You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.16 14:58

Intra-Day Fundamentals - EUR/USD, USD/CAD, and Dollar Index: Philadelphia Fed Business Outlook Survey

2017-02-16 13:30 GMT | [USD - Philly Fed Manufacturing Index]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia.

==========

From official report:

==========

EUR/USD M5: 12 pips range price movement by Philadelphia Fed Business Outlook Survey news events

==========

USD/CAD M5: 12 pips range price movement by Philadelphia Fed Business Outlook Survey news events

==========

Dollar Index M5: range price movement by Philadelphia Fed Business Outlook Survey news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.20 17:47

USD/CAD Intra-Day Fundamentals: Canada's Wholesale Trade and range price movement

2017-02-20 13:30 GMT | [CAD - Wholesale Sales]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Wholesale Sales] = Change in the total value of sales at the wholesale level.

==========

From official report:

==========

USD/CAD M5: range price movement by Canada's Wholesale Trade news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.22 16:44

USD/CAD Intra-Day Fundamentals: Canada's Retail Sales and 42 pips range price movement

2017-02-22 13:30 GMT | [CAD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Retail Sales] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

==========

USD/CAD M5: 42 pips range price movement by Canada's Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.24 14:57

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and 37 pips range price movement

2017-02-24 13:30 GMT | [CAD - CPI]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

==========

USD/CAD M5: 37 pips range price movement by Canada's Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.28 09:07

Quick Technical Overview - USD/CAD: trading to be within 100-daySMA/200-SMA ranging area waiting for the direction of the trend to be started (adapted from the article)

D1 price is located within 100 SMA/200 SMA levels for the ranging market condition:

If the price breaks 1.3055 support level on close D1 bar so the price will be reversed back to the primary bearish condition and with 1.3008 nearest target to re-enter.

If price breaks 1.3334 resistance level so the primary bullish trend will be resumed with 1.3460 daily bullish target.

If not so the price will be ranging within levels for direction.

Trend: ranging

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.01 16:49

USD/CAD Intra-Day Fundamentals: BOC Overnight Rate and 459 pips range price movement

2017-03-01 15:00 GMT | [CAD - Overnight Rate]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

From official report:

==========

USD/CAD M5: 59 pips range price movement by BOC Overnight Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.02 15:33

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 35 pips range price movement

2017-03-02 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

==========

USD/CAD M5: 35 pips range price movement by Canada's Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.11 10:06

Weekly Outlook: 2017, March 12 - March 19 (based on the article)

The US dollar ended the week on the back foot despite the upcoming rate hike. Apart from the Fed decision, we have rate decisions also in the UK and Japan, US consumer confidence and housing data, and lots more. These are the main events on forex calendar for this week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.15 09:20

USD/CAD Ahead of FOMC (based on the article)

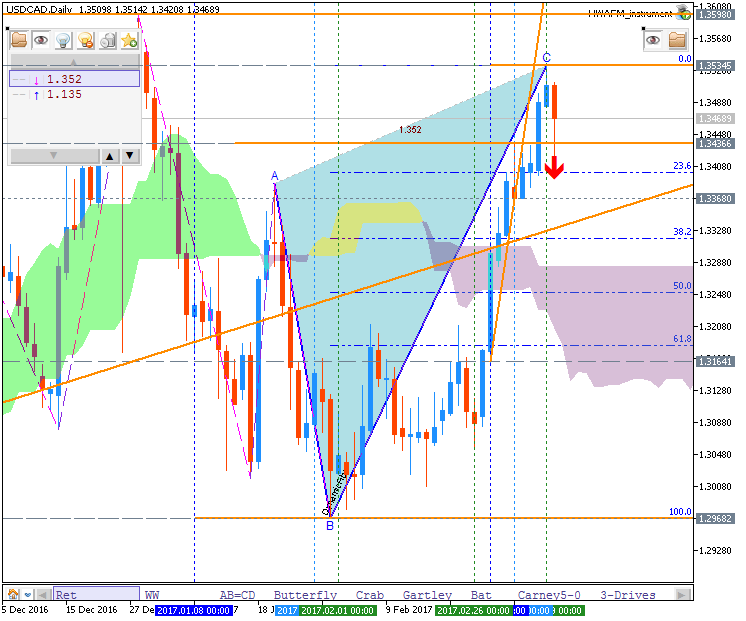

Daily price broke Ichimoku cloud to above for the breakout with the bullish reversal: the price is testing resistance level at 1.3534 to above for the bullish trend to be continuing with 1.3598 target to re-enter.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.18 14:30

Weekly Fundamental Forecast for USD/CAD (based on the article)USD/CAD - "Meanwhile, the main economic event in Canada in the week ahead is the Federal budget but that is unlikely toinclude any major tax reforms or additional stimulus measures above and beyondthoseannounced in last year’s budget. The economy is growing at a respectable pace, with GDP expected to expand by around 1.8% annualized in the first quarter. Yet the Bank of Canada is unlikely to turn hawkish while the shadow of US President Donald Trump’s trade policies hang over it."