Join our fan page

- Views:

- 5435

- Rating:

- Published:

- 2016.10.10 14:55

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Semaphore arrow signal indicator based on the AroonOscillator oscillator leaving the overbought and oversold areas, which features alerts, sending emails and push-notifications to mobile devices.

The following changes have been made to the indicator code in order to implement the alerts, email messages and push-notifications:

- Introduced new input parameters

input uint NumberofBar=1;//Bar number for the signal input bool SoundON=true; //Enable alerts input uint NumberofAlerts=2;//Number of alerts input bool EMailON=false; //Enable mailing the signal input bool PushON=false; //Enable sending the signal to mobile devices

- Added three new functions to the end of the indicator code: BuySignal(), SellSignal() and GetStringTimeframe()

//+------------------------------------------------------------------+ //| Buy signal function | //+------------------------------------------------------------------+ void BuySignal(string SignalSirname, // text of the indicator name for email and push messages double &BuyArrow[], // indicator buffer with buy signals const int Rates_total, // the current number of bars const int Prev_calculated, // the number of bars on the previous tick const double &Close[], // close price const int &Spread[]) // spread { u//--- static uint counter=0; if(Rates_total!=Prev_calculated) counter=0; bool BuySignal=false; bool SeriesTest=ArrayGetAsSeries(BuyArrow); int index; if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; if(NormalizeDouble(BuyArrow[index],_Digits) && BuyArrow[index]!=EMPTY_VALUE) BuySignal=true; if(BuySignal && counter<=NumberofAlerts) { counter++; MqlDateTime tm; TimeToStruct(TimeCurrent(),tm); string text=TimeToString(TimeCurrent(),TIME_DATE)+" "+string(tm.hour)+":"+string(tm.min); SeriesTest=ArrayGetAsSeries(Close); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; double Ask=Close[index]; double Bid=Close[index]; SeriesTest=ArrayGetAsSeries(Spread); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; Bid+=Spread[index]; string sAsk=DoubleToString(Ask,_Digits); string sBid=DoubleToString(Bid,_Digits); string sPeriod=GetStringTimeframe(ChartPeriod()); if(SoundON) Alert("BUY signal \n Ask=",Ask,"\n Bid=",Bid,"\n currtime=",text,"\n Symbol=",Symbol()," Period=",sPeriod); if(EMailON) SendMail(SignalSirname+": BUY signal alert","BUY signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); if(PushON) SendNotification(SignalSirname+": BUY signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); } u//--- } //+------------------------------------------------------------------+ //| Sell signal function | //+------------------------------------------------------------------+ void SellSignal(string SignalSirname, // text of the indicator name for email and push messages double &SellArrow[], // indicator buffer with sell signals const int Rates_total, // the current number of bars const int Prev_calculated, // the number of bars on the previous tick const double &Close[], // close price const int &Spread[]) // spread { u//--- static uint counter=0; if(Rates_total!=Prev_calculated) counter=0; bool SellSignal=false; bool SeriesTest=ArrayGetAsSeries(SellArrow); int index; if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; if(NormalizeDouble(SellArrow[index],_Digits) && SellArrow[index]!=EMPTY_VALUE) SellSignal=true; if(SellSignal && counter<=NumberofAlerts) { counter++; MqlDateTime tm; TimeToStruct(TimeCurrent(),tm); string text=TimeToString(TimeCurrent(),TIME_DATE)+" "+string(tm.hour)+":"+string(tm.min); SeriesTest=ArrayGetAsSeries(Close); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; double Ask=Close[index]; double Bid=Close[index]; SeriesTest=ArrayGetAsSeries(Spread); if(SeriesTest) index=int(NumberofBar); else index=Rates_total-int(NumberofBar)-1; Bid+=Spread[index]; string sAsk=DoubleToString(Ask,_Digits); string sBid=DoubleToString(Bid,_Digits); string sPeriod=GetStringTimeframe(ChartPeriod()); if(SoundON) Alert("SELL signal \n Ask=",Ask,"\n Bid=",Bid,"\n currtime=",text,"\n Symbol=",Symbol()," Period=",sPeriod); if(EMailON) SendMail(SignalSirname+": SELL signal alert","SELL signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); if(PushON) SendNotification(SignalSirname+": SELL signal at Ask="+sAsk+", Bid="+sBid+", Date="+text+" Symbol="+Symbol()+" Period="+sPeriod); } u//--- } //+------------------------------------------------------------------+ //| Getting the timeframe as a string | //+------------------------------------------------------------------+ string GetStringTimeframe(ENUM_TIMEFRAMES timeframe) { //---- return(StringSubstr(EnumToString(timeframe),7,-1)); //---- }

- Added a couple of calls to BuySignal() and SellSignal() functions after the indicator calculation cycles in the OnCalculate() block

BuySignal("iWPRSign",BuyBuffer,rates_total,prev_calculated,close,spread); SellSignal("iWPRSign",SellBuffer,rates_total,prev_calculated,close,spread);

Where BuyBuffer and SellBuffer are the names of the indicator buffers for storing the buy and sell signals. As the empty values in the indicator buffers either zeros or EMPTY_VALUE must be set.

It is assumed that the only one call to the BuySignal() and SellSignal() functions will be used in the OnCalculate() block of the indicator code.

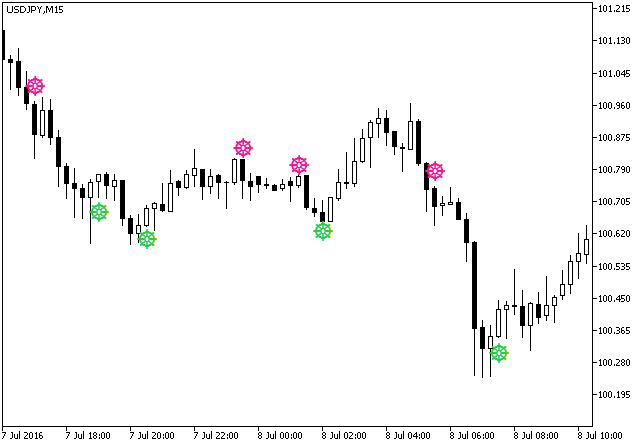

Fig.1. The AroonOscillatorSignAlert indicator on the chart

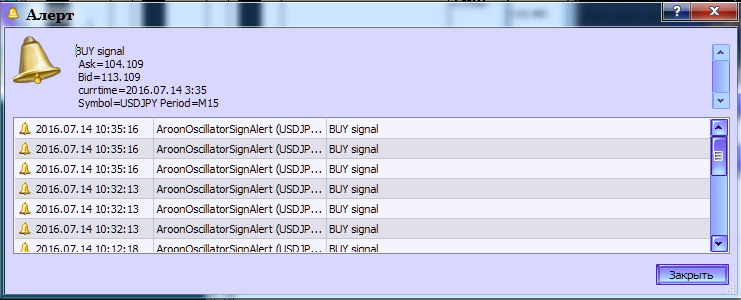

Fig.2. The AroonOscillatorSignAlert indicator. Generating alerts.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/15942

MaxPriceDistribution

MaxPriceDistribution

Vertical histogram with distribution of Highs.

MinPriceDistribution

MinPriceDistribution

Vertical histogram with distribution of Lows.

ADXDMI_HTF

ADXDMI_HTF

The ADXDMI indicator with the timeframe selection option available in input parameters.

Exp_ADXDMI

Exp_ADXDMI

The Exp_ADXDMI trading system based on the signals of the ADXDMI oscillator.