You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and range price movement

2017-12-01 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report :

==========

USD/CNH M15: range price movement by Caixin Manufacturing PMI news event

==========

The chart was made on M5 timeframe with standard indicators of Metatrader 4 except the following indicator (free to download):

Crude Oil - weekly bullish eranging within narrow levels for direction (based on the article)

Weekly price is above Ichimoku cloud in the bullish area of the chart: the price is on ranging within the narrow 64.63/61.16 s/r levels for the bullish trend to be resumed or for the secondary correction to be started.

==========

The chart was made on W1 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):

MaksiGen_Range_Move MTF - indicator for MetaTrader 5

USD/CAD Intra-Day Fundamentals: Canada GDP and range price movement

2017-12-01 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

USD/CAD M15: range price movement by Canada GDP news event

==========

The chart was made on W1 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):

MaksiGen_Range_Move MTF - indicator for MetaTrader 5

S&P 500 - daily bullish with 2,657 as a target (based on the article)

Daily price is very far above Ichimoku cloud in the bullish area of the chart: the price is testing resistance level at 2,657 to above for the bullish trend to be continuing.

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Weekly Outlook: 2017, December 03 - December 10 (based on the article)

The US dollar managed to recover in the week after Thanksgiving on positive data, upbeat Fed statements, imminent tax cuts, and despite a major development in Trump’s troubles. The Non-Farm Payrolls is the key event and we also have rate decisions from Australia and Canada Here are the highlights for the upcoming week.

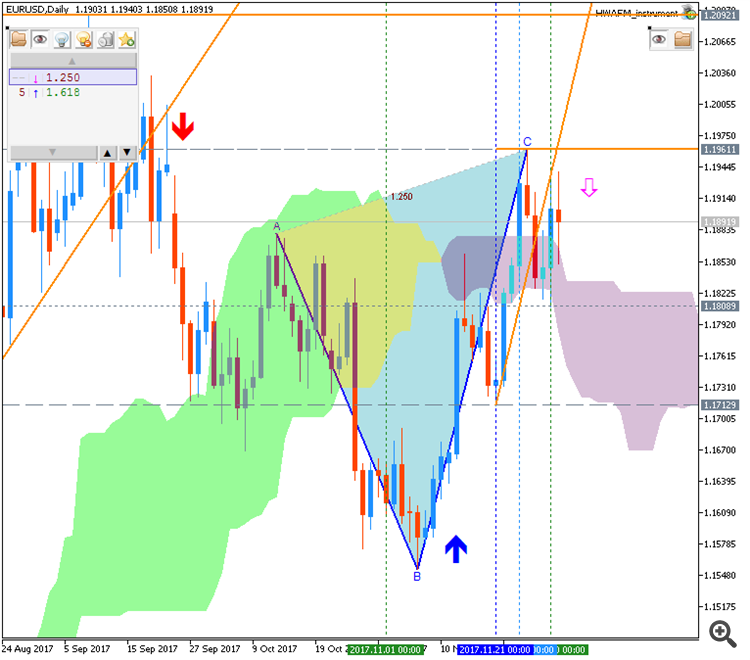

Weekly EUR/USD Outlook: 2017, December 03 - December 10 (based on the article)

EUR/USD struggled to continue advancing as the dollar found its footing. The upcoming week features a constant stream of data including PMIs, industrial output and more. Here is an outlook for the highlights of this week.

EUR/USD - long-term rally to the bullish reversal; 1.2091 is the long-term resistance for bullish (based on the article)

Price on the monthly chart is near and below Ichimoku cloud for the trying to be reversed to the primary bullish market condition. Chinkou Span line broke historical price to above for the secondary rally within the bearish trend, and the price is testing resistance level at 1.2091 to above to be reversed to the primary bullish market condition.

==========

The chart was made on MN1 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

AUD/USD Intra-Day Fundamentals: Australia Company Gross Operating Profits and range price movement

2017-12-04 00:30 GMT | [AUD - Company Operating Profits]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Company Operating Profits] = Change in the total value of profits earned by corporations.

==========

From official report :

==========

AUD/USD M5: range price movement by Company Gross Operating Profits news event

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Turkish Lira - bullish breakout; 3.98 is the key (based on the article)

Weekly price was bounced from 3.38 bearish reversal level to above for the bullish breakout: the price is testing resistance level at 3.98 for the breakout to be continuing.

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

NZD/USD - weekly bearish breakdown (based on the article)

Weekly price broke Ichimoku cloud to below for the breakdown with the bearish reversal: the price is testing support level at 0.6779 to below for the bearish trend to be continuing.

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5: