newdigital, 2013.11.30 19:22

GBPUSD Fundamental Analysis (based on dailyfx.com article)

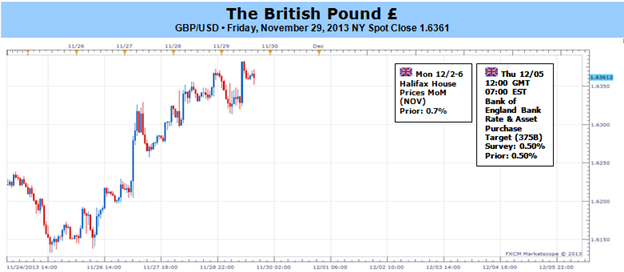

Fundamental Forecast for the British Pound: Bullish

- British Pound May Pay for Data-Driven Rally to 2-Year High

-

GBP/USD 2013 High in Focus at 1.6380; Breakout or Fakeout?

The technical outlook for the GBPUSD remains constructive as the bullish momentum in the daily Relative Strength Index (RSI) gathers pace, and we may see a more meaningful move at 1.6400 (61.8% Fibonacci expansion) to 1.6420 (1.618% Fibonacci expansion) should the fundamental developments further the BoE’s case to normalize monetary policy ahead of schedule. In turn, we will retain our game plan to buy dips in the pound-dollar, but we could be looking for a correction (higher low) before the end of the year as the RSI approaches overbought territory.

Shunmas, 2013.12.02 10:40

U.K. manufacturing PMI rises to 33-month high of 58.4 in November

In a report, market research group Markit said that its U.K. manufacturing PMI rose to a seasonally adjusted 58.4 in November from a reading of 56.5 in October.

Analysts had expected the manufacturing PMI to ease down to 56.0 last month.

On the index, a reading above 50.0 indicates industry expansion, below indicates contraction.

Commenting on the report, Rob Dobson, senior economist at survey compiler Markit, said, “The sector is on course to beat the 0.9% increase in output seen in the third quarter, with the quarterly pace of growth so far in the final quarter tracking comfortably above the 1.0% mark.”

Following the release of the data, the pound added to gains against the U.S. dollar, with GBP/USD rising 0.27% to trade at 1.6415, compared to 1.6387 ahead of the data.

Meanwhile, European stock markets remained mixed. The EURO STOXX 50 fell 0.15%, France’s CAC 40 dipped 0.1%, Germany's DAX tacked on 0.2%, while London’s FTSE 100 dipped 0.3%.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M55 : 38 pips price movement by GBP - Manufacturing PMI

Shunmas, 2013.12.02 16:35

Forex - GBP/USD slips but remains near 27-month highs

Investing.com - The pound slipped against the U.S. dollar on Monday, after upbeat U.S. data but still remained within close range of 27-month highs as data showed that activity in the U.K. manufacturing sector expanded at the fastest rate in 33 months in November.

GBP/USD hit 1.6343 during U.S. morning trade, the session low; the pair subsequently consolidated at 1.6354, down 0.11%.

Cable was likely to find support at 1.6278, the low from November 28 and resistance at 1.6450.

In the U.S., the Institute of Supply Management said its manufacturing purchasing managers’ index rose to 57.3 in November from 56.4 in October, expanding at the fastest rate since April 2011. Analysts had expected the index to fall to 55.0.

The report said both production and new orders rose by around 3 points to 62.8 and 63.6 respectively. The employment component of the index indicated some improvement in the labor market in November, rising by more than 3 points to 56.5.

The pound strengthened earlier, after data showed that the U.K. manufacturing purchasing managers’ index rose to 58.4 last month, the highest level since February 2011, from an upwardly revised 56.5 in October.

Analysts had expected the manufacturing PMI to tick down to 56.0.

The new orders component of the index jumped to 64.6, the highest in almost 20 years, from 61.3 in October.

“The sector is on course to beat the 0.9% increase in output seen in the third quarter, with the quarterly pace of growth so far in the final quarter tracking comfortably above the 1.0% mark,” Rob Dobson, senior economist at survey compiler Markit, said.

