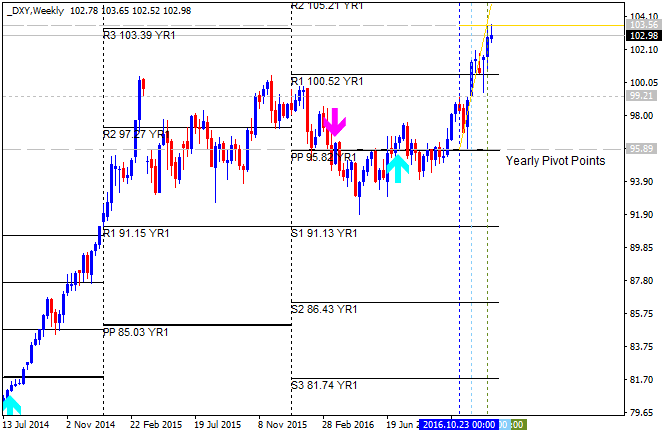

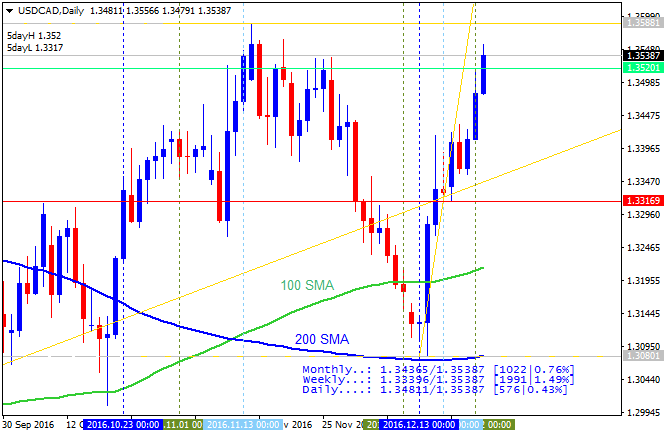

USDCAD Technical Analysis 2016, December: bullish trend to be continuing with 1.3588 level as the nearest bullish weekly target

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.26 12:18

Weekly Outlook: 2016, November 27 - December 04 (based on the article)

The US dollar reached new highs against the euro and the yen, but some profit taking was seen amid the Thanksgiving vaction. We are not back to full business: GDP data in the US and Canada, US consumer confidence and a full buildup to the US Non-Farm Payrolls stand out.

- Mario Draghi speaks: Monday, 14:00. European Central Bank President Mario Draghi is due to testify on economic and monetary developments following the Brexit vote before the European Parliament’s Economic Committee in Brussels. Draghi noted recently that the ECB will extend its €1.7 trillion bond-purchase program on December, warning that the Eurozone’s weak economy remains clouded by downside risks and heavily reliant on the ECB’s stimulus.

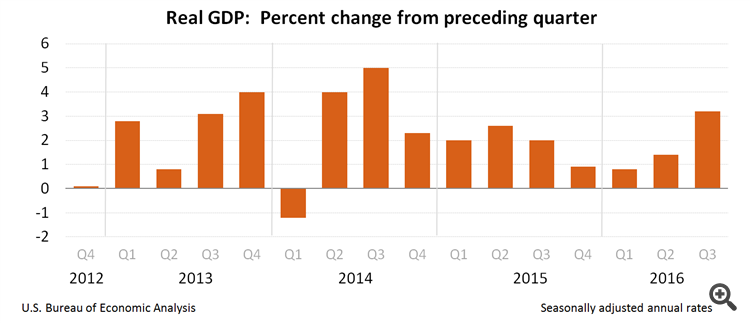

- US GDP data: Tuesday, 13:30. After three unimpressive quarters, the US economy rebounded in Q3 and advanced at 2.9% according to the initial report, which came out slightly better than expected. The second release is expected to show a small upgrade to 3% annualized growth. Note that significant revisions are common in the US.

