You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

WTI Crude Declines; Price Differential between WTI and Brent Widens

Amidst the declining prices of the West Texas Intermediate or WTI, the price differential between it and Brent widened to $14/bbl, and according to some market observers this is happening due to the fact that WTI prices remained weak on rising stock levels, planned and unplanned refinery maintenance, strong import levels, and rising oil production.

People who have been keeping an eye on the global oil prices admit that as each benchmark diverged for geopolitical and fundamental reasons, the difference between the crude prices from the two i.e. WTI and Brent was expected. Additionally, there are reports of increased oil production in the U.S. by the oil companies.

The US Energy Information Administration has already brought a report wherein it claims that the new drilling and productivity report clearly shows that Bakken output should cross the limit of 1 million b/d in December. Similarly, Eagle Ford production is expected to reach 1.3 million b/d.

China's Bold Reforms Are Bad News For Markets

China has unveiled its most sweeping reform agenda in more than 30 years, after a meeting of key Communist Party leaders in Beijing last week. The agenda aims to transition China to a more free-market consumer economy with fewer social controls. On the economic front, the plans include reducing the power of giant state-owned companies, removing a swathe of price controls, phasing out caps on interest rates and moving towards yuan convertibility. More broadly, the plans also outline loosening the one-child policy, abolishing the controversial “re-education” labor camps and introducing steps toward an independent judiciary.

2013-11-18 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - Current Account]

if actual > forecast = good for currency (for EUR in our case)

==========

Euro zone current account surplus narrows to EUR13.7 billion

The euro zone’s current account surplus narrowed unexpectedly in September, official data showed on Monday.

In a report, the European Central Bank said that the euro zone current account recorded a seasonally adjusted surplus of EUR13.7 billion in September, down from a surplus of EUR17.9 billion in August, whose figure was revised up from a previously reported surplus of EUR17.4 billion.

Economists had expected the region’s current account surplus to widen to EUR19 billion in September.

2013-11-18 15:00 GMT (or 16:00 MQ MT5 time) | [USD - NAHB Housing Market Index]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Homebuilder Confidence Holds Steady In November

Homebuilder confidence in the U.S. held steady in the month of November, according to a report released by the National Association of Home Builders on Monday.

The report said the NAHB/Wells Fargo Housing Market Index came in at 54 in November, unchanged from the downwardly revised reading for October.

Economists had expected the index to come in unchanged compared to the 55 originally reported for the previous month.

The NAHB noted that the reading above 50 indicates that more builders viewed market conditions as good than poor for the sixth consecutive month.

NAHB Chief Economist David Crowe said, "The fact that builder confidence remains above 50 is an encouraging sign, considering the unresolved debt and federal budget issues cause builders and consumers to remain on the sideline."

EURUSD Technical Analysis (based on EUR/USD weekly outlook: November 18 - 22 article)

Monday, November 18

The euro zone is to release data on the current account balance.

The U.S. is to release private sector data on the outlook for the housing sector.

Tuesday, November 19

The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

The U.S. is to release data on the employment cost index, an important inflationary indicator.

Wednesday, November 20

In the euro zone, Germany is to release data on producer price inflation.

The U.S. is to release a series of data including a report on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. The nation is also to publish data on consumer inflation, existing home sales and business inventories.

Later Wednesday, the Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

Thursday, November 21

The euro zone is to release preliminary data on manufacturing and service sector activity, a leading indicator of economic health. Germany and France are also to release individual reports.

The U.S. is release data on producer price inflation, as well as the weekly report on initial jobless claims. The U.S. is also to release data manufacturing activity from the Philly Fed.

Friday, November 22

The Ifo Institute is to publish a report on German business climate, a leading indicator of economic health.

Untangling the Libor and Forex Scandals

Regulators in the United States, Hong Kong, Singapore, the United Kingdom, Switzerland and elsewhere are investigating potential manipulation of the market for foreign currency, sometimes called FX or foreign exchange. It is natural to compare these reports to the manipulation of Libor, the London Interbank Offered Rate.

