Join our fan page

- Views:

- 11004

- Rating:

- Published:

- 2013.10.11 11:31

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

IREA is an automated trade algorithm based on the idea of that an unusual impact in price changes will be adjusted by an inverse movement (you can see this in many shocks).

It works with the indicator InverseReaction (version 1.2) and trades on its signals (when the price changes exceeds some predefined limits, with the new bar, IREA will trade in inverse direction).

Parameters:

- Stop loss:(1000 as default) Safety limit for loss in points;

- Take profit:(250 as default) Profit target in points;

- Trade volume: (1.0 as default) Lot value for the order;

- Affordable order slippage: (3 as default) acceptable instant deviation from the order price;

- Minimum bar size for signal: (300 points as default) 1st filtering parameter for the EA. An InverseReaction -mostly comes out after a shock in market. This parameter is the minimum bar size value which supposed to be a shock. You can try different values !! But it shouldn't be smaller than Take profit level !!

- Maximum bar size for signal: (2000 points as default) 2nd filtering parameter for the EA. There is a difference between small shocks and gamechangers (crashes, booms, interventions, etc.). And, even the original strategy is inspired by crashes, the EA is focused on smaller shocks. This parameter is supposed to determine a maximum size for shocks (at the lower picture, look to the date '10.07.2013' to see an example). You can try different values.

- Confidence coefficient: (Golden Ratio as default) Indicator's parameter. Do not change it unless you know exactly what you do. For more details please see indicators page;

- Moving average period: (3 as default) Indicator's parameter. Do not change it unless you know exactly what you do. For more details please see indicators page;

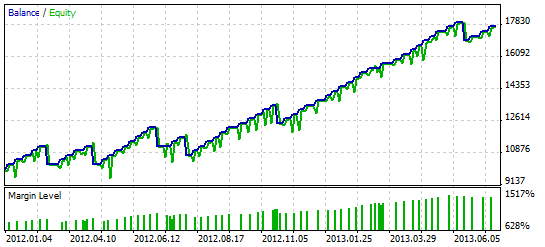

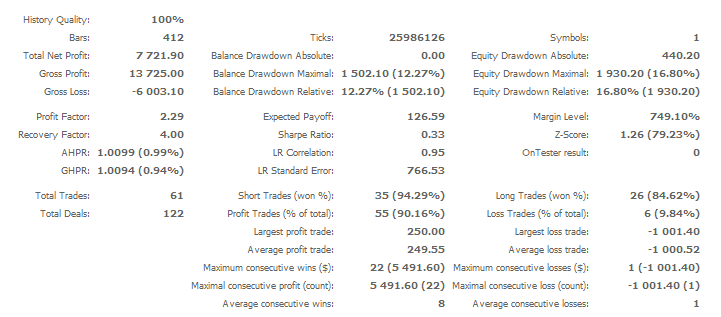

Test Results:

EURUSD, D1, Testing interval: 01.01.2012 - 01.08.2013, Leverage: 1:100, Initial deposit:10 000 USD.

Tips

- Be sure that you have version 1.2 of InverseReaction indicator.

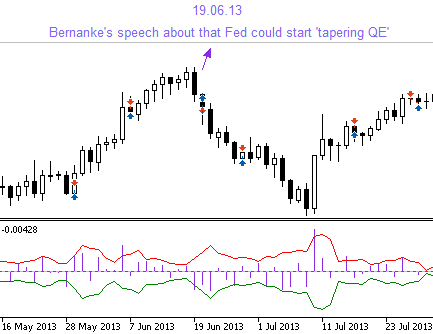

- Inverse Reaction strategy is very unstable right after big economic events (after possible game-changing behaviours in market). This can be seen from the test results. Look at the last loss at the picture below, it was a FED speech that affected all long-term expectations:

So, it is advised not to implement this strategy after such news.

- This EA is created only to show how InverseReaction strategy can work alone in trading conditions. It is not an elegantly designed, intelligent EA and as it is told in Indicator's main page, the strategy is much more powerful while using with other technical analysis tools (see the indicator's page InverseReaction to see details). So it is advised not to use this EA in real trading with any condition.

Awesome Oscillator Divergence

Awesome Oscillator Divergence

This indicator will plot divergence lines on the Awesome_Oscillator indicator and will give buy and sell signal by displaying arrows.

Script for Calculation of Candle Statistics

Script for Calculation of Candle Statistics

The script calculates candles statistics (the minimal, maximal and average values of candles body and shadows) of the current chart.

MQL5 Wizard - Trading Signals of Candlestick Patterns + Stochastic

MQL5 Wizard - Trading Signals of Candlestick Patterns + Stochastic

Trading signals of candlestick patterns with confirmation by Stochastic indicator.

FilterOverWPR

FilterOverWPR

An indicator of trend power with four states.