- US CB Consumer Confidence: Tuesday, 15:00. Consumer morale declined in October to 98.6 compared to 103.5 posted in the prior month, suggesting households remained cautious amid weaker economic growth and pre-election uncertainty. Economists forecasted a decline to 101.5. Most analysts believe this decline was temporary reflecting the nervousness about the looming presidential election. Nevertheless, consumers continue to spend boosting growth. Analysts forecast a rise in consumer confidence to 101.3.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. The ADP jobs report for October continued to disappoint with a smaller than expected release of 147,000 new positions, the weakest figure since April 2013. Construction and education jobs dropped sharply as the overall trend of job gains continues to weaken. However, job growth remains strong but the pace of growth is slowing. ADP report is expected to show a jobs gain of 161,000 in November.

- Canadian GDP data: Wednesday, 13:30. The November release showed the Canadian gross domestic product advanced at the slowest pace in three months, rising 0.2% in August compared to 0.4% in July and 0.6% in June. Between August of 2015 and August of 2016, the Canadian GDP has increased a mere 1.3%. Goods-producing industries, the main contributors to GDP, increased by 0.7% from July and fell 0.9% from a year ago. The service sector remained unchanged in August. GDP in Canada is forecasted to rise 0.1% in October.

- US Crude Oil Inventories: Wednesday, 15:30. U.S. crude oil stocks declined in the week to Nov. 18 after three straight weeks of gains as imports dropped and refineries hiked output. Crude inventories declined 1.3 million barrels, compared after an increase of 671,000 barrels in the previous week.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment benefits edged up from a 43-year low last week, but remained positive, reflecting a tightening labor market. The number of new claims increased by18,000 to a seasonally adjusted 251,000 while economists expected a gain of 241,000. Claims remained below 300,000 for 90 straight weeks. The four-week moving average of claims fell 2,000 to 251,000 last week. The number of new claims is expected to reach 252,000 this week.

- US ISM Manufacturing PMI: Thursday, 15:00. The US ISM manufacturing index gained momentum in October rising to 51.9 from 51.5 in the previous month. The reading was a bit lower than the expectations of 51.7. Production strengthened to 54.6 from 52.8, but orders declined to 52.1 from 55.1. The employment index returned to growth at 52.9 from 49.7 in the previous month and export orders remained in positive territory for the eighth successive month. The ISM manufacturing index is expected to rise further to 52.1 in November.

- Canadian Employment data: Friday, 13:30. The Canadian employment market gained 44,000 jobs in October. The increase was entirely due to part-time employment offsetting a loss in full-time positions. The reading was further evidence that Canada is struggling to provide quality, high-paying jobs. The increase in employment was driven by 67,000 additional part-time positions, while full-time jobs plunged by 23,000. The unemployment rate remained steady at 7.0% as more people entered the labor market, looking for work. Analysts expected an overall job loss of 10,000. The Canadian employment market is expected to gain only 100 jobs in November and the unemployment rate is expected to remain at 7%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 13:30. The U.S. monthly jobs report showed a smaller than expected jobs gain of 161,000 in October. While the unemployment rate remained unchanged at 4.9%. However, hourly pay increased 10 cents reflecting a 2.8% annualized increase. Analysts believe this is a step in the right direction which will enable the Fed to proceed with their rate hike plans. US job market is expected to create 165,000 in November and the unemployment rate is forecasted to remain at 4.9%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.29 09:04

