Join our fan page

- Views:

- 8752

- Rating:

- Published:

- 2018.01.26 12:57

- Updated:

- 2018.01.26 12:58

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

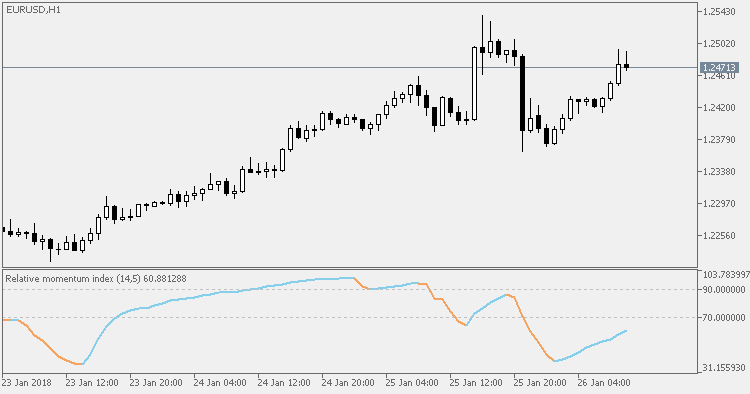

The Relative Momentum Index (RMI) was developed by Roger Altman. It was first introduced in the February 1993 issue of Technical Analysis of Stocks & Commodities magazine.

The RMI is a variation of the RSI indicator. The RMI counts up and down days from the Close relative to the Close X days ago (where X is not limited to 1 as is required by the RSI) instead of counting up and down days from Close to Close as the RSI does.

Note that an RMI with parameters of C, 14, 1 is equivalent to a 14 period RSI of the Close price. This is because the Momentum parameter is calculating only a 1-day price change (which the RSI does by (default).

As the Momentum periods are increased the RMI fluctuations become smoother.

Since the RMI is an oscillator it exhibits the same strengths and weaknesses of other overbought / oversold indicators. During strong trending markets it is likely that the RMI will remain at overbought or oversold levels for an extended period of time.

However, during non-trending markets the RMI tends to oscillate more predictably between an overbought level of 70 to 90 and an oversold level of 10 to 30.

Moving slope rate of change - Extended

Moving slope rate of change - Extended

Extended version of MSROC indicator.

Moving slope rate of change

Moving slope rate of change

Moving slope rate of change.

Vertical Horizontal Filter

Vertical Horizontal Filter

The Vertical Horizontal Filter ("VHF") determines whether prices are in a trending phase or a congestion phase. The VHF was first presented by Adam White in an article published in the August, 1991 issue of Futures Magazine.

Ulcer Index

Ulcer Index

This Ulcer Index indicator was derived from the stock risk indicator by Peter Martin in the 1987 book "The Investors Guide to Fidelity Funds".