You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Why Is The Price Of An Ethereum Going Up? (based on the article)

Intra-day H4 price is on bullish breakout: the price is located very far from Ichimoku cloud in the primary bullish area of the chart with resistance level at 684 to be broken to above for the bullish trend to be continuing.

============

The chart was made on H4 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

GBP/USD Intra-Day Fundamentals: ILO Unemployment Rate, Average Earnings Including Bonuses 3m/y and range price movement

2017-12-13 09:30 GMT | [GBP - Average Earnings Index]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Average Earnings Index] = Change in the price businesses and the government pay for labor, including bonuses.

==========

From official report :

==========

GBP/USD M5: range price movement by Average Earnings Index news event

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Intra-Day Fundamentals - EUR/USD, AUD/USD and GOLD: Federal Funds Rate

2017-12-13 19:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From official report :

==========

EUR/USD M5: range price movement by Federal Funds Rate news events

==========

AUD/USD M5: range price movement by Federal Funds Rate news events

==========

XAU/USD M5: rrange price movement by Federal Funds Rate news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

S&P 500 - daily bullish breakout; 2,671 is the key (based on the article)

Daily price is on bullish breakout for the resistance level at 2,671 to be broken to above for the bullish trend to be continuing.

============

The chart was made on H4 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

AUD/USD Intra-Day Fundamentals: Australia Employment Change and range price movement

2017-12-14 00:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

From official report :

==========

AUD/USD H1: range price movement by Australia Employment Change news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

More Interest Rate Hikes To Come In 2018? (based on the article)

1. The upward pressure on interest rates is likely to continue.

2. The Fed feels pretty good about the economy."

S&P 500 - bounced from 55 SMA for the strong intra-day trend to be continuing (based on the article)

Intra-day price on H4 chart is above 200 SMA for the primary bullish trend: the price was bounced from 55 SMA to above for the strong bullish trend to be continuing, otherwise - ranging within the levels.

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

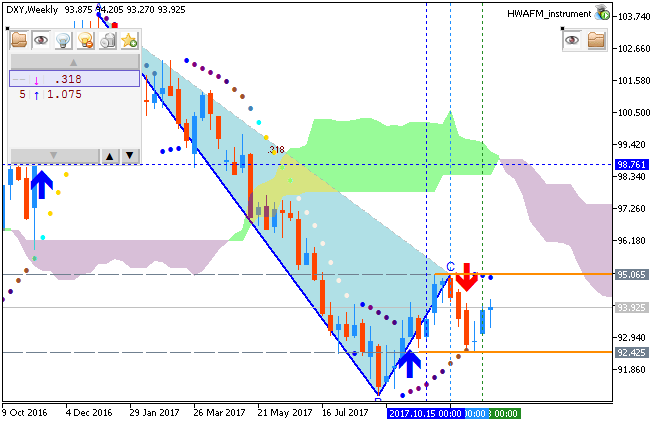

Weekly Outlook: 2017, December 17 - December 24 (based on the article)

The US dollar was on the back foot but managed to climb back in a busy week. As we enter the last week before the holidays, how will currencies make their last-minute adjustments? GDP data from the US, the UK, and Canada stand out. Here are the highlights for the upcoming week.

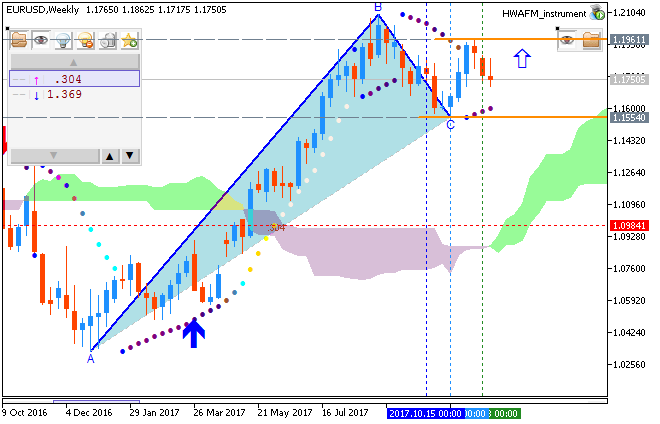

Weekly EUR/USD Outlook: 2017, December 17 - December 24 (based on the article)

EUR/USD made a move to the upside but eventually failed to stay there and retreated amid the ECB meeting. What’s next? Final inflation figures and a key German survey stand out. Here is an outlook for the highlights of this week.