Low ATR=Ranging_Markets. High ATR=Trending_Markets.

Like everything else, you'll have to define whats Low vs High.

Use a Range_Based Method in Ranging_Markets (Example Grids).

Use a Trend_Based Method in Trending_Markets (Example Turtle).

Low ATR=Ranging_Markets. High ATR=Trending_Markets.

Like everything else, you'll have to define whats Low vs High.

Use a Range_Based Method in Ranging_Markets (Example Grids).

Use a Trend_Based Method in Trending_Markets (Example Turtle).

Thanks for the response, i'm going to do research on what you have mentioned.

Right now, i'm playing around with a random entry, ie when random number is zero, I sell, when random number is a 1, I buy.

With random entry, keeping the risk/reward ratio 1:1 with the ATR, the win/loose ratio is 40/60, that is close enough to any other system I have written/tested, if not better :)

Right now, i'm playing around with a random entry, ie when random number is zero, I sell, when random number is a 1, I buy.

With random entry, keeping the risk/reward ratio 1:1 with the ATR, the win/loose ratio is 40/60, that is close enough to any other system I have written/tested, if not better :)

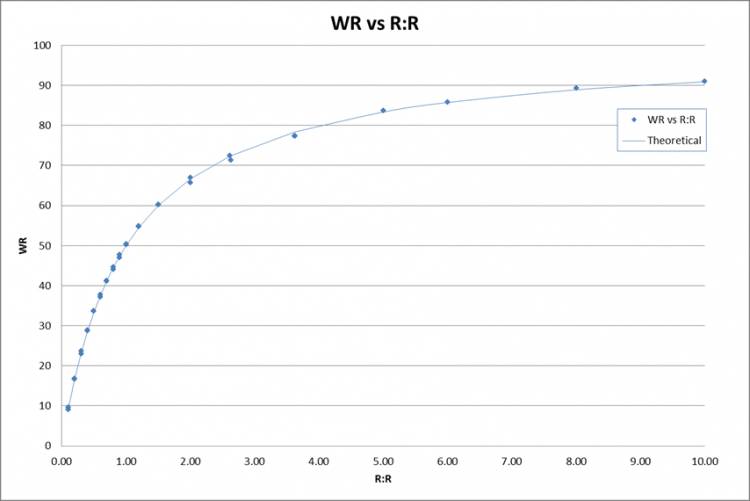

If you want to improve the Win rate just adjust the R:R, increase the risk, decrease the reward . . .

doesn't the theory recommend to stay away from things like: risk=1, reward 0.5??

I've tried this already, with no success.

But it does increase the win rate,doesnt it? The theory is not wrong here, as you have have already proofen.

You increase the win rate, but you cut the profit amount.

So for example, you have to win 2, and loose 1 to break even.

So yes it does increase the win.

It's like a scale, gain on one side, loose on the other. In this case, you gain win rate, loose profit, which brings you back to square one.

The system overall is a looser with this approach.

doesn't the theory recommend to stay away from things like: risk=1, reward 0.5??

I've tried this already, with no success.

Risk of 10 and Reward of 1 can be very profitable if you have a WR of 99% and Risk of 1 and Reward of 10 can blow your account if you have a WR of 8%

The farther away from the line the better . . . any strategy that is no better than a coin toss will be close to the line.

This chart was made using 1.9 million trades in the Strategy Tester.

The system overall is a looser with this approach.

Yes it is...

I know that the ATR indicator is indirectional, i'm wondering what others would do for entries.

Personally, I don't use ATR or other indicators for entries. I use price action for entries and MA for risk calculation (sl/tp/price action for exit). I tried a lot of indicators and combination of them... For me, it did never fit with what I did imagine.

- Don't believe everything you read.

- Truth is, "It doesn't matter"

- I've been saying this Forever

- Risk/Reward: 1/2 is Not better than 2/1

- Risk/Reward: 2/1 is Not better than 1/2

- Better depends on the Win-Rate

- Win_Rate=90% is Not better than Win_Rate=10

- Win_Rate=10% is Not better than Win_Rate=90

- Better depends on the Risk/Reward Ratio

- Heres a Link I saved recently which may help.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello MQL4 Community,

I'm wondering, If you only had to use a single indicator like ATR, what rules would you setup for entries, assuming the ATR satisfied your volatility level.

I know that the ATR indicator is indirectional, i'm wondering what others would do for entries.

Thanks,

c0d3