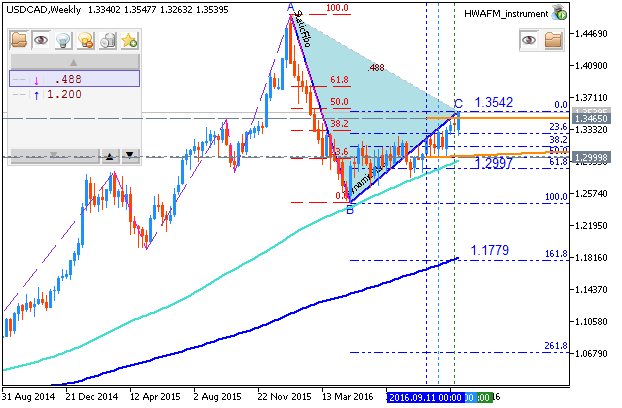

USDCAD Technical Analysis 2016, 13.11 - 20.11: bullish breakout to be continuing with 1.3551 resistance

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.12 08:19

Weekly Outlook: 2016, November 13 - November 20 (based on the article)

GDP data from Japan and Germany, Mario Draghi’s speech, Inflation figure from the UK and the US, Employment data from the UK, Australia and the US, US Building Permits, Philly Fed Manufacturing Index and Janet Yellen’s testimony before the Joint Economic Committee. These are the major events on forex calendar.

- Japan GDP data: Sunday, 23:50. Japan’s growth in the third quarter is expected to remain at 0.2%.

- Mario Draghi speaks: Monday, 15:00, ECB President Mario Draghi will speak in Rome and in Frankfurt. Market volatility is expected.

- Eurozone German GDP: Tuesday, 7:00. German GDP is expected to rise 0.3% in the third quarter.

- UK Inflation data: Tuesday, 9:30. UK inflation is expected to advance further by 1.1% in October.

- US Retail sales: Tuesday, 13:30. Retail sales are expected to edge up by another 0.6% in October while core sales are expected to increase by 0.5%.

- UK Employment data: Wednesday, 9:30. The number of unemployed is expected to rise by 1,900 this time.

- US PPI: Wednesday, 13:30. Producer prices are expected to rise by 0.3% in October.

- US Crude Oil Inventories: Wednesday, 15:30.

- Australian employment data: Thursday, 0:30. The employment market is expected to increase by 20,300 new jobs while the unemployment rate is forecast to rise to 5.7%.

- US Building Permits: Thursday, 13:30. The number of permits for new private homes is expected to register a seasonally-adjusted 1.19 million units.

- US inflation data: Thursday, 13:30. CPI is expected to gain 0.4% in October while the core CPI is forecasted to rise 0.2%.

- US Philly Fed Manufacturing Index: Thursday, 13:30. Philly Fed manufacturing index is predicted to register 8.1 in November.

- US Unemployment Claims: Thursday, 13:30. The number of new jobless claims is expected to reach 257,000 this week.

- Janet Yellen speaks: Thursday, 15:00. Federal Reserve Chair Janet Yellen will testify before the Joint Economic Committee, in Washington DC. She may provide clues regarding the Fed’s rate plans in light of the recent win of the republican candidate Donald Trump. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.15 09:01

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD : German Gross Domestic Product

2016-11-15 07:00 GMT | [EUR - GDP]

- past data is 0.4%

- forecast data is 0.3%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

"German economic growth is losing some momentum. In the third quarter of 2016, the gross domestic product (GDP) rose 0.2% on the second quarter of 2016 after adjustment for price, seasonal and calendar variations; this is reported by the Federal Statistical Office (Destatis). In the first half of the year, the GDP had increased somewhat more, by 0.4% in the second quarter and 0.7% in the first quarter."

==========

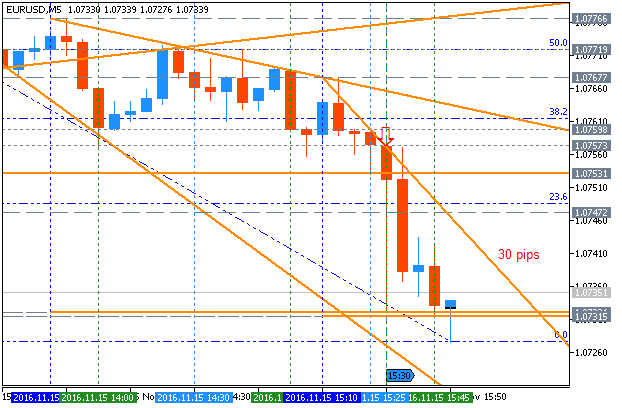

EUR/USD M5: 30 pips range price movement by German Gross Domestic Product news events

==========

USD/CAD M5: 25 pips range price movement by German Gross Domestic Product news events

