Join our fan page

MQL5 Wizard - Trade Signals Based on Crossover of Two EMA with intraday time filter - expert for MetaTrader 5

- Views:

- 22030

- Rating:

- Published:

- 2011.01.13 14:32

- Updated:

- 2021.11.01 10:33

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

MQL5 Wizard allows to create the code of Expert Advisors automatically. See Creating Ready-Made Expert Advisors in MQL5 Wizard for the details.

The trading signals of the strategy, based on two moving averages are considered in MQL5 Wizard - Trade Signals Based on Crossover of Two Exponentially Smoothed Moving Averages. The moving averages are effective when trend, in other cases they provide many false signals. One of the ways to improve the strategy is the use of the time filters (for example, open new positions when European session of FOREX).

Here we will consider the strategy based on crossover of two exponentially smoothed Moving Averages (fast EMA and slow EMA) with intraday time filter. The strategy called "Signals based on crossover of two EMA with intraday time filter" (when creating EA automatically in MQL5 Wizard).

Trade signals:

- Open long position: the Fast EMA crossovers upward the slow EMA and intraday time filter conditions are not satisfied.

- Open short position: the Fast EMA crossovers downward the slow EMA and intraday time filter conditions are not satisfied.

This strategy is implemented in CSignal2EMA_ITF class.

The trading system is based on pending orders, the price levels are calculated depending on values of moving average, the ATR units (Average True Range) are used.

Figure 1. Trade signals, based on crossover of two EMA with intraday time filter

Trade signals

The trading strategy is implemented in CSignal2EMA_ITF, it has some protected methods to simplify access to indicator values:

double FastEMA(int ind) // returns the value of fast EMA of the bar double SlowEMA(int ind) // returns the value of slow EMA of the bar double StateFastEMA(int ind) // returns the positive/negative value if fast EMA increased/decreased double StateSlowEMA(int ind) // returns the positive/negative value if slow EMA increased/decreased double StateEMA(int ind) // returns the difference between fast and slow EMA double ATR(int ind) // returns the value of ATR of the bar

- Limit>0. It will enter on back movement when false breakdown of moving average on the price better than market price (Buy Limit and Sell Limit orders will be placed depending on trade signal)

- Limit<0. It will enter in price movement direction (Buy Stop and Sell Stop orders will be placed depending on trade signal).

- Limit=0. In this case it will trade using the market prices.

1. Open long position

It checks the conditions to open long positon: if the difference between the fast and slow EMA on the last completed bar has changed its sign from "-" to "+" (StateEMA(1)>0 && StateEMA(2)<0).

Next, it checks the conditions intraday time filter by calling the CheckOpenLong() method of the CSignalITF class. If trading allowed, it will calculate the base price level (the value of moving average) and the value ATR range of the last completed bar.

Depending on sign of the Limit input parameter it will place the buy pending order. The order price, Take Profit and Stop Loss levels are calculated relative to the base price level (in ATR units). The order expiration time is defined (in bars) by Expiration input parameter.

//+------------------------------------------------------------------+ //| Checks conditions to open long position (buy) | //+------------------------------------------------------------------+ bool CSignal2EMA_ITF::CheckOpenLong(double& price,double& sl,double& tp,datetime& expiration) { if(!(StateEMA(1)>0 && StateEMA(2)<0)) return(false); if(!m_time_filter.CheckOpenLong(price,sl,tp,expiration)) return(false); //--- double ema=SlowEMA(1); double atr=ATR(1); double spread=m_symbol.Ask()-m_symbol.Bid(); //--- price=m_symbol.NormalizePrice(ema-m_limit*atr+spread); sl =m_symbol.NormalizePrice(price+m_stop_loss*atr); tp =m_symbol.NormalizePrice(price-m_take_profit*atr); expiration+=m_expiration*PeriodSeconds(m_period); //--- return(true); }

2. Close long position

In our case the function, that checks the conditions to close long position always returns false, i.e. it's assumed that long position will be closed by Take Profit or Stop Loss. If neccessary, you can write your own code with implementation of this method.

//+------------------------------------------------------------------+ //| Checks conditions to close long position | //+------------------------------------------------------------------+ bool CSignal2EMA_ITF::CheckCloseLong(double& price) { return(false); }

3. Open short position

It checks the conditions to open short positon: if the difference between the fast and slow EMA on the last completed bar has changed its sign from "+" to "-" (StateEMA(1)<0 && StateEMA(2)>0).

