You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD Intra-Day Fundamentals: U.S. Advance Retail Sales and 14 pips range price movement

2016-03-15 12:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

EURUSD M5: 14 pips range price movement by U.S. Advance Retail Sales news event :

Trading News Events: U.K. Claimant Count Change (based on the article)

What’s Expected:

Even though the EU referendum clouds the economic outlook for the U.K., a further improvement in labor-market dynamics may spur a split within the Bank of England (BoE) as central bank officials remain upbeat on the economy and see a risk of overshooting the 2% inflation-target over the policy horizon.

Nevertheless, waning confidence along with the slowdown in service-based activity may drag on employment, and a dismal labor report may produce near-term headwinds for the sterling as it market participants push out bets for a BoE rate-hike.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Job/Wage Growth Exceed Market Forecast

- Need green, five-minute candle following the print to consider a long GBP/USD trade.

- If market reaction favors buying sterling, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: Jobless Claims, Average Hourly Earnings Disappoint- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

GBP/USD Intra-Day Fundamentals: UK Jobless Claims and 30 pips range price movement

2016-03-16 09:30 GMT | [GBP - Claimant Count Change]

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Claimant Count Change] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

GBPUSD M5: 30 pips range price movement by UK Jobless Claims news event :

EUR/USD Intra-Day Fundamentals: U.S. Consumer Price Index and 20 pips price movement

2016-03-16 12:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.2 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.0 percent before seasonal adjustment."

==========

EURUSD M5: 20 pips price movement by U.S. Consumer Price Index news event :

Trading News Events: FOMC Federal Funds Rate (based on the article)

What’s Expected:

Why Is This Event Important:

The FOMC may continue to prepare U.S. households and businesses for higher interest rates especially as the economy approaches ‘full-employment,’ and the central bank may sound more hawkish this time around as Chair Janet Yellen remains confident in achieving the 2% inflation-target over the policy horizon.

However, waning confidence paired with subdued wage growth may prompt to Fed to adopt a more cautious tone this time around, and the dollar stands at risk of facing near-term headwinds should the central bank show a greater willingness to further delay the normalization cycle.

How To Trade This Event Risk

Bullish USD Trade: FOMC to Stay on Course to Further Normalize Policy in 2016

- Need red, five-minute candle following the rate decision to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Fed Curbs Expectations for Higher Borrowing-Costs- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

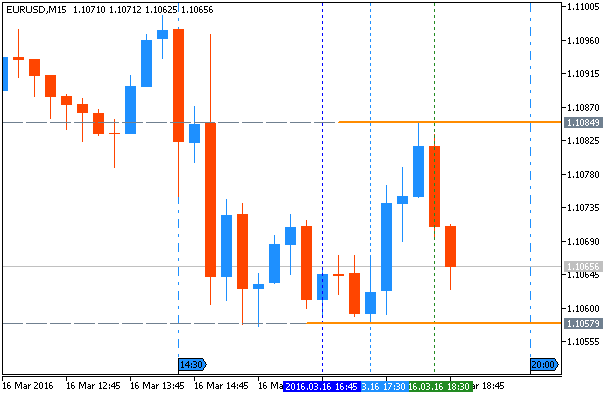

EUR/USD Intra-Day Fundamentals: FOMC Federal Funds Rate and 14 pips range price movement

2016-03-16 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. However, global economic and financial developments continue to pose risks. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to monitor inflation developments closely.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EURUSD M5: 14 pips range price movement by FOMC Federal Funds Rate news event :

AUD/USD Intra-Day Fundamentals: Australia Jobless Rate and 64 pips price movement

2016-03-17 00:30 GMT | [AUD - Unemployment Rate]

if actual < forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month.

==========

==========

AUDUSD M5: 64 pips price movement by Australia Jobless Rate news event :

Technical Targets for GBP/USD by United Overseas Bank (based on the article)

GBP/USD: ranging bullish - 1.4311 resistance to be broken for the strong bullish trend to be continuing

M15 price is located above 100 period SMA and 200 period SMA for the primary bullish market condition with the secondary ranging: the price is ranging within 1.4311 resistance and S1 Yearly Pivot level at 1.4222.

RSI indicator is estimating the secondary ranging to be continuing.

EUR/USD Intra-Day Fundamentals: Euro-Zone Trade Balance and 45 pips price movement

2016-03-17 10:00 GMT | [EUR - Trade Balance]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

"The first estimate for euro area (EA19) exports of goods to the rest of the world in January 2016 was €145.3 billion, a decrease of 2% compared with January 2015 (€148.0 bn). Imports from the rest of the world stood at €139.1 bn, a fall of 1% compared with January 2015 (€140.9 bn). As a result, the euro area recorded a €6.2 bn surplus in trade in goods with the rest of the world in January 2016, compared with +€7.1 bn in January 2015. Intra-euro area trade remained stable at €132.5 bn in January 2016 compared with January 2015."

==========

EURUSD M5: 45 pips price movement by Euro-Zone Trade Balance news event :

GBP/USD Intra-Day Fundamentals: Bank of England Rate Decision and 41 pips price movement

2016-03-17 12:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

"The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 16 March 2016, the MPC voted unanimously to maintain Bank Rate at 0.5%. The Committee also voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion."

==========

GBPUSD M5: 41 pips price movement by Bank of England Rate Decision news event :