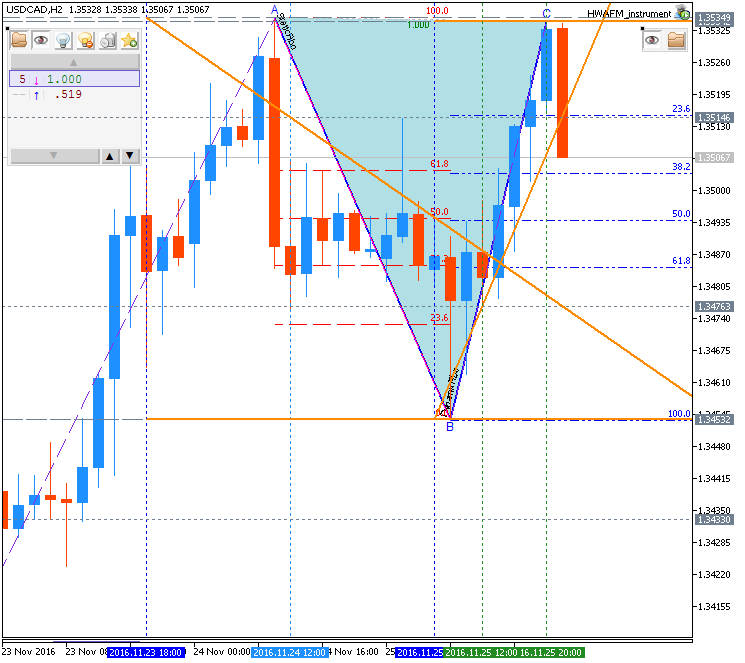

USD/CAD Intra-Day Fundamentals: BoC Governor Stephen Poloz Speech and 34 pips price movement

2016-11-29 00:45 GMT | [CAD - BOC Gov Poloz Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[CAD - BOC Gov Poloz Speaks] = Speech titled "The Role of Services in Canada’s Economy" at the C.D. Howe Institute Annual Benefactors’ Lecture, in Toronto.

==========

From official report:

- "I strongly believe that the continued expansion of our service sector is pointing the way toward full economic recovery and the return of sustained, natural growth."

- "The data are limited, but evidence suggests firm creation in this industry is above the average of the rest of the economy. Output has grown by more than 15 per cent since the start of 2011—a faster pace than the rest of the service sector and more than double the pace of the goods sector. In the past five years, the industry has grown by close to $8 billion and now represents more than 3 per cent of our economy. This is the kind of creation that follows the destruction."

- "Certainly, the concept of an output gap is gradually changing, as services capacity depends mainly on people and skills rather than industrial capacity, while some parts of our old industrial capacity could become redundant in the face of major structural changes. The concept of investment is shifting away from plants and machinery toward human capital. Even the concept of inventories is changing."

- "The conduct of monetary policy must manage uncertainty as a matter of routine—uncertainty about the economic outlook, about unobservable variables such as potential output, and so on. It is the nature of economics and economic models that we should always express our expectations in probabilistic terms—that is, a number surrounded by a margin of error—and make policy decisions that carefully weigh and manage those risks. In short, monetary policy is not like engineering."

==========

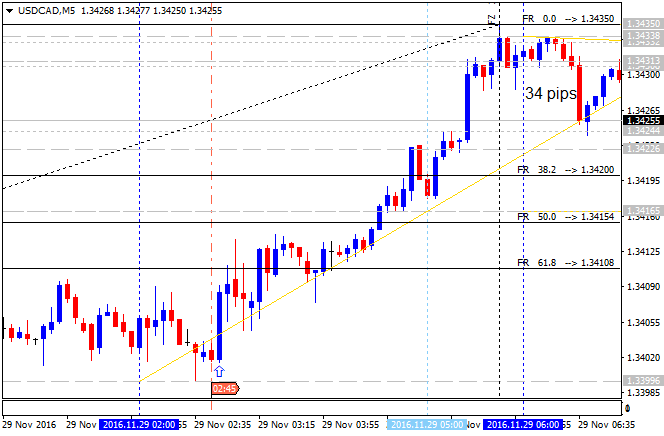

USD/CAD M5: 34 pips price movement by BoC Governor Stephen Poloz Speech news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.29 15:06

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. Gross Domestic Product

2016-11-29 13:30 GMT | [USD - GDP]

- past data is 2.9%

- forecast data is 3.0%

- actual data is 3.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the value of all goods and services produced by the economy.

