You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast = good for currency (for GBP in our case)

[GBP - Interest Rate] = Interest rate at which banks lend balances held at the BOE to other banks. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

BoE Retains Key Rate At Historic Low; QE At GBP 375 Bln

As widely expected, the Bank of England on Thursday kept its interest rate at a historic-low and the size of quantitative easing at GBP 375 billion.

The Monetary Policy Committee governed by Mark Carney voted to leave the key bank rate unchanged at 0.50 percent. The rate has been at the current 0.50 percent since March 2009.

The panel also decided to maintain the asset purchase programme at GBP 375 billion. The previous change in asset purchases was in July 2012, when it was raised by GBP 50 billion.

The bank first launched quantitative easing in March 2009 with an initial value of GBP 75 billion.

In August 2013, the bank pledged not to hike the interest rate until the unemployment rate falls to 7 percent.

As the unemployment started falling faster than estimated to a level below the target, the BoE widened the scope of its forward guidance last February, and assured markets that interest rates will not be raised before the second quarter of 2015.

if actual < forecast = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy.

==========

U.S. Weekly Jobless Claims Come In Above Expectations

While the U.S. Labor Department released a report on Thursday showing a modest rebound in initial jobless claims in the week ended May 31st, the four-week moving average still fell to its lowest level in about seven years.

The report said initial jobless claims rose to 312,000, an increase of 8,000 from the previous week's revised level of 304,000. Economists had expected claims to climb to 310,000 from the 300,000 originally reported for the previous week.

Meanwhile, the Labor Department said the less volatile four-week moving average dipped to 310,250, a decrease of 2,250 from the previous week's revised average of 312,500.

With the decrease, the four-week moving average fell to its lowest level since hitting 307,500 in the week ended June 2, 2007.

EUR/USD Outlook Remains Bearish Below Former Support

Despite expectations for seeing another 215K rise in U.S. employment, the jobless rate is expected to increase to an annualized 6.4 percent from 6.3 percent in April, and a mixed batch of data print may continue to produce range-bound prices in the greenback as the Federal Reserve sticks to its current approach for monetary policy. At the same time, Average Weekly Earnings are projected to increase an annualized 2.0 percent during the same period following the 1.9% expansion the month prior, but we would need to see a marked pickup in wage growth to see a more material shift in the Fed’s policy outlook as Chair Janet Yellen retains a dovish outlook for inflation.

ECB's Draghi Signals More Action If Needed

After announcing the historic move of cutting interest rates to negative territory on Thursday, European Central Bank President Mario Draghi said the bank is not over with action in its battle against sticky low inflation and stands ready to take non-standard measures, if required.

"The key ECB interest rates will remain at present levels for an extended period of time in view of the current outlook for inflation. This expectation is further underpinned by our decisions today," Draghi said in the introductory statement to his customary post-meeting press conference.

"Moreover, if required, we will act swiftly with further monetary policy easing. The Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate should it become necessary to further address risks of too prolonged a period of low inflation."

Earlier on Thursday, the central bank cut its interest rates, taking the main refi rate to a record low 0.15 percent and the deposit rate into the uncharted negative territory at -0.10 percent. The ECB thus became the first leading central bank to adopt negative interest rates. The marginal lending rate was lowered to 0.40 percent.

Draghi also announced EUR 400 billion targeted longer-term refinancing operations, or TLTROs, that will mature in September 2018. Under the plan, financial institutions can borrow money from the ECB, totaling 7 percent of their total loans to the non-financial private sector.

The bank will conduct two successive TLTROs, in September and December 2014. The rate will be set at the main refi rate plus a fixed spread of 10 basis points.

Responding to questions from reporters, Draghi said the ECB has reached the 'lower bound' on interest rates for all practical purposes. However, "we are not finished yet", he said, adding that the bank is ready to undertake unconventional measures, if needed.

Today's ECB package was significant and the Governing Council was unanimous in its decision, Draghi said. He also said that the bank is confident that the latest measures will help to bring inflation close to 2 percent.

"In pursuing our price stability mandate, today we decided on a combination of measures to provide additional monetary policy accommodation and to support lending to the real economy," Draghi said.

