Join our fan page

- Views:

- 7952

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Theory :

The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980.

CCI measures a security’s variation from the statistical mean.The CCI is calculated as the difference between the typical price

of a commodity and its simple moving average, divided by the mean

absolute deviation of the typical price. The index is usually scaled by

an inverse factor of 0.015 to provide more readable numbers. For scaling purposes, Lambert set the constant at 0.015 to ensure

that approximately 70 to 80 percent of CCI values would fall between

−100 and +100.

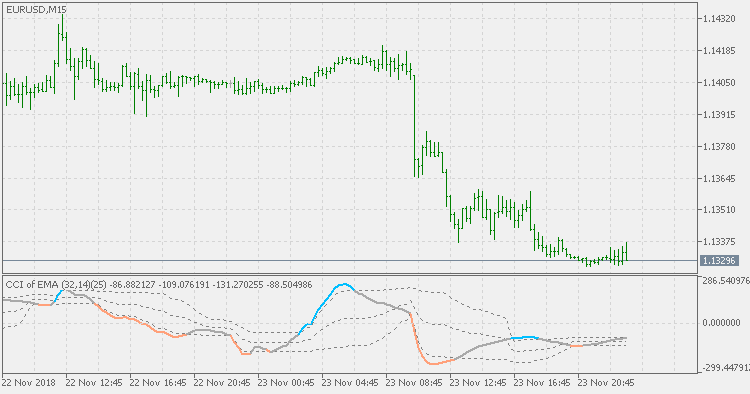

This version :

Sometimes CCI is "nervous" - if you use it for signals based on levels crossing, it can produce a lot of false signals. One of the possible ways is to pre-filter the prices prior to being used in CCI calculation (that way adds significantly less lag then smoothing the already calculated CCI). This version does that : uses pre-filtered price for CCI calculation. You can use the usual set of averages types :

- simple moving average (SMA)

- exponential moving average (EMA)

- smoothed moving average (SMMA)

- linear weighted moving average (LWMA)

Also, the CCI fluctuates above and below zero. The percentage of CCI values that fall between +100 and −100 will depend on the number of periods used. A shorter CCI will be more volatile with a smaller percentage of values between +100 and −100. Conversely, the more periods used to calculate the CCI, the higher the percentage of values between +100 and −100.But in order to avoid constant period adjusting to keep those values in "predictable" ranges / levels bounds, this version is adding floating levels. That, as usually. makes the CCI implicitly adaptive too

Usage :

You can use the color changes as signals

Higher Highs & Lower Lows Stochastic

Higher Highs & Lower Lows Stochastic

Higher Highs & Lower Lows Stochastic

Stochastic extended - floating levels

Stochastic extended - floating levels

Stochastic extended - floating levels

Deviation scaled MA - extended

Deviation scaled MA - extended

Deviation scaled MA - extended

Filtered deviation scaled MA

Filtered deviation scaled MA

Filtered deviation scaled MA