Join our fan page

- Views:

- 8586

- Rating:

- Published:

- 2018.06.16 09:56

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

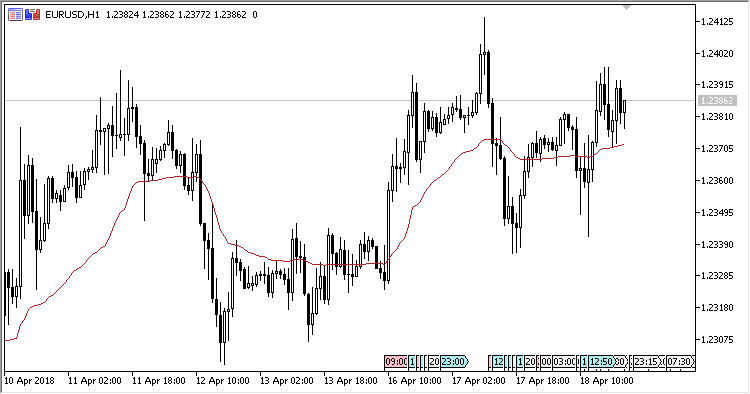

The Kaufman Adaptive Moving Average is a version of the adaptive moving average based on the exponentially smoothed moving average combined with the original methods of detecting and applying volatility as a dynamically changing smoothing constant.

The indicator has two input parameters:

- Period - calculation period;

- Applied price - price used for calculations.

Calculations:

KAMA[i] = KAMA[i-1] + sc * (Price[i] - KAMA[i-1])

where:

sc = (er * 0.6015 + 0.0645) * (er * 0.6015 + 0.0645), er = Abs(Price[i] - Price[i-Period+1]) / Sum1, and Sum1 = Sum(Abs(Price[i] - Price[i-1])) from (i-Period+1) to i

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/20502

Price Impulse

Price Impulse

The EA waits for the price to pass XXX points within NNN ticks.

N-_Candles_v7

N-_Candles_v7

The Expert Advisor searches for N identical candlesticks in a row. It buys on bullish candlesticks and sells on bearish ones. The account type is taken into consideration, i.e., whether it is a netting or a hedging one.

SSIFT

SSIFT

Smoothed Stochastic Inverse Fisher Transform.

Volume_Accumulation

Volume_Accumulation

Indicator of volumes accumulated.