You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

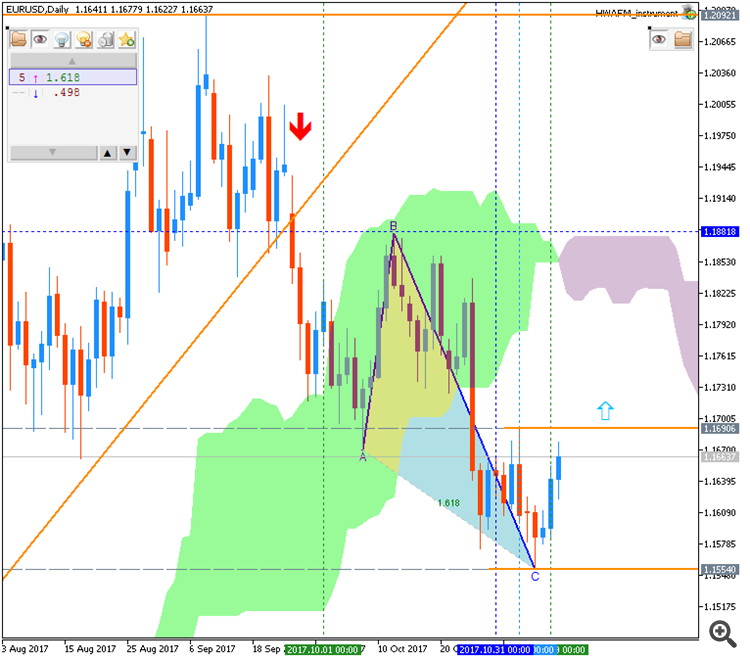

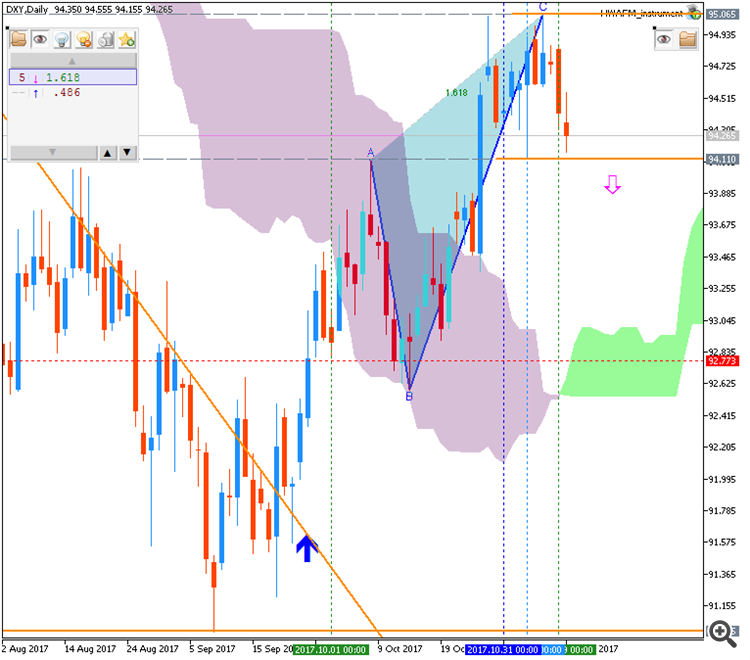

EUR/USD - intra-day bearish ranging within narrow levels for direction (based on the article)

Intra-day H4 price is on narrow ranging to be below Ichimoku cloud: the price is on primary bearsh trend for the ranging within bullish reversal levet at 1.1637 and the bearish continuation support at 1.1553.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

A 5-year annualized S&P 500 return of 10% or more has never produced an annualized return of over 10% during the next 5 years (based on the article)

Price on the daily chart is on bullish breakout for 2,593 resistance level to be breaking for the bullish trend to be continuing.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Facebook vs. Alibaba = bullish breakout (based on the article)

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

USD/CNH Intra-Day Fundamentals: China CPI and range price movement

2017-11-09 01:30 GMT | [CNY - CPI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

From rttnews article :

==========

USD/CNH M15: range price movement by China CPI news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Nikkei 225 - long-term bullish trend since the beginning of September this year (based on the article)

Intra-day H4 price is located above Ichimoku cloud in the bullish area of the chart: the price is testing the resistance level at 2,342 to above for the bullish trenbd to be continuing.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

AUD/USD - daily ranging bearish; 0.7627 is the key (based on the article)

Daily price is below Ichimoku cloud for the ranging within 0.7728 resistance level for the bear market rally to be started and 0.7627 support level for the bearish trend to be resumed.

- "The Australian Dollar is perched at trend-defining support, with the currency yet to decide on near-term direction against its US counterpart. A series of descending highs and lows argues for a bearish near-term bias but the longer-term view warns that recent losses might have been corrective within a larger advance."

- "Support is in the 0.7611-25 area (October 27 low, 23.6% Fibonacci expansion), with a daily close below that exposing the 38.2% level at 0.7538 and arguing for a structural tone shift in favor of the downside. Alternatively, a breach of the 23.6% Fib retracement at 0.7743 targets the 38.2% mark at 0.7816."

==========Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Monetary Policy Statement and range price movement

2017-11-10 00:30 GMT | [AUD - RBA Monetary Policy Statement]

[AUD - RBA Monetary Policy Statement] = It provides valuable insight into the bank's view of economic conditions and inflation - the key factors that will shape the future of monetary policy and influence their interest rate decisions.

==========

From theaustralian article :

==========

AUD/USD M1: range price movement by RBA Monetary Policy Statement news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

GBP/USD - daily bearish ranging near Senkou Span reversal level (based on the article)

The price on the daily chart is on ranging below Ichimoku cloud: price is within the following support/resistance levels:

By the way, 1.3027 is the weekly support level, and if the price breaks this level to below on close weekly bar so the long-term bearish reversal will be started with the secondary ranging way.

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

Weekly Outlook: 2017, November 12 - November 19 (based on the article)

The US dollar was somewhat on the backfoot in a relatively slow week. Will it continue sliding? The upcoming week features the all-important inflation and retail sales figures from the US as well as housing data and more. Here are the highlights for the upcoming week.

Weekly EUR/USD Outlook: 2017, November 12 - November 19 (based on the article)

EUR/USD managed to tick up amid OK data from Europe and weakness in the US dollar. GDP data stands out in a busier week. Here is an outlook for the highlights of this week.