You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Based on Bearish GBP Momentum at Risk on Hawkish BoE Inflation Report article

===========

Trading the News: Bank of England Inflation Report

The Bank of England’s (BoE) Inflation Report may heavily influence the near-term forecast for the British Pound as market participants see the central bank implementing its exit strategy ahead of schedule.

What’s Expected:

Why Is This Event Important:

There’s speculation that Governor Mark Carney will rein in the optimism surrounding the U.K. economy, but the central bank may adopt a more hawkish tone for monetary policy as the stronger recovery raises the risk for a prolonged period of above-target inflation.

Potential Price Targets For The Release

- Threatens Range Following U.K. CPI Report; Bearish RSI Momentum Remains Intact

- Interim Resistance: 1.6250 Pivot to 1.6300 Pivot (2012 highs)

- Interim Support: 1.5900 Pivot to 1.5910 (78.6% Fibonacci expansion)

How To Trade This Event RiskBullish GBP Trade: BoE Raises Forecast; Adopts More Hawkish Tone

- Need green, five-minute candle following the statement to favor a long GBP trade

- If reaction favors buying British Pound, long GBPUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: BoE to Retain Highly Accommodative Stance Throughout 2014The BoE implemented forward-guidance for monetary policy as they pegged a 7.0% threshold for unemployment, but we saw Governor Mark Carney refrain from implementing a growth target as the central bank continues to operate under its inflation-targeting framework. In turn, the initial dip in the British Pound was short-lived, with the GBPUSD climbing above the 1.5400 handle, and the sterling continued to gain ground throughout the day as the pair closed at 1.5486.

2013-11-12 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Claimant Count Change]

if actual < forecast = good for currency (for GBP in our case)

==========

UK Jobless Claims Fall More Than Forecast, Unemployment Rate DropsBritish unemployment claims declined more than expected by economists in October, while the jobless rate edged lower in the three-months to September, data from the Office for National Statistics showed Wednesday.

The claimant count for October fell by 41,700 from a month earlier to 1.31 million, the lowest level since January 2009. Economists had forecast a decline of 30,000. The claimant count rate fell to 3.9 percent from 4 percent in September.

The unemployment rate fell to 7.6 percent in July-September from 7.8 percent in April-June 2013. The figure matched economists forecast. There were 2.47 million unemployed people in the country in the September quarter.

2013-11-12 10:30 GMT (or 11:30 MQ MT5 time) | [GBP - BOE Inflation Report]

==========

BoE Governor Mark Carney on inflation reportBank of England Governor MarkCarney released the central bank's latest quarterly inflationreport on Wednesday.

Highlights of his comments are below.

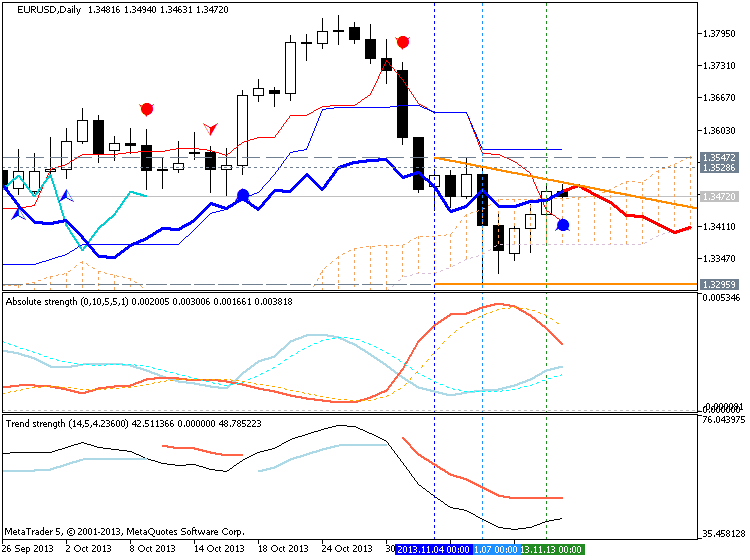

Trading the News: German Gross Domestic Product (based on Euro Rebound at Risk on Slowing 3Q GDP- More Dovish ECB Ahead? article)

Germany’s 3Q Gross Domestic Product (GDP) report may highlight a weakening outlook for the euro-area as the region’s largest economy faces a slowing recovery. In turn, a dismal development may heighten the bearish sentiment surrounding the single currency as it spurs bets for additional monetary support.