Sterling was higher against the euro with EUR/GBP shedding 0.22%, to hit 0.8282.

In the euro zone, data on Monday showed that the bloc’s manufacturing PMI rose to a two year high of 51.6 last month from October's 51.3, slightly higher than a preliminary estimate of 51.5.

However, Spain’s manufacturing sector contracted for the first time since July last month, while the French manufacturing sector contracted for the 21st straight month.

The Spanish PMI fell to 48.6 from 50.9 in October, led lower by weaker orders and output.

The French index fell to 48.4 from 49.1 in October, the lowest level since June.

It was Interesting analysis.

Shunmas, 2013.12.01 16:42

GBP/USD Weekly Outlook: December 2 - 6

Investing.com - The pound rose to 27-month highs against the dollar on Friday after the Bank of England said Thursday it was rolling back stimulus to the U.K. housing market, adding to indications that the economic recovery is deepening.

GBP/USD hit highs of 1.6383, the highest since late August 2011, before ending Friday’s session at 1.6367. The pair ended the week with gains of 1.24%.

Cable is likely to find support at 1.6275, Thursday’s low and resistance at 1.6475.

The BoE announced Thursday that it is modifying its Funding for Lending Scheme, which was launched last year to boost mortgage lending, in response to what it called “evolving risks” to financial stability.

BoE Governor Mark Carney said the Funding for Lending Scheme will no longer be aimed a house buyers and would only apply to businesses from January 2014.

Carney said an overheated housing market would be a risk to the economy and added that supporting mortgage lending was "no longer necessary".

The data came one day after revised data showed that the rate of growth in the U.K. economy in the third quarter was in line with preliminary estimates.

The Office for National Statistics said its second estimate of U.K. third-quarter gross domestic product was unchanged at 0.8% quarter-on-quarter, while the annual rate of growth was also unchanged at 1.5%.

It was the fastest quarterly rate of growth in over three years. Consumer spending rose by 0.8%, the fastest pace since the second quarter of 2010, the ONS said.

The euro slumped to 10-month lows against the pound on Friday, withEUR/GBP ending Friday’s session at 0.8300, the lowest since January. The pair was down 0.82% for the week.

Elsewhere, sterling ended the week at five year highs against the broadly weaker yen, with GBP/JPY settling at 167.74, the highest level since October 2008. For the week, the pair gained 2.32%.

The yen continued to be pressured by expectations that the Bank of Japan will implement further stimulus measures in order to meet its target of 2% inflation by 2015.

In the week ahead, investors will be focusing on Friday’s U.S. nonfarm payrolls report for November, amid expectations that the Federal Reserve will start to scale back its stimulus program at one of its next few meetings.

Data on the U.K.’s dominant service sector and the latest rate decision by the BoE will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Federal Reserve Chairman Ben Bernanke is to speak at an event in Washington. Later Monday, the Institute of Supply Management is to release its manufacturing PMI.

Tuesday, December 3

The U.K. is to release its construction PMI.

Wednesday, December 4

The U.K. is also to publish its services PMI, a leading indicator of economic health.

The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The Institute of Supply Management is to release its services PMI. The U.S is also to publish data on new home sales and the trade balance, the difference in value between imports and exports.

Thursday, December 5

The BoE is to announce its benchmark interest rate.

The U.S. is to publish a revised estimate of third quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth. Meanwhile, the Labor Department is to release its weekly report on initial jobless claims. The U.S. is also to publish data on factory orders.

Friday, December 6

The University of Michigan is to release the preliminary reading of its consumer sentiment index. The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Shunmas, 2013.12.03 11:06

Forex -GBP/USD near 27-month highs after U.K Data

Investing.com - The pound rose against the dollar on Tuesday, to trade near 27-month highs after data showed that activity in the U.K. construction sector expanded at the fastest rate in six years November.

GBP/USD was up 0.34% to 1.6411 during European morning trade, holding just below Monday’s high of 1.6441, the highest level since August 2011.Cable was likely to find support at 1.6341, Monday’s low and near-term resistance at 1.6441.

The U.K. construction purchasing managers' index rose to 62.6 in November, the highest level since August 2007, from 59.4 in October.