Next, it checks the conditions intraday time filter by calling the CheckOpenLong() method of the CSignalITF class. If trading allowed, it will calculate the base price level (the value of moving average) and the value ATR range of the last completed bar.

Depending on sign of the Limit input parameter it will place the sell pending order. The order price, Take Profit and Stop Loss levels are calculated relative to the base price level (in ATR units). The order expiration time is defined (in bars) by Expiration input parameter.

//+------------------------------------------------------------------+ //| Checks conditions to open short position (sell) | //+------------------------------------------------------------------+ bool CSignal2EMA_ITF::CheckOpenShort(double& price,double& sl,double& tp,datetime& expiration) { if(!(StateEMA(1)<0 && StateEMA(2)>0)) return(false); if(!m_time_filter.CheckOpenShort(price,sl,tp,expiration)) return(false); //--- double ema=SlowEMA(1); double atr=ATR(1); //--- price =m_symbol.NormalizePrice(ema+m_limit*atr); sl =m_symbol.NormalizePrice(price+m_stop_loss*atr); tp =m_symbol.NormalizePrice(price-m_take_profit*atr); expiration+=m_expiration*PeriodSeconds(m_period); //--- return(true); }

4. Close short position

In our case the function, that checks the conditions to close short position always returns false, i.e. it's assumed that position will be closed by Take Profit or Stop Loss. If neccessary, you can write your own code with implementation of this method.

//+------------------------------------------------------------------+ //| Checks conditions to close short position | //+------------------------------------------------------------------+ bool CSignal2EMA_ITF::CheckCloseShort(double& price) { return(false); }

5. Trailing Stop of Buy Pending Order

The Expert Advisor will trail pending orders depending on current value of moving average and ATR.

//+--------------------------------------------------------------------+ //| Checks conditions to modify pending buy order | //+--------------------------------------------------------------------+ bool CSignal2EMA_ITF::CheckTrailingOrderLong(COrderInfo* order,double& price) { //--- check if(order==NULL) return(false); //--- double ema=SlowEMA(1); double atr=ATR(1); double spread=m_symbol.Ask()-m_symbol.Bid(); //--- price=m_symbol.NormalizePrice(ema-m_limit*atr+spread); //--- return(true); }

6. Trailing Stop of Sell Pending Order

The Expert Advisor will trail pending orders depending on current value of moving average and ATR.

The order will be executed if market price will reach the order price.

//+--------------------------------------------------------------------+ //| Checks conditions to modify pending buy order | //+--------------------------------------------------------------------+ bool CSignal2EMA_ITF::CheckTrailingOrderShort(COrderInfo* order,double& price) { //--- check if(order==NULL) return(false); //--- double ema=SlowEMA(1); double atr=ATR(1); //--- price=m_symbol.NormalizePrice(ema+m_limit*atr); //--- return(true); }

Creating Expert Advisor using MQL5 Wizard

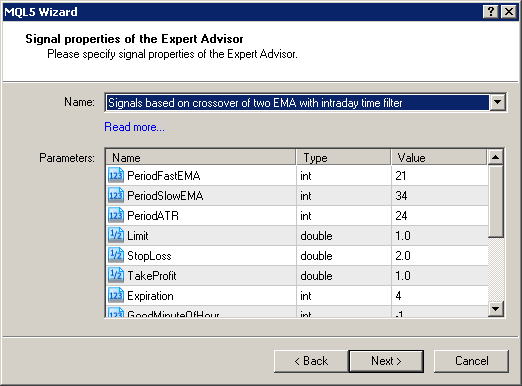

To create a trading robot based on the strategy you need to select the signal properties as "Signals based on crossover of two EMA with intraday time filter" in "Creating Ready-Made Expert Advisors" option of MQL5 Wizard:

Figure 2. Select "Signals based on crossover of two EMA with intraday time filter" in MQL5 Wizard

The next you have to specify the needed trailing stop algorithm and money and risk management system. The code of Expert Advisor will be created automatically, you can compile it and test in Strategy Tester of MetaTrader 5 client terminal.