Further, the ECB extended the existing eligibility of additional assets as collateral, at least until September 2018. Draghi also announced that the bank will intensify preparatory work related to outright purchases in the asset-backed securities, or ABS, market to enhance the functioning of the monetary policy transmission mechanism.

The ECB also decided to continue conducting the main refinancing operations as fixed rate tender procedures with full allotment for at least until the end of 2016. The bank will also suspend the weekly fine-tuning operation sterilizing the liquidity injected under the Securities Markets Programme.

Draghi also unveiled the latest ECB Staff macroeconomic projections. The growth forecast for this year was cut to 1 percent from 1.2 percent, while the projection for next year was raised to 1.7 percent from 1.5 percent. The forecast for 2016 was left unchanged at 1.8 percent. "The risks surrounding the economic outlook for the euro area continue to be on the downside," Draghi said.

Inflation projections were lowered through 2016. The inflation forecast for this year was slashed to 0.7 percent from 1 percent and the outlook for next year was cut to 1.1 percent from 1.3 percent. The projection for 2016 was reduced to 1.4 percent from 1.5 percent. The prediction for the fourth quarter of 2016 was also cut to 1.5 percent from 1.7 percent. The bank sees the risks to the inflation outlook as broadly balanced.

Draghi reiterated that policymakers do not see deflation risk in the euro area. However, the longer low inflation lasts, the higher will be the risks, he warned. The central bank is reacting to the risk of a period of low inflation, he said.

He also repeated that the euro exchange rate is not a policy target, but is important for maintaining price stability and growth.

Quizzed regarding the measure of large scale asset purchases, Draghi said an option that ECB has and will be considered, if needed.

Regarding concerns of savers, especially those in Germany, Draghi said their worries are taken very seriously and that interest rates will rise when growth returns.

3 Steps to Trade Major News Events (based on dailyfx article)

Talking Points:

- News releases can be stressful on traders

- Develop a plan before the event arrives

Major news releases can be stressful on traders. That stress can show up for a variety of trading styles.Perhaps you are already in a good position with a good entry and you are afraid the news release may take a bite out of your good entry.

Perhaps you want to enter into a new position as prices are near a technically sound entry point, but you are uncertain if the technical picture will hold up through the volatile release. Therefore, you agonize over the decision of whether to enter now or after the news event.

Maybe, you like to be in the action and initiating new positions during the release. The fast paced volatility during the news release still gets makes your palms sweat as you place trades.

As you can see, news events stress traders in a variety of ways.

Today, we are going to cover three steps to trade news events.

Step 1 - Have a Strategy

It sounds simple, yet the emotion of the release can easily draw us off course. We see prices moving quickly in a straight line and are afraid to miss out or afraid to lose the gains we have been sitting on. Therefore, we make an emotional decision and act.

Having a strategy doesn’t have to be complicated. Remember, staying out of the market during news and doing nothing is a strategy.

A strategy for the trader with a floating profit entering the news event could be as simple as “I am going to close off half my position and move my stop loss to better than break even.”

For the trader wanting to initiate a new position that is technically based, they may decide to wait until at least 15 minutes after the release, then decide if the set-up is still valid.

The active news trader may realize they need a plan of buy and sell rules because they trade based on what ‘feels good.’

Step 2 - Use Conservative Leverage

If you are in the market when the news is released, make sure you are implementing conservative amounts of leverage. We don’t know where the prices may go and during releases, prices tend to move fast. Therefore, de-emphasize the influence of each trade on your account equity by using low amounts of leverage.

Our Traits of Successful Traders research found that traders who implement less than ten times effective leverage tend to be more profitable on average.

3 - Don’t Deviate from the Strategy

If you have taken the time to think about a strategy from step number one and if you have realized the importance of being conservatively levered, then you are 90% of the way there! However, this last 10% can arguably be the most difficult. Whatever your plan is, stick to it!

If I put together a plan to lose 20 pounds of body weight that includes eating healthier and exercising, but I continue to eat high fat and sugar foods with limited exercise, then I am only setting myself up for frustration.

You don’t have to be stressed or frustrated through fundamental news releases.