==========

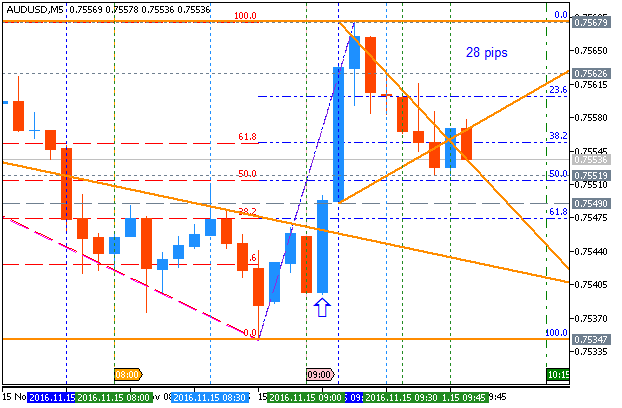

AUD/USD M5: 28 pips range price movement by German Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.15 15:01

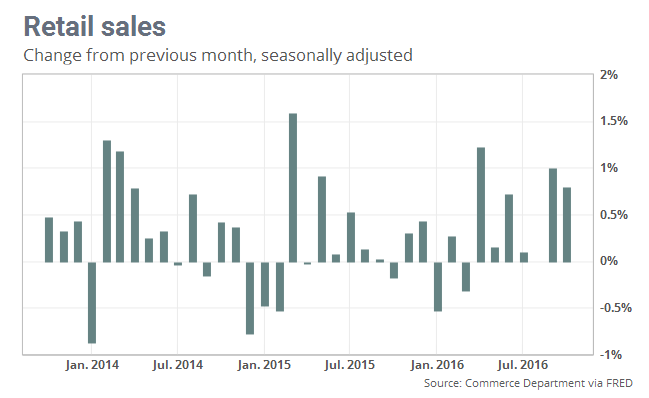

Intra-Day Fundamentals - EUR/USD, USD/CAD and GOLD (XAU/USD): Advance Retail Sales2016-11-15 13:30 GMT | [USD - Retail Sales]

- past data is 1.0%

- forecast data is 0.6%

- actual data is 0.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From Market Watch article: U.S. retail sales post biggest back-to-back sales since 2014

"Retail sales jumped 0.8% last month after a revised 1% gain in September, the government said Tuesday. Economists surveyed by MarketWatch had forecast a seasonally adjusted 0.7% advance."

==========

EUR/USD M5: 30 pips range price movement by U.S. Retail Sales news events

==========

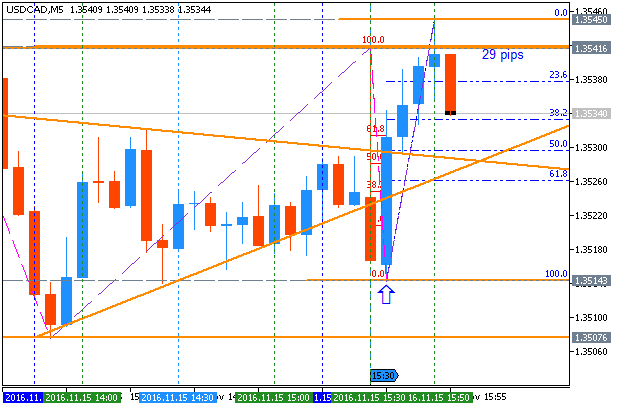

USD/CAD M5: 29 pips range price movement by U.S. Retail Sales news events

==========

GOLD (XAU/USD) M5: range price movement by U.S. Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.18 10:48

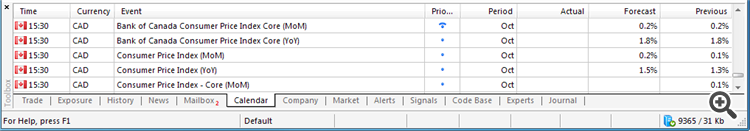

Trading News Events: Canada Consumer Price Index (adapted from dailyfx)

- "Another uptick in Canada’s Consumer Price Index (CPI) along with stickiness in the core rate of inflation may foster a larger pullback in USD/CAD as the Bank of Canada (BoC) ‘expects total CPI inflation to be close to 2 percent from early 2017 onwards.’"

- "Even though the BoC ‘actively’ discussed more stimulus for the real economy, it seems as though Governor Stephen Poloz and Co. will continue to endorse a wait-and-see approach for monetary policy as ‘Canada’s economy is still expected to grow at a rate above potential starting in the second half of 2016.’ The risk of overshooting the 2% target for inflation may push the BoC to gradually move away from its easing-cycle, but signs of subdued price growth may encourage the central bank to further support the real economy as the region is anticipated to return to ‘full capacity around mid-2018, materially later than the Bank had anticipated in July.’"

Bullish CAD Trade: Canada CPI Picks Up for Second Consecutive Month

- "Need to see red, five-minute candle following the release to consider a short trade on USD/CAD."

- "If market reaction favors a long loonie trade, sell USD/CAD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

- "Need green, five-minute candle to favor a long USD/CAD trade."