==========

From official release:

==========

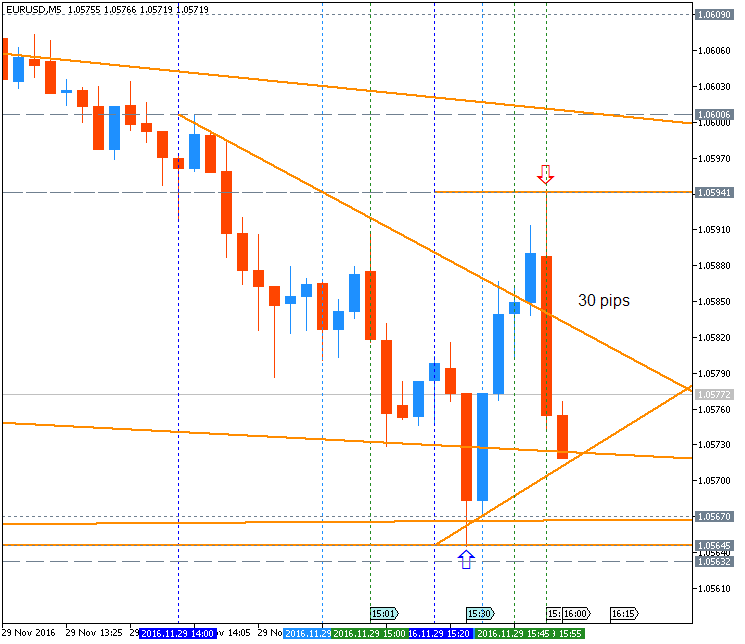

EUR/USD M5: 30 pips range price movement by U.S. Gross Domestic Product news events

==========

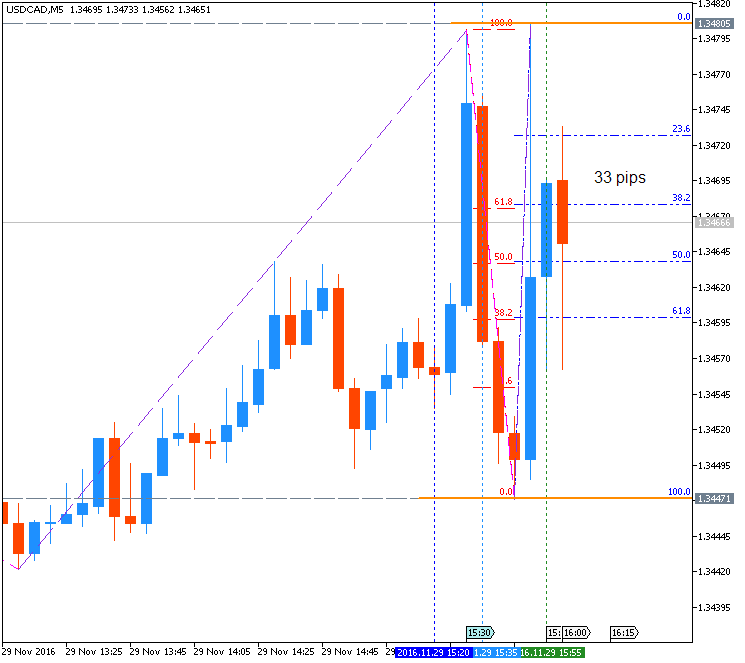

USD/CAD M5: 33 pips range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.30 15:07

USD/CAD Intra-Day Fundamentals: Canada Gross Domestic Product and 36 pips range price movement

2016-11-30 13:30 GMT | [CAD - GDP]

- past data is 0.2%

- forecast data is 0.1%

- actual data is 0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

- "Real gross domestic product rose for the fourth consecutive month in September, growing 0.3%. Higher output in the mining, quarrying, and oil and gas extraction sector was the major contributor to the increase."

- "Goods-producing industries grew by 1.1% as all sectors increased, led by mining, quarrying and oil and gas extraction."

==========

USD/CAD M5: 36 pips range price movement by Canada Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.01 16:25

Intra-Day Fundamentals - EUR/USD, USD/CAD and USD/JPY: ISM Purchasing Managers' Index

2016-11-29 15:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 51.9

- forecast data is 52.4

- actual data is 53.2 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

"The November PMI® registered 53.2

percent, an increase of 1.3 percentage points from the October reading

of 51.9 percent. The New Orders Index registered 53 percent, an increase

of 0.9 percentage point from the October reading of 52.1 percent. The

Production Index registered 56 percent, 1.4 percentage points higher

than the October reading of 54.6 percent. The Employment Index

registered 52.3 percent, a decrease of 0.6 percentage point from the

October reading of 52.9 percent. Inventories of raw materials registered

49 percent, an increase of 1.5 percentage points from the October

reading of 47.5 percent. The Prices Index registered 54.5 percent in

November, the same reading as in October, indicating higher raw

materials prices for the ninth consecutive month. Comments from the

panel cite increasing demand, some tightness in the labor market and

plans to reduce inventory by the end of the year."