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

U.S. Non-Farm Payrolls (NFP) are projected to increase another 215K in May, but the data print may spur a mixed reaction in the EUR/USD as the jobless rate is expected to widen to an annualized 6.4% from 6.3% the month prior.

What’s Expected:

Why Is This Event Important:

Despite the ongoing improvement in the labor market, it seems as though the Federal Open Market Committee (FOMC) will stick to its current approach at the June 18 meeting, and we would need to see a marked pickup in NFPs to see a material shift in the Fed’s policy outlook at Chair Janet Yellen remains in no rush to normalize monetary policy.

The ongoing improvement in business sentiment along with the resilience in private sector consumption may encourage U.S. firms to further expand their labor force, and a positive development may spur a bullish reaction in the greenback as it puts increased pressure on the Fed to move away from its highly accommodative policy stance.

Nevertheless, the rise in planned job-cuts paired with the persistent slack in the real economy may ultimately generate a disappointing labor report, and a dismal print may heighten the bearish sentiment surrounding the reserve currency as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: NFPs Climb 215K+; Unemployment Holds Steady

- Need to see red, five-minute candle following the NFP print to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job Growth, Jobless Rate Disappoint- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Failure to Close Above Former Support Favors Bearish Forecast

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3780 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

EURUSD M5 : 48 pips by USD - NFP news event

U.S. Non-Farm Payrolls increased 288K in April following a revised 203K rise the month prior, while the jobless rate unexpectedly slipped to an annualized 6.3% from 6.7% as discouraged workers continued to leave the labor force. The better-than-expected NFP print pushed the EUR/USD back down towards the 1.3800 handle, but the market reaction was certainly short-lived as the pair ended the day at 1.3871.

Abnormal Volume Stocks To Watch On Friday

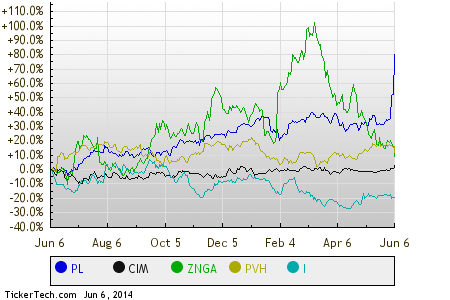

Topping the list of stocks with abnormal volume in yesterday’s trading is Protective Life, with 7.0x normal volume. In the prior session, PL traded 6.88 million shares, versus normal volume of approximately 981,903. Dai-ichi Life Insurance and Protective Life Corporation announced that they have entered into a definitive agreement under which Dai-ichi Life will acquire all outstanding shares of Protective Life Corporation for $70.00 per share in cash, or a total transaction value of approximately $5.7 billion. This strategic transaction will create the 13th largest global insurer, with total assets of $424 billion.

Chimera Investment ranked #2 on the list, with 4.8x normal volume, based on the approximately 19.50 million shares trading in the last session, versus a calculated normal volume of 4.10 million. Chimera Investment declared dividends, announced its March 31, 2014 estimated book value and distributed supplemental financial information. The Company announced that its Board of Directors has declared a second quarter 2014 cash dividend of $0.09 per common share. This dividend is payable July 24, 2014, to common shareholders of record on June 30, 2014. The ex-dividend date is June 26, 2014. The Board has also reviewed the dividend program and announced that the Company will continue to pay a dividend of $0.09 per share for each of the third and fourth quarters of 2014. The Company said its estimated March 31, 2014 GAAP book value was $3.27 per share and its economic book value was $3.01 per share, compared to its December 31, 2013 GAAP book value of $3.24 per share and economic book value of $2.82 per share.

Looking for abnormal volume stand-outs, we comb through the closing trading data for the Russell 1000 components, to find these stand-outs that traders will be interested to watch during Friday’s upcoming session. To compile the list (see below), we first calculate “normal” volume for each stock by computing the average over the trailing three month period, and then we compare that figure against the volume seen during the session.

Coming in at #3, Zynga (NASD: ZNGA) saw 4.7x normal trading volume, with volume of 152.11 million shares versus the usual 32.49 million. According to theflyonthewall.com, “Shares of Internet video game maker Zynga (ZNGA) are falling after the company’s CEO sounded cautious about its profitability and declined to provide details about its longer term outlook.”