- "Implement same setup as the bullish Canadian dollar trade, just in the opposite direction."

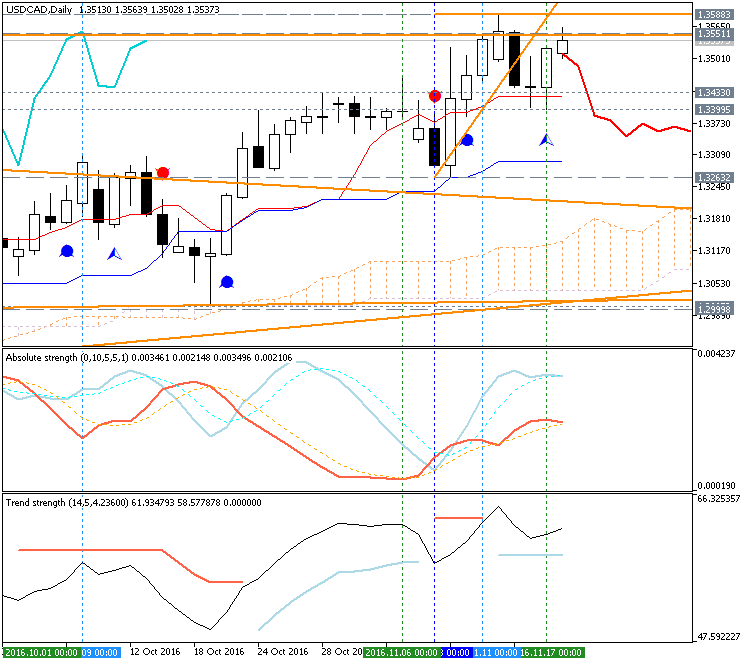

Daily price is

on bullish ranging condition for 1.3551 resistance level to be broken on close daily bar for the daily bullish trend to be resumed. Alternative, if the price breaks 1.3399 support level to below on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

- If the price will break 1.3551 resistance level on close daily bar so the primary bullish trend will be resumed.

- If price will break 1.3399 support

on close daily bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

- If not so the price will be ranging within the levels.

-------

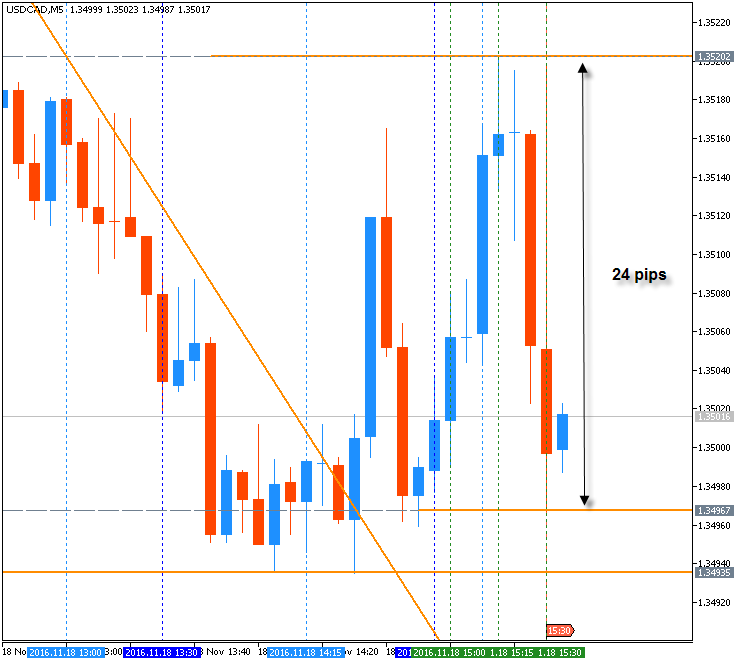

USD/CAD M5: 24 pips range price movement by Canada Consumer Price Index news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is above Ichimoku cloud in the bullish area of the chart. The price is on bullish breakout which was started in the beginning of the last week with 1.3524 resistance level to be tested above for 1.3551 bullish target to re-enter for the bullish breakout to be continuing. Chinkou Span line of Ichimoku indicator is located above the price indicating the future trend as the bullish, Absolute Strength indicator is evaluating the future trend as the bullish breakout, and Trend Strength indicatorn is estimating the ranging condition to be started in the future.

By the way, Tenkan Sen line (moving average of the highest high and lowest low over the last 9 trading days. (Highest high + Lowest low) / 2 over the last 9 trading days) was crossed with Kijun Sen line (moving average of the highest high and lowest low over the last 26 trading days. (Highest high + Lowest low) / 2 over the last 26 trading days) two weeks ago for the bullish trend to be continuing with good breakout possibility for the week.

If D1 price breaks 1.3263 support level on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If D1 price breaks 1.2999 support level on close bar so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price breaks 1.3551 resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on bullish ranging within the levels.

SUMMARY: bullish

TREND: breakout