Join our fan page

- Views:

- 30546

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

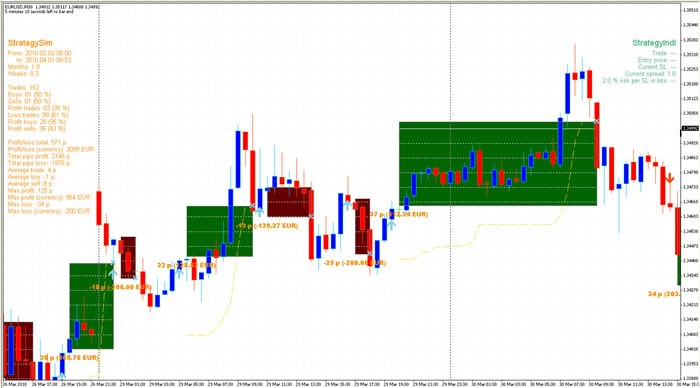

Many of us have often wanted to see in a visual way where a certain trading strategy has its flaws. And if we could see the objective trading statistics at the same time it would be really great.

There is a backtester in MT4 but running a backtest in a visual mode for each change in the EA takes a lot of time. Also, its visual capabilities are quite limited. Then, you cannot test multi-currency strategies with it, at least not in an efficient way.

I have tried to address all of these issues and the result is this open-source indicator for visually testing trading strategies. Of course it is not possible to make a completely universal indicator for all the purposes but the current framework can be easily modified and expanded for specific needs (like multi-currency).

As a demonstration of the strategy testing indicator I am adding a trading indicator with a simple trading strategy. The strategy rules are based on MA crosses with respect to price action (so that trades can be placed even before they actually cross, to remove the lag). Exit strategy is also present (using opposite signals and slow MA crossing in an opposite way), as well as stop loss handling is implemented via a modified Chandelier SL strategy. This indicator serves to provide a sample that could be extended for specific needs, but some people find it even good enough for their manual trading.

The idea behind the whole system

The indicator system is built in a modular way. First, we have to implement a trading strategy into a trading indicator, where two buffers are currently used for entry signals, two for exit signals and one for stop loss. A sample of such an indicator with full functionality is the attached StrategyIndi_1.0.

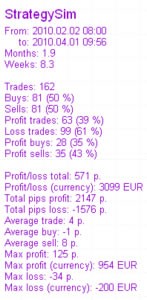

We can then evaluate this strategy with a strategy testing indicator StrategySym_1.0. If we are not satisfied with the results, we just optimize the trading indicator and we can see the results of changes in real-time and objectively, via statistics.

If we want later to implement an EA, it is very easy to do so, since by calling a custom trading indicator we get all the entry and exit signals, as well as SL values.

How to use this system and adapt it to your own needs?

To use the system as it is, you just copy both indicators to your MetaTrader\experts\indicators folder. Make sure you restart the terminal before using them so that they get compiled.

There are certain settings you might want to modify, most are self-evident from their names so I will describe only the others:

StrategyIndi parameters:

ChandBars = 7 number of bars for the Chandelier SL strategy

ChandATRFact = 2.0 factor to multiply the long-term ATR, to get the Chandelier distance

RiskPercent = 2.0 risk in percent of the free account balance for lot calculation according to the starting SL (this is used for manual trading information only)

Offset = 10 offset from bars on the chart for placing arrows, in 4-digit pips

BarsBack = 2000 number of bars to process, from the past

AlertSound = "alert.wav" WAV file for sound alerts

UseSoundAlert = true if we want sound alerts (for manual trading)

UsePopupAlert = true if we want pop-up window alerts (for manual trading)

WriteToLog = false if we want to write log details (for debugging)

StrategySim parameters

MaxLossAtSL = 200.0 how much money (in account currency) we are ready to lose at each SL (for some it is more intuitive instead of percent, but is can be easily changed)

BarsBack = 2000 number of bars to process for the strategy evaluation

WriteToLog = false if we want to write log details (for debugging)

If you are adapting the system to your own needs you have to add to the StrategySym indicator all the parameters from your own StrategyIndi indicator – those that matter for the simulation. They are used later in the GetIndiSignals method and you just put fixed values for other parameters (like UseSoundAlert). Nothing else needs to be changed in the StrategySim, unless you want it for other purposes (like multi-currency strategies). In this case code comments and variable names will hopefully be helpful enough. If you need assistance we will be glad to help, just contact us at the web address below.

So, with this system I would like to contribute to the objectivity in evaluating trading strategies (for manual systems or EAs) as the current marketing approaches are often very manipulative and as such they cause many beginners to lose their hard-earned money.

Greetings, Robert

For any comments, for MT4 programming or advising on the subject please contact me at robert [dot] leskovar [at] gmail [dot] com. The MQLTools website in the source code is not active anymore.

BPNN dll temp fix

BPNN dll temp fix

Hi All, This is temporary fix to the original BPNN.dll posted by gpwr. Now you can play with the NN he created. Please keep in mind this is a makeshift - it will leave unreleased memory so be sure you restart your system after use. ALX

Another VSA indi.

Another VSA indi.

VSA is about reading the market and mapping it out to give you a better understanding of what it might do next.

A measure of fractal self-similarity

A measure of fractal self-similarity

This indicator measure the dispersion of the fractal dimension of various timeframes around the fractal dimension of a reference timeframe (which is the longer timeframe considered).

Simplest Hedging EA ever

Simplest Hedging EA ever

This EA simply opens two opposing positions at the beginning of the first new bar it comes across. Both positions can win lose or draw. Works best in 5M timeframe and can be optimised using "Open prices only".