You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.18 16:32

Dow Jones Industrial Average - All-Time Intraday Highs (based on the article)

H4 price broke Ichimoku cloud from below to above to be reversed back to the primary bullish market condition. The price crossed 22,275 resistance level for the bullish breakout to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.22 07:51

Dow Jones Industrial Average - The Week Ahead (based on the article)

Daily price is above 55 SMA/200 SMA revcersal levels in the bullish area of the chart: the price is testing Fibo resistance level at 23,316 to above for the bullish trend to be continuing

==========

The chart was made on D1 timeframe with standard indicators of Metatrader 4 except the following indicator (free to download):

Dow Jones - breakdown with the daily bearish reversal

Daily price was bounced from 26.698 resistance level to below for the correction with the bearish reversal: the price is testing 23,775 support level to below for the daily bearish trend to be continuing.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Seems Brainwashing system caught this recent movement -

============

Brainwashing System

The beginning

After

- Brainwashing system/AscTrend system (MT5) - the thread

============Dow Jones - breakdown with the daily bearish reversal

Daily price was bounced from 26.698 resistance level to below for the correction with the bearish reversal: the price is testing 23,775 support level to below for the daily bearish trend to be continuing.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

That crush !! no one could have anticipate that it will fall to to that extend.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.02.11 06:31

U.S. Stock Market: "That's All, Folks!" ... So soon? (based on the article)

Dow Jones Index daily price broke Ichimoku cloud to be reversed to the primary ebarish market condition as short-term situation for example.

By the way, it is just a secondary correction within the primary bullish trend in medium term (W1), and the strong bullish trend is still continuing in the long-term (MN1).

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.04.29 08:21

Dow Jones Industrial Average - daily bearish to be started; weekly ranging near bearish reversal (based on the article)

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.05.21 06:13

The Week Ahead: relatively quiet week (based on the article)

============

The chart was made on Metatrader 5 using HWAFM tool pattern tool from this post.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.06.08 06:51

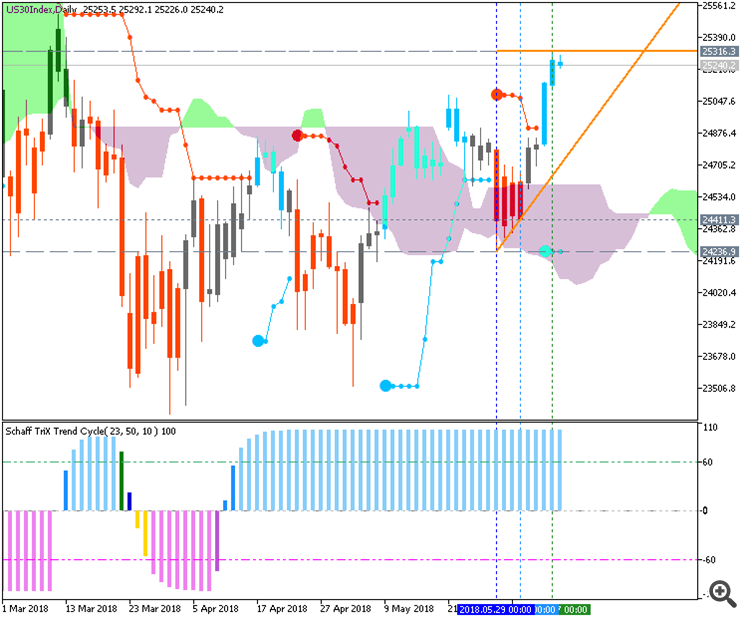

Dow Jones Industrial Average - daily bullish breakout; 25,316 is the key (based on the article)

==========

The chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.06.28 09:17

Dow Jones Industrial Average - daily bearish reversal (based on the article)

D1 price broke 200 SMA to below for the bearish reversal to be started. The 55 SMA was not yet crossed with 200 SMA to below on close daily bar so the price may be bounced back to the bullish area soon.

Strategy: waiting for 55 SMA/200 SMA cross on daily chart together with 23,516 monthly last low as a support level for the final bearish daily reversal.

==========

The chart was made on MT5 with standard indicators of Metatrader 5 together with the following custom indicators: