Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.13 06:29

5 Things to Watch For in Next Week's Fed Meeting (based on the article)

- The Fed will hike rates by 25 basis points, only the second increase in 10 years. This will be driven by additional progress toward its dual objectives -- full employment and inflation converging to 2 percent -- along with a desire to validate high market expectations about rates, and to respond to diminished headwinds from abroad (particularly from Europe, despite the results of last week’s Italian referendum).

- In terms of these dual objectives, the Fed’s policy deliberations will be influenced by the decline of the unemployment rate to 4.6 percent along with the sluggish participation rate, despite continued solid monthly job creation. When it comes to inflation, the inclination to fully embrace the rise in market expectations will be tempered by the recent decline in the growth rate of average hourly earnings.

- On forward guidance, the Fed will keep open the possibility of multiple hikes in 2017. This is due not only to its anticipation of a solid economic baseline for next year but also the new upside for growth and inflation associated with the recent policy announcements by President-elect Donald Trump. An important consideration here is the degree to which a more active fiscal policy, especially if led by productive infrastructure spending, would allow faster normalization of monetary policy.

- For the first time in a long while, the FOMC’s “blue dots” -- the expectations of individual members of the Fed board for the future path of rates -- will not migrate down significantly. Instead, they will remain broadly unchanged, while market expectations will continue to converge upward over time.

- Nonetheless, the Fed’s signals of a somewhat tighter monetary policy will be nuanced, and with good reason. U.S. central bankers will wish to wait for the details of the Trump administration’s economic policies before moving toward significant alterations of a forward guidance that remains heavily “data dependent.”

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.14 09:19

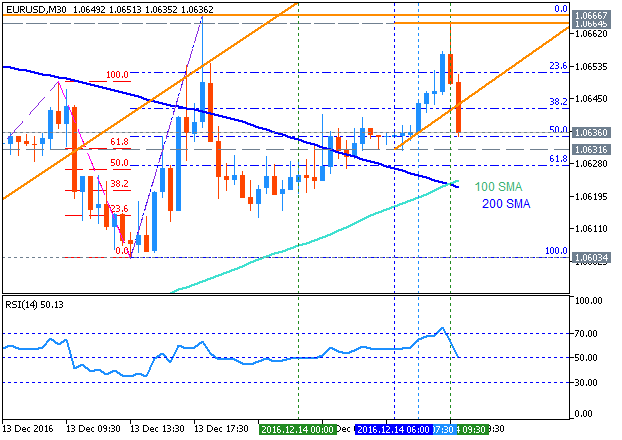

USD Into FOMC: More Gains As Market Reprices More Fed Hikes - Goldman Sachs (based on the article)

- "We expect the FOMC to raise the federal funds rate by 25bp."

- "We expect the USD to continue to move higher and we forecast the TWI USD to appreciate about 7% versus G10 currencies over the next 12 months."

- "We expect further USD strength as the market re-prices more tightening from the Fed."

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register