==========

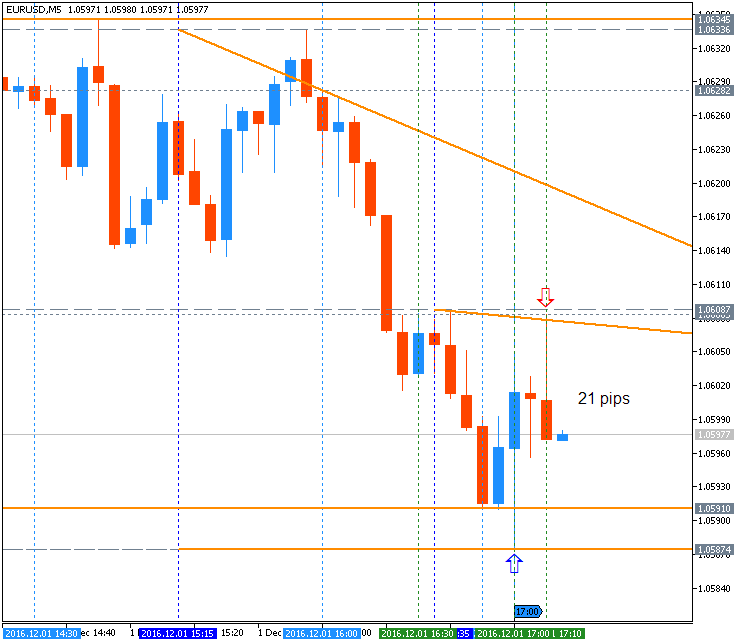

EUR/USD M5: 21 pips range price movement by ISM Manufacturing PMI news events

==========

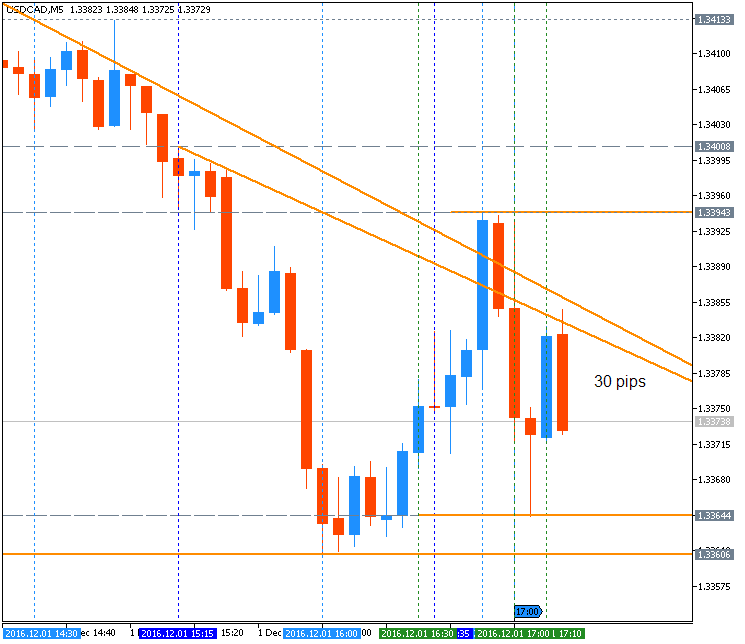

USD/CAD M5: 30 pips range price movement by ISM Manufacturing PMI news events

==========

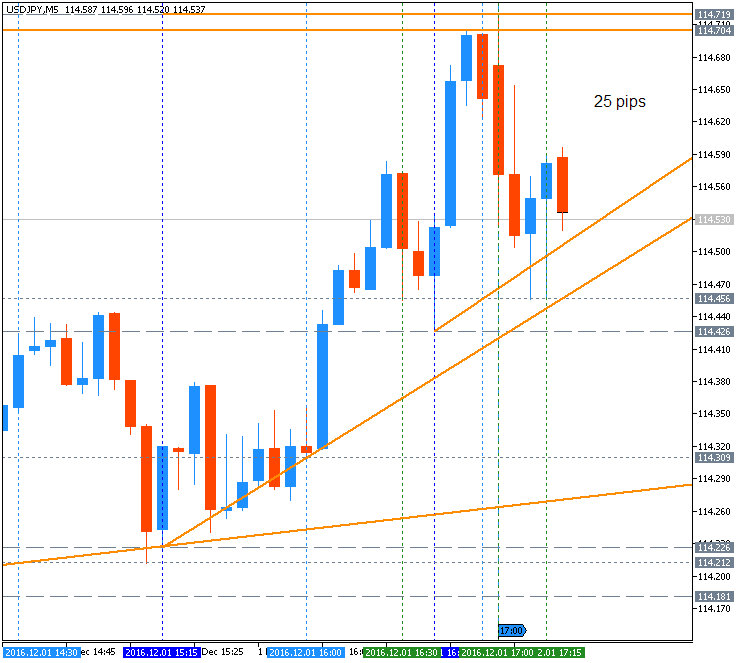

USD/JPY M5: 25 pips range price movement by ISM Manufacturing PMI news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.02 14:55

Intra-Day Fundamentals - EUR/USD, USD/CAD and S&P 500: Non-Farm Payrolls