Analysts had expected the index to tick down to 59.0.

The report said overall activity rose for the seventh month in a row, with "sharp increases” in new orders and employment, while growth in house-building in November was the fastest in 10 years.

“Looking ahead, there are a number of positive signs that improvements in activity levels will be maintained, as job creation picked up again in November and confidence about the business outlook reached its highest level since September 2009,” senior economist at survey compiler Markit Tim Moore said.

The report came a day after data showed that the manufacturing sector in the U.K. expanded at the fastest rate in 33 months in November. The upbeat fuelled expectations that the Bank of England may tighten monetary policy ahead of other central banks.

Elsewhere, the euro was trading close to 11-month lows against sterling, with EUR/GBP slipping 0.13% to 0.8267.

newdigital, 2013.12.04 15:42

2013-12-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

- past data is 62.5

- forecast data is 62.0

- actual data is 60.0 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

British Service Sector Sustains Growth Momentum

British service sector continued to expand solidly in November, a survey by Markit Economics and the Chartered Institute of Purchasing and Supply (CIPS) revealed Wednesday.

The headline business activity index recorded a reading of 60 in November, suggesting strong growth in activity in historical terms. However, this was the weakest index level in five months and lower than October's multi-year high of 62.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 29 price movement by GBP - Services PMI

newdigital, 2013.12.05 06:21

The GBPUSD has reached an extreme negative reading to start December trading (adapted from dailyfx article)

Below you can see the GBPUSD trending as much as 1692 pips higher from Julys low through this week’s high:

The price broke 1.6357 resistance for bullish continuing especially on W1 timeframe. But on D1 - flat sorry :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD D1 flat market condition

newdigital, 2013.12.05 15:02

2013-12-05 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

BoE Leaves Rates Unchanged; Osborne Upgrades GDP Outlook

The Bank of England left its key policy rates unchanged on Thursday, while Chancellor of Exchequer George Osborne said in his autumn statement that the economy is better placed than they had expected early this year.

In his 2013 Autumn Statement, Osborne said Britain's economic plan is working and the hard work of the British people is paying off. The economic growth forecast for 2013 was more than doubled to 1.4 percent from 0.6 percent, he told lawmakers.

According to estimates by the Office for Budget Responsibility, the economy will grow 2.4 percent next year, up from the 1.8 percent projected in March.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 20 pips price movement by GBP - Interest Rate

newdigital, 2013.12.06 15:06

2013-12-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

- past data is 204K

- forecast data is 180K

- actual data is 203K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Employment Increases By More Than Expected In November

In another upbeat sign for the U.S. labor market, the Labor Department released a report on Friday showing stronger than expected job growth in the month of November.

The report showed that non-farm payroll employment rose by 203,000 jobs in November following a revised increase of 200,000 jobs in October.

Economists had been expecting employment to increase by about 180,000 jobs compared to the addition of 204,000 jobs originally reported for the previous monthMetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 46 pips price movement by USD - Non-Farm Employment Change

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is primary bullish on D1 timeframe and price is crossing 1.6357 resistance level.

W1 timeframe : it was flat and ranging for past few weeks but primary bullish is started for now on open W1 bar

Monthly timeframe : Chinkou Span line crossed historical price from below to above, and price is located inside Ichimoku cloud/kumo. So, if Chinkou Span will cross the price on close monthly bar so we may have ranging breakout for MN timeframe (bullish breakout because the price is already above Sinkou Span A line which is indicating the bullish market condition for monthly timeframe).

If the price will cross 1.6357 on close daily bar so the primary bullish will be continuing.

If the price will cross 1.6297 support level so we may see the ranging market condition up to secondary correction.

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2013-12-02 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

2013-12-02 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2013-12-03 00:01 GMT (or 01:01 MQ MT5 time) | [GBP - BRC Retail Sales Monitor]

2013-12-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

2013-12-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

2013-12-04 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2013-12-04 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2013-12-04 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2013-12-05 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]

2013-12-05 13:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2013-12-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movement

SUMMARY : ranging

TREND : bullish

Intraday Chart