You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Facebook - "the most important driver of our business has never been time spent by itself" (based onthe article)

============

The chart was made on weekly timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

Crypto News: daily bearish reversal (based on the article)

Daily price was reversed to the bearish market condition: the price is testing 8,416 support level to below for the bearish breakdown to be continuing.

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Crypto News - DigixDAO (DGD) Price Up 60% Despite Market Drop, Outperforms All Top 100 Cryptocoins (based on the article)

Intra-Day Fundamentals - USD/CAD, XAU/USD and Brent Crude Oil: Non-Farm Payrolls

2018-02-02 13:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Level of a composite index based on surveyed households.

==========

From official report :

==========

USD/CAD M5: range price movement by Non-Farm Payrolls news events

==========

XAU/USD M5: range price movement by Non-Farm Payrolls news events

============

Brent Crude Oil M5: range price movement by by Non-Farm Payrolls news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Bitcoin broke important levels (based on the article)

The daily price broke Ichimoku cloud together with low last weekly candle to below to be reversed to the primary bearish market condition. The price is breaking 8,416 support level for the daily berarish trend to be continuing.

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Litecoin - daily bearish reversal; 116.96 is the key (based on the article)

The daily price broke Ichimoku kumo to below for the bearish reversal to be started. If the price breaks low last weekly candle at 139.72 on close daily bar together with 116.96 support level so the bearish reversal will be finished.

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Ripple - daily bearish breakdown to be started; .86 support is the key (based on the article)

The daily price is breaking Ichimoku cloud for the bearish reversal to be started: the price is testing 0.86 support level to below for the bearish trend to be continuing.

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Ethereum is finally breaking too (based on the article)

The daily price was bounced from 1,257 resistance level to below for the secondary correction within the primary bullish trend. If the price breaks support level at 860 together with low last weekly candle so the bearish reversal will be started.

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

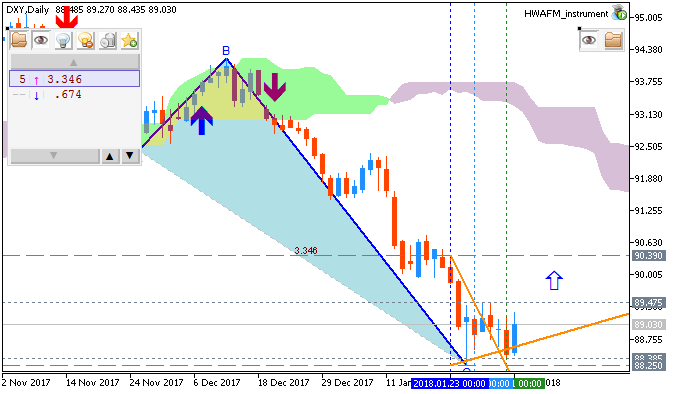

Weekly Outlook: 2018, February 04 - February 11 (based on the article)

The US dollar made an attempt to recover but the results were mixed in a very busy week. What’s next? The focus shifts away from the US as we have three rate decisions and two jobs reports from other places Here are the highlights for the upcoming week.

============

The chart was made on Metatrader 5 using HWAFM tool pattern tool from this post.