2016-12-02 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 142K

- forecast data is 177K

- actual data is 178K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

"The unemployment rate declined to 4.6 percent in November, and total nonfarm payroll employment increased by 178,000, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in professional and business services and in health care."

==========

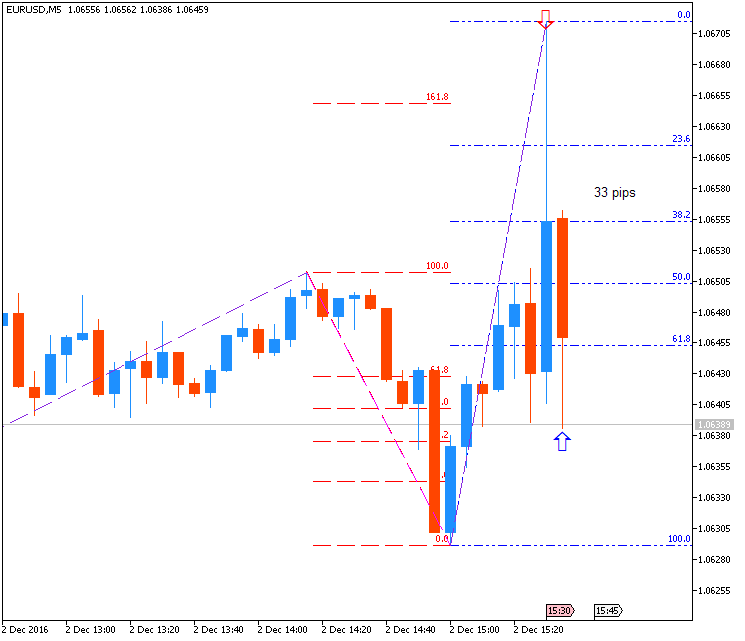

EUR/USD M5: 33 pips range price movement by Non-Farm Employment Change news events