What’s Expected:

Time of release: 11/14/2013 7:00 GMT, 2:00 EST

Primary Pair Impact: EURUSD

Expected: 0.3%

Previous: 0.7%

Forecast: 0.1% to 0.3%

Why Is This Event Important:

Following the surprise rate cut last week, it seems as though the European Central Bank (ECB) will further embark on its easing cycle as President Mario Draghi maintains his pledge to keep interest rates at the current level or lower, and the Governing Council may adopt more non-standard measures over the coming months as growth and inflation remains subdued.

Potential Price Targets For The Release

How To Trade This Event Risk

Bearish Euro Trade: German 3Q GDP Misses Market Forecast

- Need red, five-minute candle following the report to favor a bearish Euro trade

- If reaction favors selling Euro, short EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish Euro Trade: Growth Rate Exceeds 0.3%After holding flat during the first three-months of 2013, Europe’s largest economy grew 0.7% in the second quarter to emerge from the recession, while the euro-area expanded 0.3% during the same period amid forecasts for a 0.2% print. Nevertheless, the initial uptick in the EURUSD was short-lived, with the pair slipping back below the 1.3275 region, and the single currency struggled to hold its ground throughout the day as it closed at 1.3252.

2013-11-14 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Retail Sales]

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Retail Sales Fall In October

U.K. retail sales volume dropped 0.7 percent month-on-month in October due to a notable 1.3 percent fall in non-food store sales, the Office for National Statistics said Thursday.

The drop in sales volume follows a 0.6 percent rise in September. It was forecast to remain flat in October.

Excluding automotive fuel, retail sales volume slipped 0.6 percent, partially offsetting the 0.8 percent rise in September. The rate of decline also exceeded the expectations for a 0.1 percent fall.

AUD/USD Technical Analysis (based on Forex: AUD/USD Technical Analysis – Bears Aim to Challenge 0.92 article)

Talking Points

Eurozone Economy Moves Closer To Stagnation

The Eurozone economy moved to near-stagnation in the third quarter, underscoring the fragile nature of recovery in the region as Germany and France failed to maintain the growth momentum. Further, the relapse in economic activity will possibly make the task of the European Central Bank difficult to take inflation back to the target level.

Natural gas futures trimmed losses on Thursday to bounce off a one-week low after U.S. government data showed that natural gas supplies rose broadly in line with market expectations last week.

On the New York Mercantile Exchange, natural gas futures for delivery in December traded at USD3.550 per million British thermal units during U.S. morning trade, down 0.45%.

Futures traded at USD3.499 prior to the release of the U.S. Energy Information Administration report.

Nymex gas prices fell to a session low of USD3.492 per million British thermal units earlier, the weakest level since November 7.

The December contract settled 1.41% lower at USD3.513 per million British thermal units on Wednesday.

Nymex gas futures were likely to find support at USD3.454 per million British thermal units, the low from November 6 and resistance at USD3.659, the high from November 13.

The U.S. Energy Information Administration said in its weekly report that natural gas storage in the U.S. in the week ended November 8 rose by 20 billion cubic feet, compared to expectations for an increase of 21 billion cubic feet.

USDJPY 98.90 serves as key pivot now; buying a dip (based on USDJPY Highlights a Number of Trade Setups for Next Week article)

Trading Strategy: Order to go long at 99.90, stop 98.80. A breakout could be phenomenal so allow the market to dictate upside (if it plays out).

The Week Ahead: Where in the World to Invest?

It was another week where the stock market surprised the majority by continuing higher despite the already lofty levels of the major averages. The S&P 500 broke through short-term resistance on Wednesday and closed the week just below the 1800 level.

Oftentimes, there is selling when a market average reaches a round number like 1800 but it is also possible this time that a strong close above this level will move more money off the sidelines. Mutual fund managers have a relatively high level of cash on hand and many are not keeping pace with their benchmarks. A failure to match or exceed the benchmarks could jeopardize their year-end bonuses.

Many continue to voice concern over the high level of bullish sentiment, which implies that the smaller investors have joined the party. But Charles Schwab CEO Walter Bettinger commented on CNBC that only about half of their clients think it is a good time to be investing in equities. Furthermore he said “Our clients are engaged, but they’re very cautious about the markets overall.”