You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

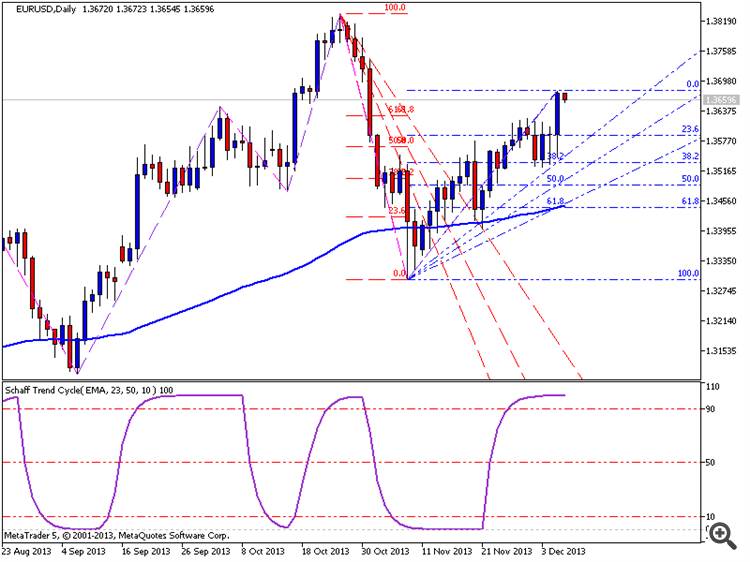

Trading the News: European Central Bank Interest Rate Decision (based on dailyfx.com article)

The European Central Bank (ECB) is widely expected to adopt a more dovish tone for monetary policy as the Governing Council remains poised to implement more non-standard measures in 2014.

What’s Expected:

Time of release: 12/05/2013 12:45 GMT, 7:45 EST

Primary Pair Impact: EURUSD

Expected: 0.25%

Previous: 0.25%

Forecast: 0.25%

Why Is This Event Important:

Given the recent headlines surrounding the ECB, there may be little in terms of new surprises as the Governing Council looks at a range of policy tools (Negative Deposit Rates, Long-Term Refinancing Operations, and Quantitative Easing), but the Euro may struggle to hold its ground following the policy meeting should President Mario Draghi layout a more detailed schedule for its easing cycle.

Bearish EUR Trade: ECB Lays Out Detailed Easing Schedule

- Need to see red, five-minute candle following the decision/statement to consider a short Euro trade

- If market reaction favors a short trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Adopts More Neutral TonePotential Price Targets For The Rate Decision

2013-12-05 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]

if actual > forecast = good for currency (for GBP in our case)

==========

BoE Leaves Rates Unchanged; Osborne Upgrades GDP Outlook

The Bank of England left its key policy rates unchanged on Thursday, while Chancellor of Exchequer George Osborne said in his autumn statement that the economy is better placed than they had expected early this year.

In his 2013 Autumn Statement, Osborne said Britain's economic plan is working and the hard work of the British people is paying off. The economic growth forecast for 2013 was more than doubled to 1.4 percent from 0.6 percent, he told lawmakers.

According to estimates by the Office for Budget Responsibility, the economy will grow 2.4 percent next year, up from the 1.8 percent projected in March.

The Trading System Development Step-By-Step Process (based on thetechnicaltraders article)

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. economy is expected to add another 185K jobs in November and a positive development may highlight a bullish outlook for the dollar as it raises the Fed’s scope to taper the asset-purchase program at the December 17-18 meeting.

What’s Expected:

Time of release: 12/06/2013 13:30 GMT, 8:30 EST

Primary Pair Impact: EURUSD

Expected: 185K

Previous: 204K

Forecast: 160K to 200K

Why Is This Event Important:

A further improvement in the U.S. labor market may spark a more material shift in the policy outlook as the Fed retains its forward-guidance for monetary policy, and we may see a growing number of central bank officials show a greater willingness to move away from the easing cycle.

How To Trade This Event Risk

Bullish USD Trade: NFP Increases 185K+; Unemployment Slips to 7.2%

- Need to see red, five-minute candle following the print to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: November Job Growth Disappoints2013-12-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Employment Increases By More Than Expected In November

In another upbeat sign for the U.S. labor market, the Labor Department released a report on Friday showing stronger than expected job growth in the month of November.

The report showed that non-farm payroll employment rose by 203,000 jobs in November following a revised increase of 200,000 jobs in October.

Economists had been expecting employment to increase by about 180,000 jobs compared to the addition of 204,000 jobs originally reported for the previous monthGold at important cycle points (based on dailyf article)

Bitcoin Gets Valued: Bank Of America Puts A Price Target On The Virtual Tender

Today, Bank of America became the first major finical institution to initiate analyst coverage of Bitcoin.

But Bitcoin is highly volatile. Thursday alone it hit a high of $1,240 before tumbling down to $870 on news that the Chinese government has restricted banks from using it. The value is back up to around $1,100 since that early morning low.

About Bitcoin...

Shunmas

Please stop vendetta :)