After all, both Libor and the leading FX benchmarks are massively influenced by the actions of a few international banks. Investigations into both have exhumed embarrassing online chat sessions: FX traders met in chat rooms called The Bandit's Club and The Cartel, while Libor traders promised bottles of Bollinger Champaign. And both markets are massively important: there are $5 trillion in FX trades daily, while Libor gets about halfway there ($2.5 trillion) with one product alone.

2013-11-19 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - RBA Meeting Minutes]

==========

Dollar up on RBA's cautious optimism

he Australian dollar edged up on Tuesday after the Reserve Bank of Australia noted mounting evidence that interest rate cuts were working to stimulate the economy, though it would not rule out the chance of easing further if necessary.

The Aussie initially dipped to a session low of 93.53 US cents, from an early start at 93.77 US cents, but quickly recovered to last trade at 93.86 US cents.

"Investors were expecting stronger jaw-boning from the RBA about the high currency but didn't get it," said Joseph Capurso, a strategist at Commonwealth Bank of Australia.

He expects the Aussie to remain subdued this week as the US dollar shows signs of stabilisation across the board.

Based on How Fundamentals Move Prices in the FX Market article

Why Currency Values Matter

Currency prices matter because of cross-border trade.

The concept of Fundamental Analysis in the Forex Market can be all boiled down to one simple data point: Interest Rates. If interest rates move higher, investors have a greater incentive to invest their capital; and if interest rates move lower, that incentive is lessened. This relationship is at the heart and soul of macroeconomics; and this is what allows Central Bankers to have tools to steward their respective economies.

How Interest Rate Cycles Drive Economies

It all goes back to the incentive to invest. If Central Bankers want to slow down their economy, they look to raise rates. If they want to encourage more growth within an economy, they look to decrease rates. Higher or lower rates bring a two-pronged impact on the economy

What do Central Bankers Watch?

Both Central Bankers and Forex Traders watch macroeconomic data prints with the goal of getting something out of them; but their objectives are slightly different. FX Traders are often interested in the price reaction of a data print. Central Bankers, however, take a much more broad view on such statistics.

How Technical Analysis can improve your fundamental approach

Traders can incorporate price action to see where these trends may be existing, and to what degree they might be traded. Then, traders can also use price action to buy up-trends cheaply, and sell down-trends expensively; so that if that momentum continues, they can look to profit.

Why You Should Target Trades based on Central Bank Policy

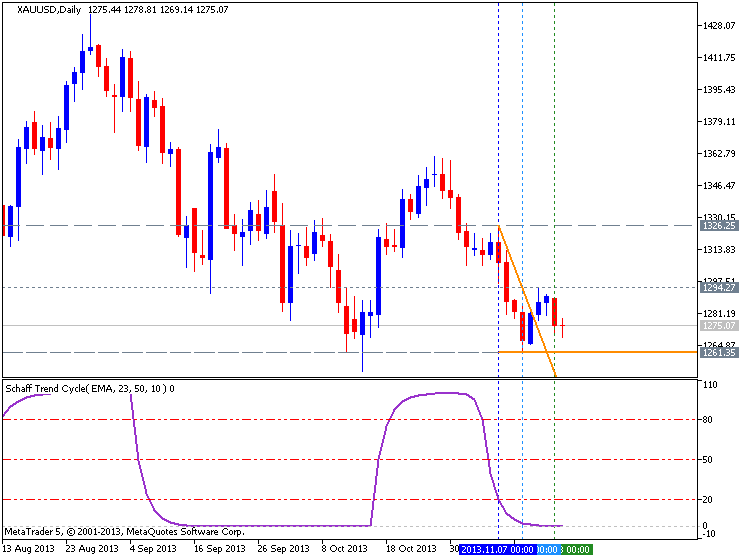

Gold Technical Analysis (based on Where are the Stops? Tuesday, November 19: Gold and Silver article)

Below are today’s likely price locations of buy and sell stop orders for the active Comex gold and silver futures markets. The asterisks (**) denote the most critical stop order placement level of the day (or likely where the heaviest concentration of stop orders are placed on this day).