Some people asked about how to make same charts which I am making here. That is simple - all the indicators are free and uploaded so everybody can make same analysis for every pair for example :

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.06.05 19:03

Well ... so we go ...

Indicators

Template

- marketcondition1.tpl (attached)

Installation

- place 4 indicators in indicators folder (for example - to here: C:\Program Files\MetaTrader 5\MQL5\Indicators

- place template file in template folder (for example to C:\Program Files\MetaTrader 5\Profiles\Templates

- compile indicators in MetaEditor, or restart MetaTrader 5

How to use

- open D1 (or H4, or H1) charts of your selected pair

- right mouse click on any place of the chart - select Templates - and name of our template (marketcondition1)

You should have the chart similar with this one:

This is flat for USDJPY today in the morning - market was not significally moved on [JPY - Current Account] and [JPY - Eco Watchers Survey] news events :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

usdjpy h4 flat

newdigital, 2013.07.08 08:45

Japan Data On Tap For Monday :

Japan is scheduled to release a raft of data on Monday, highlighting a light day for Asia-Pacific economic activity. On tap are May figures for current account, as well as June numbers for bank lending, bankruptcies and the eco watchers survey.

The current account is expected to reflect a surplus of 600.0 billion yen, down from the 750.0 billion yen surplus in April. Bank lending in May was up 2.1 percent on year, while lending including trusts added an annual 1.8 percent. Bankruptcies were down 9.0 percent on year in May, while the eco watchers outlook survey saw a score of 56.2 and the current survey came in at 55.7.

Australia will see the June results of the job advertisement survey from ANZ Bank; in May, job ads dipped 2.4 percent on month.

============

2013-07-07 23:50 GMT | [JPY - Current Account]

- past data is 750.0B

- forecast data is 600.0B

- actual data is 540.7 according to the latest press release.

actual > forecast = good for currency (for JPY in pour case)

Japan Has Y540.7 Billion Current Account Surplus In May :

Japan posted a current account surplus of 540.7 billion yen in May, the Ministry of Finance said on Monday - remaining in the green for the fourth straight month after three consecutive months of deficit.

The headline figure missed forecasts for a surplus of 600.0 billion yen following the 750.0 billion yen surplus in April.

The surplus jumped 58.1 percent on year, also shy of expectations for a jump of 91.6 percent following the 100.8 percent spike in the previous month.

The trade balance reflected a deficit of 906.7 billion yen versus forecasts for a shortfall of 902.1 billion yen following the 818.8 billion yen deficit in the previous month.

New D1 bar was opened above the cloud (above Sinkou Span line) and it is correction going on right now :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

usdjpy d1 correction

and it is the same situation for H4 timeframe - correction on open bar :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

usdjpy h4 correction on open bar

May be I am wrong but I do not expect any news events today which can significally move USDJPY price ... just the following news events for today may be interesting :

2013-07-09 23:50 GMT | [JPY - Tertiary Industry Index]

D1 timeframe - price went to inside kumo (Ichimoku cloud) on open bar, and Chinkou Span line (light blue line on the far left of the chart) is going along historical price :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

usdjpy d1 - price to inside the cloud on open bar

As to H4 timeframe so it is breakdown is going on right now :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

usdjpy h4 breakdown

We can see it on M5 timeframe with support /resistance levels :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_54424.png

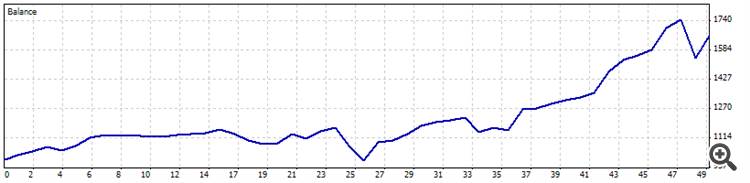

I just made some pips in profit ... you know - I am usually missing big/good movement of the price sorry ... so - it is good that I took at least few pips. This is the statement with news trading results :

We will have the following high impacted news events today :

2013-07-10 18:00 GMT | [USD - FOMC Meeting Minutes]

2013-07-10 20:10 GMT | [USD - Fed Chairman Bernanke Speech]

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price reversed to orimary bullish and it was inside the cloud for the last week for ranging market condition with correction trying. And price came very close to Sinkou Span A line (which is the border of the cloud) in the end of the week breaking it on open bar and breaking 100.85 resistance line (on open bar too).

If the price will break Sinkou Span A and 100.85 resistance level so it will be fully primary bullish with good breakout for whole the week. If the price will ame to correction market condition so it will be ranging market once again because of inside the cloud. But as the cloud it thin enough to be broken so I am expecting good breakout soon or later in the end of the week anyway.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for the next week)

2013-07-07 23:50 GMT | [JPY - Current Account]

2013-07-08 05:00 GMT | [JPY - Eco Watchers Survey]

2013-07-08 12:30 GMT | [EUR - ECB President Draghi Speech]

2013-07-09 01:30 GMT | [CNY - Consumer Price Index]

2013-07-09 23:50 GMT | [JPY - Tertiary Industry Index]

2013-07-09 23:50 GMT | [JPY - CGPI]

2013-07-10 18:00 GMT | [USD - FOMC Meeting Minutes]

2013-07-10 20:10 GMT | [USD - Fed Chairman Bernanke Speech]

2013-07-11 03:00 GMT | [JPY - Interest Rate]

2013-07-11 15:00 GMT | [USD - FOMC Member Speech]

2013-07-12 05:00 GMT | [JPY - BoJ Monthly Economic Survey]

2013-07-12 12:30 GMT | [USD - PPI core]

2013-07-12 13:55 GMT | [USD - Michigan Consumer Sentiment Index]

SUMMARY : possible breakout

TREND : ranging bullish

Intraday Chart