You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD Nears Week Long Range Break; JPY-crosses Continue Run (based on dailyfx article)

Event risk is at its lowest point of the week on Tuesday, but it's shaping up to be the 'calm before the storm' if anything. Numerous 'medium' and 'high' rated events will help unleash volatility starting tomorrow, including the European Central Bank meeting on Thursday and the November US labor market report on Friday.

Ahead of then, we're starting to see the ranges that persisted around the holiday trading conditions last week start to bend, just not yet break. One of these instances is occurring in EURUSD, where the closing highs and lows on H4 charts going back to November 27 are starting to be probed.

Elsewhere, the big theme at present is the ongoing Japanese Yen depreciation. USDJPY's triangle/flag going back to November 17 is on the verge of cracking higher; and the momentum in EURJPY and GBPJPY sees continuation higher as well, irrespective of event risk.

AUDIO - The Dollar, Gold and Oil with John O'Donnell (based on fxstreet article)

The story of the year has been the drop in oil prices and its impact on global markets. John O’Donnell joins Merlin in studio to talk about how the dollar has impacted these commodities and the impact they will have on domestic markets, but global markets as well.

USD/JPY Aims Higher After Climb Above 119 With Reversal Signals Absent (based on dailyfx article)

- Strategy: Long (From: 119.20), Stop: 119.00 (Daily Close), Target 1: 119.80, Target 2: 124.10

- Breakout Amid Absence Of Reversal Signals Opens Further Gains

- Intraday Chart Reveals Some Caution From The Bulls

USD/JPY has closed above the 119.00 handle with key reversal candlesticks lacking. Amid a core uptrend this may open the prospect of further gains. An initial upside target is offered by the nearby August 2007 high at 119.80, with an additional target in the distance at the June ’07 high near 124.10.Awaiting Breakout Amid Absence Of Bearish Signals

Key EURUSD Scalp Targets Heading Into ECB / NFPs (based on dailyfx article)

Technical Outlook

if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

Australia October Trade Deficit A$1.323 Billion

Australia posted a merchandise trade deficit of A$1.323 billion in October, the Australian Bureau of Statistics said on Thursday.

That beat expectations for a shortfall of A$1.80 billion following the revised A$2.235 billion deficit in September (originally A$2.261 billion).

It's also a decrease of A$912 million (41 percent) on the deficit in September 2014.

Exports were up 2.0 percent on year to A$26.904 billion. They were worth A$26.495 billion in September.

Non-rural goods climbed A$700 million (4 percent), while non-monetary gold fell A$204 million (13 percent), rural goods lost A$115 million (4 percent) and net exports of goods under merchanting fell A$7 million (70 percent). Services credits gained A$35 million (1 percent).

USD/JPY Technical Analysis: Aiming Above 120.00 Figure (based on dailyfx article)

The US Dollar looks to be accelerating against the Japanese Yen anew, with prices poised to advance beyond the 120.00 figure. A daily close above the 23.6% Fibonacci retracement at 120.48 exposes the 38.2% level at 122.49. Alternatively, a reversal below the 14.6% Fib at 119.24 clears the way for a test of the November 27 low at 117.23.

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

EUR/USD may continue to mark fresh monthly lows over the next 24-hours of trade should the European Central Bank (ECB) take additional steps to further support the monetary union.

What’s Expected:

Why Is This Event Important:

Indeed, there’s growing speculation that the Governing Council will broaden the scope of its non-standard measures while implementing a large-scale quantitative easing (QE) program to better achieve its one and only mandate for price stability, and the single currency remains at risk of facing additional headwinds in 2015 as the outlook for growth and inflation remains subdued.

Nevertheless, the ECB may merely reiterate the policy statement from the November 6 meeting as the central bank gauges the impact of the targeted Long-Term Refinancing Operations (T-LTRO), and we may see a relief rally in EUR/USD should the Governing Council make an attempt to buy more time.

How To Trade This Event Risk

Bearish EUR Trade: ECB Implements Additional Monetary Support

- Need red, five-minute candle following the updated forward-guidance to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Looks to Buy More Time- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Will retain the approach to sell-bounces in EUR/USD as the bearish RSI break takes shape.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the ECB rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

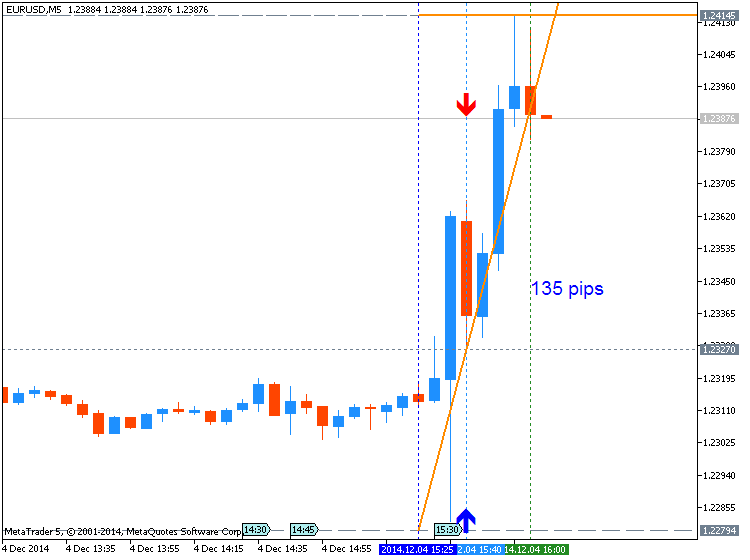

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.12.04

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 117 pips range price movement by EUR - ECB Press Conference news event

This is 135 range movement for now by this news event:

EURUSD M5: 135 pips range price movement by EUR - ECB Press Conference news event

EUR/USD Rallies to 1.24 after ECB Disappointment (based on marketpulse article)

The euro started trade on Friday higher against most of its peers but could struggle to extend gains if U.S. employment data due later in the day re-energize dollar bulls.

Investors were forced to trim bearish positions in the common currency overnight after the European Central Bank (ECB) disappointed some by not immediately expanding its stimulus program.

As a result, the euro jumped to $1.2457 from a two-year trough around $1.2279. It has since steadied at $1.2380.

It climbed towards a six-year peak of 149.12 yen set on Nov. 20, rising as far as 148.95 before losing a bit of steam to last fetch 148.27 yen.

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may spark a bearish reaction in EUR/USD as market participants expected another 230K rise in employment paired with an uptick in wage growth.

What’s Expected:

Why Is This Event Important:

A batch of positive developments may spark another near-term rally in the greenback especially as a growing number of Fed officials show a greater willingness to normalize monetary policy in 2015.

However, the employment report may disappoint amid the ongoing slack in the labor market, and the greenback may face a larger correction over the near-term as a weaker-than-expected NFP print drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Strong Job/Wage Growth Boosts Interest Rate Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: NFP Report Falls Short of Market Forecasts- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

October 2014 U.S. Non-Farm Payrolls

EURUSD M5: 83 pips pips range price movement by USD - Non-Farm Employment Change news event

GBPUSD M5: 70 pips range price movement by USD - Non-Farm Employment Change news event

USDCAD M5: 99 pips price range movement by USD - Non-Farm Employment Change news event