PVH (NYSE: PVH) ranked #4 on the list, with 4.7x normal volume, based on the approximately 5.43 million shares trading in the last session, versus a calculated normal volume of 1.16 million. PVH Corp. reported 2014 first quarter results. Earnings per share on a non-GAAP basis was $1.47 as compared to $1.91 in the prior year’s first quarter. Revenue was $1.964 billion, an increase of 4% on a non-GAAP basis as compared to the prior year amount excluding $47 million of revenue related to the Bass business (which was sold during the fourth quarter of 2013), despite revenue in the North American businesses being under significant pressure due to unseasonably cold weather across the region. On a GAAP basis, total revenue increased 3% as compared to prior year GAAP revenue of $1.910 billion. 2013 GAAP revenue was $30 million lower than revenue on a non-GAAP basis, attributable to sales returns for certain wholesale customers in the acquired Asia business in connection with an initiative to reduce excess inventory levels. The revenue increases over the prior year were principally driven by growth in the Company’s Tommy Hilfiger business of 6% and in the Company’s Calvin Klein business of 4% on a non-GAAP basis and 9% on a GAAP basis. These increases were partially offset by a revenue decline of 2% in the Company’s Heritage Brands business excluding the $47 million of 2013 Bass revenue, or 11% including such revenue.

And finally, Intelsat (NYSE: I) ranked #5 on the list, with 4.6x normal volume, seeing approximately 888,300 shares change hands, compared to normal volume of 194,882. Intelsat S.A. announced a multi-year agreement with Slovak Telekom a.s., the largest Slovak multimedia operator, to expand Slovak Telekom’s direct-to-home services in Central Eastern Europe.

Comparing these stocks on a trailing twelve month basis, below is a relative stock price performance chart, with each of the symbols shown in a different color as labeled in the legend at the bottom:

EUR/USD falls on solid U.S. May jobs report

A solid U.S. May jobs report sent the dollar gaining against the euro on Friday, as markets bet the U.S. economy and labor market continue to recover and are in need of less monetary support from the Federal Reserve.

In U.S. trading, EUR/USD was down 0.17% at 1.3639, up from a session low of 1.3621 and off a high of 1.3677.

The pair was likely to find support at 1.3503, Thursday's low, and resistance at 1.3723, the high from May 21.

The U.S. Labor Department reported earlier that the economy added 217,000 in May, more or less in with expectations for a 218,000 increase, after a 282,000 rise in April, whose figure was revised down from a previously estimated 288,000 gain.

The private sector added 216,000 jobs last month, exceeding expectations for a 210,000 gain, which drew market applause and firmed the dollar.

The report also showed that the U.S. unemployment rate remained unchanged at 6.3% last month compared to expectations for a rise to 6.4%.

The data, viewed by markets as not exceptionally robust, was still strong enough to keep expectations firm for the Federal Reserve to continue winding down its monthly bond-buying program, which weakens the dollar by suppressing long-term interest rates.

The euro, meanwhile, continued to come under pressure after the European Central Bank cut its benchmark interest rate on Thursday to a record-low 0.15% from 0.25%, cut its deposit rate to -0.1% and said it will support the banking sector to spur lending via targeted long-term credit injections.

Elsewhere on Friday, official data revealed that Germany's trade surplus widened to €17.7 billion in April from €15.0 billion in March, whose figure was revised up from a previously estimated surplus of €14.8 billion. Analysts had expected the trade surplus to widen to €15.2 billion in April

Elsewhere, the euro was down against the pound, with EUR/GBP down 0.01% at 0.8121, and down against the yen, with EUR/JPY down 0.08% at 139.80.

Mumbai: India's forex reserves fell by $273.8 million to $312.382 billion in the week to May 30, mainly on account of a drop in currency assets.

After weeks of gains, the reserves nosedived by a whopping $2.268 billion to $312.656 billion in the previous week.

Foreign currency assets (FCAs), a major constituent of overall reserves, dipped by $269.3 million to $285.291 billion in the period under review, the Reserve Bank of India (RBI) said in a statement.

FCAs, expressed in dollar terms, include the effect of appreciation/depreciation of the non-US currencies such as the euro, pound and yen held in reserves.