==========

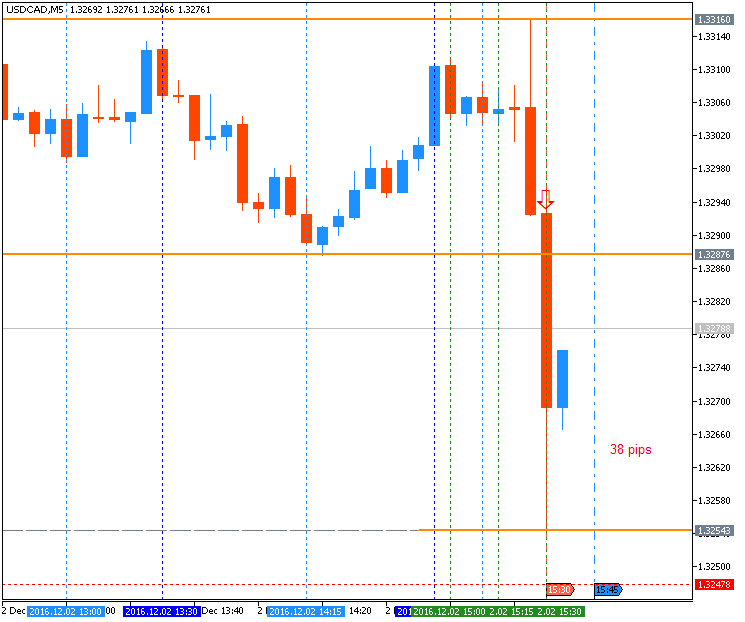

USD/CAD M5: 38 pips range price movement by Non-Farm Employment Change news events

==========

S&P 500 M5: pips range price movement by Non-Farm Employment Change news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.22 14:57

USD/CAD Intra-Day Fundamentals: Canada Consumer Price Index and 46 pips range price movement

2016-12-22 13:30 GMT | [CAD - CPI]

- past data is 1.5%

- forecast data is 1.4%

- actual data is 1.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

"The Consumer Price Index (CPI) rose 1.2% on a year-over-year basis in November, following a 1.5% gain in October."

==========

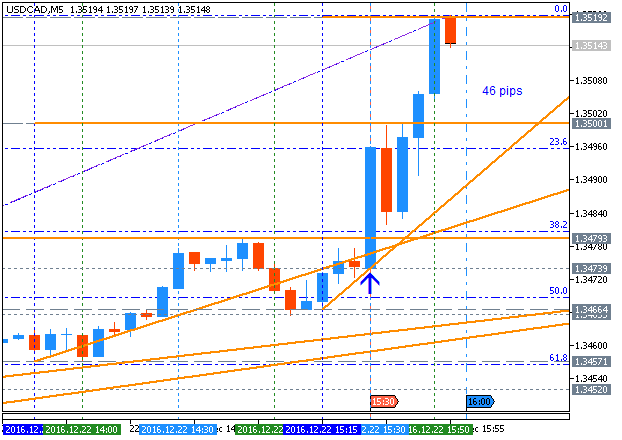

USD/CAD M5: 46 pips range price movement by Canada Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.23 14:47

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 38 pips range price movement

2016-12-23 13:30 GMT | [CAD - GDP]

- past data is 0.4%

- forecast data is 0.1%

- actual data is -0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

- "After increasing for four consecutive months, real gross domestic

product was down 0.3% in October. Widespread decreases in manufacturing

output and lower oil and gas extraction were the major contributors to

the decline."

- "Goods-producing industries contracted 1.3% as manufacturing, mining, quarrying, and oil and gas extraction, construction, utilities and the agriculture and forestry sector all declined in October."

- "Service-producing industries edged up 0.1%, mainly due to increases in real estate and rental and leasing as well as retail and wholesale trade. The public sector (education, health and public administration combined) also edged up. The finance and insurance, administrative services, accommodation and food services and transportation and warehousing services sectors declined."

==========

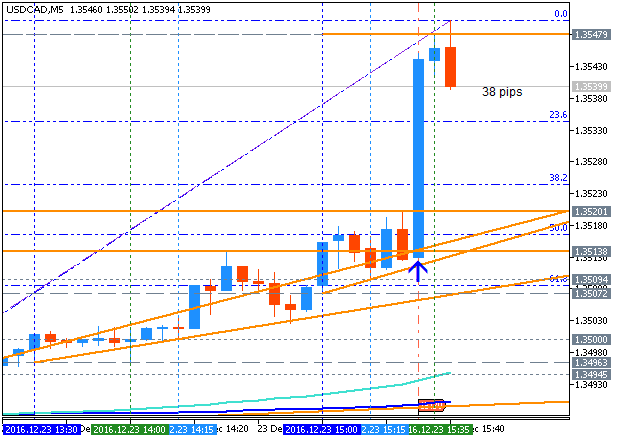

USD/CAD M5: 38 pips range price movement by Canada's Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.24 05:30

What can we expect in 2017? Interview with FXStreet (based on the article)

What emerging trends or issues should traders prepare for in 2017?

