chose

one of the 3 targets given. (I checked the targets manually, and they are the same as the original formula.)

5. Close the trade if

a) Chosen Profit Target is hit, or

b) Detrend is engaging 90% oversold, or

c) Close below 3x3, or

d) DEMA fast closing below DEMA slow, or

e) Stop Loss is taken out (should basicly never happen).

Thats it for now.

I will attach a chart of a GBP/USD trade I did yesterday.

Even though I am sure 99% of all methods would have picked up on the move.

Any comments appreciated.

Maybe you could elaborate a little further how you get your entries on

the smaller time frames?

EDIT:

Entry was the dotted white line at 7439 and my target was the yellow dotted line at 7481.Hi Dan S,

Do you still has the indicators which shown on your image especially for DDO with the levels?

Please someone to share this indicators...

.

DiNapoli and Fibos

di_napoli_objectives.mq4