Gold reserves remained unchanged at $20.965 billion in the reporting week.

Special drawing rights declined by $3.3 million to $4.449 billion, and India's reserve position with the IMF dipped $1.2 million to $1.676 billion in the period under review, the apex bank said.

Forum on trading, automated trading systems and testing trading strategies

Discussion of article "Time Series Forecasting Using Exponential Smoothing"

newdigital, 2014.06.06 21:48

Becoming a Fearless Forex Trader

- Must You Know What Will Happen Next?

- Is There a Better Way?

- Strategies When You Know That You Don’t Know

“Good investing is a peculiar balance between the conviction to follow your ideas and the flexibility to recognize when you have made a mistake.”-Michael Steinhardt

"95% of the trading errors you are likely to make will stem from your attitudes about being wrong, losing money, missing out, and leaving money on the table – the four trading fears"

-Mark Douglas, Trading In the Zone

Many traders become enamored with the idea of forecasting. The need for forecasting seems to be inherent to successful trading. After all, you reason, I must know what will happen next in order to make money, right? Thankfully, that’s not right and this article will break down how you can trade well without knowing what will happen next.

Must You Know What Will Happen Next?

While knowing what would happen next would be helpful, no one can know for sure. The reason that insider trading is a crime that is often tested in equity markets can help you see that some traders are so desperate to know the future that their willing to cheat and pay a stiff fine when caught. In short, it’s dangerous to think in terms of a certain future when your money is on the line and best to think of edges over certainties when taking a trade.

The problem with thinking that you must know what the future holds for your trade, is that when something adverse happens to your trade from your expectations, fear sets in. Fear in and of itself isn’t bad. However, most traders with their money on the line, will often freeze and fail to close out the trade.

If you don’t need to know what will happen next, what do you need? The list is surprisingly short and simple but what’s more important is that you don’t think you know what will happen because if you do, you’ll likely overleverage and downplay the risks which are ever-present in the world of trading.

- A Clean Edge That You’re Comfortable Entering A Trade On

- A Well Defined Invalidation Point Where Your Trade Set-Up No Longer

- A Potential Reversal Entry Point

- An Appropriate Trade Size / Money Management

Is There a Better Way?Yesterday, the European Central Bank decided to cut their refi rate and deposit rate. Many traders went into this meeting short, yet EURUSD covered ~250% of its daily ATR range and closed near the highs, indicating EURUSD strength. Simply put, the outcome was outside of most trader’s realm of possibility and if you went short and were struck by fear, you likely did not close out that short and were another “victim of the market”, which is another way of saying a victim of your own fears of losing.

So what is the better way? Believe it or not, it’s to approach the market, understanding how emotional markets can be and that it is best not to get tied up in the direction the market “has to go”. Many traders will hold on to a losing trade, not to the benefit of their account, but rather to protect their ego. Of course, the better path to trading is to focus on protecting your account equity and leaving your ego at the door of your trading room so that it does not affect your trading negatively.

Strategies When You Know That You Don’t Know

There is one commonality with traders who can trade without fear. They build losing trades into their approach. It’s similar to a gambit in chess and it takes away the edge and strong-hold that fear has on many traders. For those non-chess players, a gambit is a play in which you sacrifice a low-value piece, like a pawn, for the sake of gaining an advantage. In trading, the gambit could be your first trade that allows you to get a better taste of the edge you’re sensing at the moment the trade is entered.

James Stanley’s USD Hedge is a great example of a strategy that works under the assumption that one trade will be a loser. What’s the significance of this? It pre-assumes the loss and will allow you to trade without the fear that plagues so many traders. Another tool that you can use to help you define if the trend is staying in your favor or going against you is a fractal.

If you look outside of the world of trading and chess, there are other businesses that presume a loss and therefore are able to act with a clear head when a loss comes. Those businesses are casinos and insurance companies. Both of these businesses presume a loss and work only in line with a calculated risk, they operate free of fear and you can as well if you presume small losses as part of your strategy.

Another great Mark Douglas quote:

“The less I cared about whether or not I was wrong, the clearer things became, making it much easier to move in and out of positions, cutting my losses short to make myself mentally available to take the next opportunity.” -Mark Douglas

Happy Trading!

The source