"The easy answer is growing impact from politics: Trump’s first year in office, as well as elections in France and later Germany, will keep us busy. This makes central bankers somewhat less important than they used to be. They will no longer be “the only game in town” but will not disappear in the shadows either. In Europe, some fiscal stimulus could replace austerity on an election year and in line with other countries. Britain could also join in. This could be the year when we talk about “inflation lifting its ugly head” more often than worries about deflation which have dominated beforehand. Inflation could come from China rather than from the US."

Which will be the best and worst performing currencies in 2017 and why?

"The US dollar could reverse its gains as the dust settles in after Trump’s inauguration. Like with many politicians, promises are meant to be broken and a Republican Congress is where the buck could stop. The pound could extend its falls as Brexit reality bites in, something that has not happened so far. The winners could be the euro, that may fall early in the year but recover on fiscal stimulus and more mainstream election results. Another winner could be the Australian dollar, which could enjoy Chinese efforts to maintain its growth."

Which under-the-radar currency pair do you expect to make a big move in 2017?

"USD/CAD could make a big move to the upside due to two reasons. The first is oil prices unable to rise and this could weigh on the loonie. Another reason is a lack of US demand due to less stimulus. Both factors could trigger a rate cut. The BOC has already told us that the lower end for rates is -0.50%, a full percentage point under the current level. The Canadian dollar has scope for falls, something that may eventually help the Canadian economy, but not in 2017."

What will you be focused on next year?

"I will be focused on politics and their impact on markets. Central bankers are still important but have somewhat less influence, and they are less exciting than the impact of politics on currencies. This is not limited to the elections but also to policy, which could certainly be on the move."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

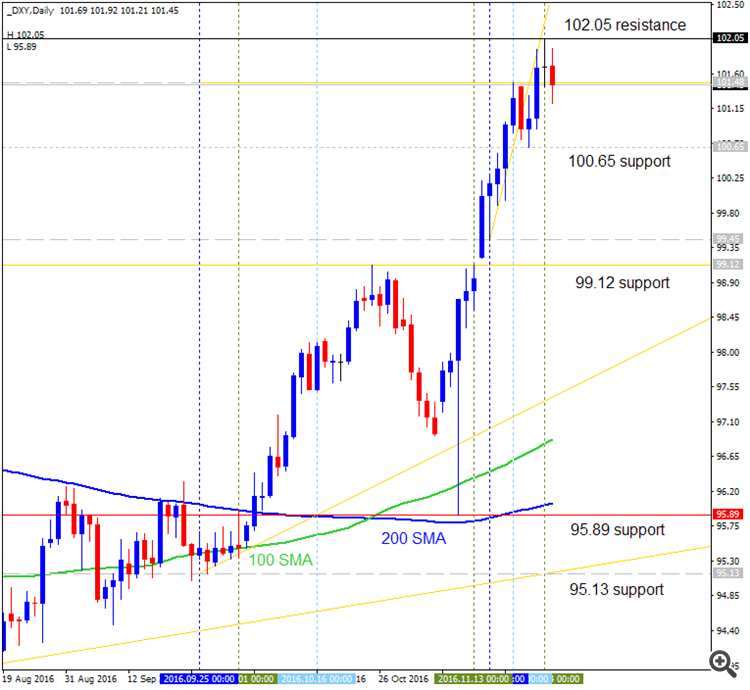

The weekly price broke Ichimoku cloud to above for the bullish reversal in the end of October this year, and the price is on testing 1.3551 resistance level to above for the bullish trend to be continuing with 1.3588 level as the nearest bullish weekly target.

The price is located within the following support/resistance levels:

If W1 price breaks 1.3155 support level to below on close bar so the reversal of the weekly price movement from the primary bullish to the primary bearish market condition will be started.

If weekly price breaks 1.3551 resistance level on close bar so the primary bullish trend will be continuing with 1.3588 target to re-enter.

If not so the price will be on bullish ranging within the levels.

SUMMARY: bullish

TREND: ranging