Testing Results

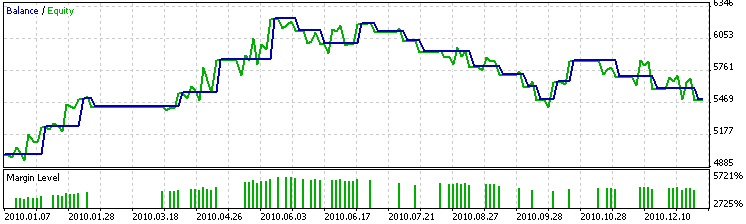

Let's consider backtesting of the Expert Advisor on historical data (EUenSD H1, testing period: 1.1.2010-05.01.2011, PeriodFastEMA=5, PeriodSlowEMA=30, PeriodATR=7, Limit=1.2, StopLoss=5, TakeProfit=8, Expiration=4, GoodMinuteOfHour=-1, BadMinutesOfHour=0, GoodHourOfDay=-1, BadHoursOfDay=0, GoodDayOfWeek=-1, BadDaysOfWeek=0).

In creation of Expert Advisor we used the fixed volume (Trading Fixed Lot, 0.1), Trailing Stop algorithm is not used (Trailing not used).

Figure 3. Testing Results of the Expert Advisor with trading signals, based on crossover of two EMA without use of ITF filter

The intraday filter is not used, so there are many false signals. The trading signals can be improved if we perform the analysis of the deal results depending on trade hours.

In our case we have found that crossover of two EMA provides many false signals starting from 6:00 till 23:59. We can specify the intraday time filter by setting the filter parameters.

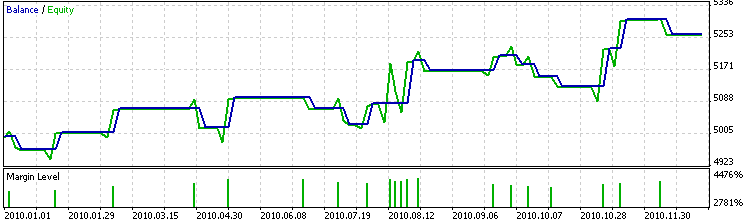

For example, we can specify time filter, that allows to open positions only from 0:00 till 5:59. It can be done by setting the value of BadHoursOfDay=16777152=111111111111111111000000b. All other trade hours are "bad", so it's better to prohibit the opening of new positions from 6:00 till end of the day.

If we set the value of BadHoursOfDay=16777152, we will filter many false signals:

Figure 4. Testing Results of the Expert Advisor with trading signals, based on crossover of two EMA with time filter (BadHoursofDay=16777152)

The CSignalITF provides many other time filtration features (just specify the "good" and "bad" minutes within the hour, hours within the day, days within the week).

Attachments: The Signal2EMA-ITF.mqh with CSignal2EMA_ITF class must be placed to terminal_data_folder\MQL5\Include\Expert\Signal folder.

The expert_2ema_itf.mq5 contains the code of the Expert Advisor, created using MQL5 Wizard.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/264

MQL5 Wizard - Trade Signals Based on Crossover of Two Exponentially Smoothed Moving Averages

MQL5 Wizard - Trade Signals Based on Crossover of Two Exponentially Smoothed Moving Averages

Trade signals based on price crossover of two exponentially smoothed moving averages is considered. The code of the Expert Advisor based on this strategy can be generated automatically using the MQL5 Wizard.

SelfGenerator

SelfGenerator

This script generates a file with its source code (solution of the classical program in MQL5). It may be useful to study programming and algorithms.

MQL5 Wizard - Trade Signals Based on Crossover of Main and Signal lines of MACD indicator

MQL5 Wizard - Trade Signals Based on Crossover of Main and Signal lines of MACD indicator

Trade signals based on crossover of main and signal lines of MACD indicator (CSignalMACD from MQL5 Standard Library) is considered. The code of the Expert Advisor based on this strategy can be generated automatically using the MQL5 Wizard.

MQL5 Wizard - Trade Signals Based on Crossover of Lines of the Alligator Indicator

MQL5 Wizard - Trade Signals Based on Crossover of Lines of the Alligator Indicator

Trade signals based on crossover of lines of the Alligator technical indicator is considered. The code of the Expert Advisor based on this strategy can be generated automatically using the MQL5 Wizard.