- Electra EA ** Released to Elite Members **

- Suggestions for EA (Loosing to Profit)

- what should I add to this code before I run it on a live account ?

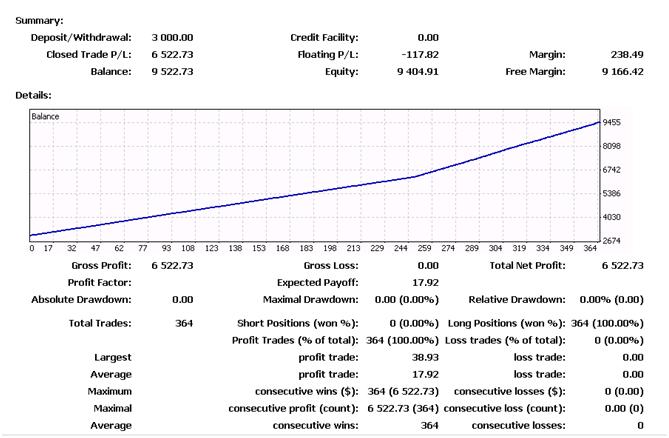

I have this EA program that I purchased. Have been running a test on it since about 5/26/09, so far it looks good, My Stats report, do you think there is enough testing on this to accept it as usable in live trading or should I run it longer before I got live?

Hi,

Well, as I thought, there is no EA give a 100% desired results.... So far you have to check it more and more and finally give that EA a rate in percentage, So that if it exceeds 70%, I think it deserves!!!

By the way, Good luck :-)

Hi,

Well, as I thought, there is no EA give a 100% desired results.... So far you have to check it more and more and finally give that EA a rate in percentage, So that if it exceeds 70%, I think it deserves!!!

By the way, Good luck :-)

Oh, I expect it to collapse at some point, as ll EA's do. But if it is solid enough I wanted to run it for a while and "farm" the earnings if this is really working. what do you mean by give that EA a rate in percentage? How long is long enough to test it?

Oh, I expect it to collapse at some point, as ll EA's do. But if it is solid enough I wanted to run it for a while and "farm" the earnings if this is really working. what do you mean by give that EA a rate in percentage? How long is long enough to test it?

Is this what you meant by percentage?

Well, as the report shows "Long Positions (won %): 364 (100.00%)" and "Short Positions (won %): 0 (00.00%)" - the average of these two positions is what I meant by percentage......

Actually, It looks pretty amazing, unless it will not work in the same way with a real account!!!!! I am kidding :-)

Go with your guts!

Good luck brother.....

Wizard__

No losing trades but all open trades are negative? Does this EA know something about the future?

Try it on a broker that allows 0.01?

What is the name of the EA?

-AN

Is this what you meant by percentage?

Never under any circunstance believe in a performance that doesnt have losing trades. I can show results like that very easy with some dangerous EAs

I know the EA product is good, so I am not worried about it being staged. The results are real, the trades are real and I have seen results from this EA before in other peoples live accounts. I got the EA from http://www.PowerTradeLive.com. The results have come from me playing with it for about a year and a half to get this close. The I do expect it to level out with taking negative trades eventually. I think it may be due to the direction of the market at this time on this currency pair. I discovered this particular formula for it about 2 months ago. The first variation blew up because I had over leveraged. So far, it handles the negatives and I have not seen it over leverage yet. I figured if I just farm the earnings regularly and set aside the starting amount out of the earnings, if it blows up, then I take the generated earnings set aside and re-seed it. If it does not blow up, then I can consider myself a lucky man.

I don't know why folks are excited about the 0 drawdown, I see it a lot in good configurations, eventually, the market gets it good, but the duration of it's survival is more my interest. Most of the EA's I have worked with never tripled this fast and had no drawdowns and made it beyond a months time. The market usually shifts and blows them out by now.

I have another one that I wrote that is doing the same thing, but it only closes the trades using a trailing stop. The numbers are not as interesting as this one, but the results are the same, no drawdowns. http://lehayes.mt4stats.com (this is the alpha version, I am up to version 4 on it now).

I just don't know when it is going to be safe enough to take it live. I am nervous about it blowing up. Trying to decide if it is worth the risk.

I know the EA product is good, so I am not worried about it being staged. The results are real, the trades are real and I have seen results from this EA before in other peoples live accounts. I got the EA from http://www.PowerTradeLive.com. The results have come from me playing with it for about a year and a half to get this close. The I do expect it to level out with taking negative trades eventually. I think it may be due to the direction of the market at this time on this currency pair. I discovered this particular formula for it about 2 months ago. The first variation blew up because I had over leveraged. So far, it handles the negatives and I have not seen it over leverage yet. I figured if I just farm the earnings regularly and set aside the starting amount out of the earnings, if it blows up, then I take the generated earnings set aside and re-seed it. If it does not blow up, then I can consider myself a lucky man.

