Join our fan page

- Views:

- 34020

- Rating:

- Published:

- 2020.11.16 18:48

- Updated:

- 2021.02.10 07:30

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

There is no magic in moving averages but they can be used to form the basis of a simple trading strategy that works.

For some reason, Forex traders especially enjoy these types of strategies. You can develop many trading systems using averages but remember that complex trading strategies are not always best.

The Triple Moving Averages

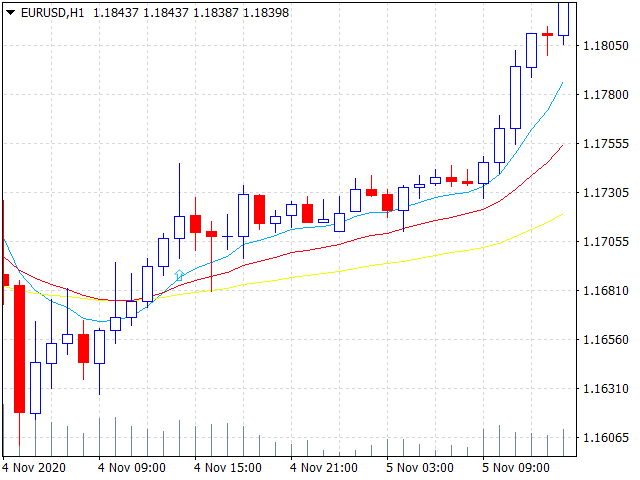

As I mentioned, the 3 EMA’s will have different lengths and they will be:

- 9 period EMA

- 21 period EMA

- 55 period EMA

-

-

The 55 EMA will be considered the longer term trend direction indicator:

- When the 55 EMA is below both the 9 and 21, we will consider the trend to be up

- When the indicator is above both of the shorter term moving averages, we will consider the longer term trend to be down

The 21 EMA is considered a medium term trend indicator:

- We want to see the 21 below the 9 and above the 55 for an uptrend

- The 21 should be above the 9 and below the 55 for a down trend

The 9 period will be seen crossing over and under the 21 period more times than crossing the 55:

- The 9 EMA crossing over the 21 while already above the 55, is an uptrend and looking for a buy trade

- If it crosses below the 21 while already below the 55, that is a down trend and looking for a sell trade

Visual Trend Indicator

Visual Trend Indicator

Visual multi-timeframe trend indicator.

CSV file creating example expert

CSV file creating example expert

Example how to use file write function

Doulble MA Cross Draw Histogram

Doulble MA Cross Draw Histogram

Use the intersection of two moving average lines to draw a vertical line

Fibonacci Potential Entry - MT4

Fibonacci Potential Entry - MT4

The 8 effective steps to build a robust day trading plan using Fibonacci retracement