I don't know why folks are excited about the 0 drawdown, I see it a lot in good configurations, eventually, the market gets it good, but the duration of it's survival is more my interest. Most of the EA's I have worked with never tripled this fast and had no drawdowns and made it beyond a months time. The market usually shifts and blows them out by now.

I have another one that I wrote that is doing the same thing, but it only closes the trades using a trailing stop. The numbers are not as interesting as this one, but the results are the same, no drawdowns. http://lehayes.mt4stats.com (this is the alpha version, I am up to version 4 on it now).

I just don't know when it is going to be safe enough to take it live. I am nervous about it blowing up. Trying to decide if it is worth the risk.

exactly. thast the problem. is the same thing that you set aside earning and reseed the account when it burn the account because it eventually will burn all your earnings. I have just learned to focus in the way all EA manages the lossing trades. I can almost bet that it lets the lossing trades to go more that 100 pips negative before it wins it 13 pips. so with 1 lossing trade it erase 10 wining trades.

yep, from the 15th of june to the 24th of june the EURUSD has move 380 pips away from open trades. My goal in my design was to withstand 500 pips in the negative before the account was at risk of being trashed. These trades are counter trend and only set the take profit on the power trader. Now the market is coming back just as you and I predicted and will soon close the trades and go to a small earning of 15 pips.

The other EA is designed to stop trading if the free margin reaches a specific percentage of the balance, currently set to half of the balance. Further, I have a lot calculation that divides free margin by # of max orders times a # of currency pairs openly trading time 15% risk. This reduces the lot size to .1 until the account is big enough to take more, then using this calculation wll only take lots based on that calculation. So here alone is a second level of money management and adverse over leveraging. I am also considering implementing some code that will monitor for surprise break outs and close all trades in favor of opening a single trade in the direction of the breakout, followed by a reverse to cover the retracement. This should help shelter the automation from suffering the damages of multiple open trades in a breakout scenario. For now, I would be happy just closing the open trades, the second part of getting some of those earnings would be nice, but a lower priority. Even better would be to have it close only trades opposing the break away direction, let open trades run with the break away. This EA only performs a trailing stop loss. No stops, no take profit. the idea is to let the market do as it pleases instead of trying to control it, work with. In addition to all of this, I diversify my risk and returns by managing through multiple currency pair trading with same EA. When one currency threatens to trash the account with moving away from the profit range it is in, the other currency pairs continue in their profit ranges. the odds of all of currency pairs running away from the profit range at the same time is low enough to keep the account live and growing. Of course to be really effective, the number of currency pairs has to be fairly high and so does the balance on the account, so currency pairs can only be added when the balance can support them. My latest test put it at 1 currency pair per $1000 of balance. Open trades are limited to 1 trade per $500. The overall design of this EA was to reduce risk of over leveraging and still being able to grow dynamically. Instead of taking acceptable losses, I wanted the account to be able to let the market opperate normally, taking a casual ride into the negative without blowing out the account. Now this is not to say that a 500 pip movement or worse cannot cause some serious damage at some point, but for now, it is not going to take any unneccessary damage.

As stated earlier, my final level of protection of earnings is to take the cash off the table.

My theory here is that the market is a living beast, the more you try to trap it with stop losses and take profits, the more it is going resist. So, I designed to protect earnings and let the beast roam as it may where it may. I will still milk it as it comes near me, but I will not attempt to trap it into someplace where it does not want to be.

Ok, so, some time has passed and the currency is bouncing a little from this run up it has been doing. Although it is not actually going down yet, I am surprised that the trade has done so well.

While I still do expect the fall of this trade, I cannot complain at the amount of growth it has succeeded in.

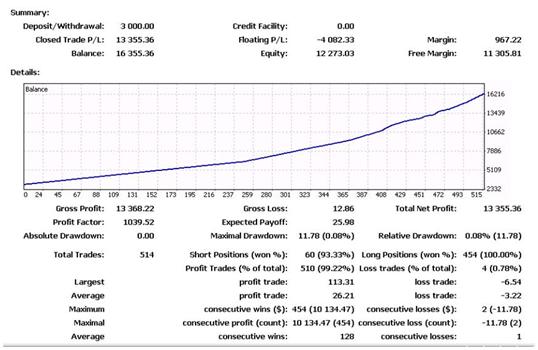

I have been increasing the lot size by .1 everytime it earns the original balance. What started out as $3k is now up to $16k and I have set the lot size to .5 as of $15k.

I am concerned that it may reverse and eat the earnings at this point. I have considered stopping the EA and just letting it close the open trades to clear out some risk.

I am trying to figure out where the drawdown is coming from. Is this from the negative swap?

Report Stats

If image does not show up, I attached it to this thread.

I have been thinking about changing my rule on when to bump up the lot size. Every $3k seems to be getting to the point where I get there too fast and need to consider a longer period. I was thinking of adjusting to every $10k or something like that. Any opinions on this?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use