Join our fan page

- Views:

- 16292

- Rating:

- Published:

- 2010.01.26 11:04

- Updated:

- 2018.07.25 17:15

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

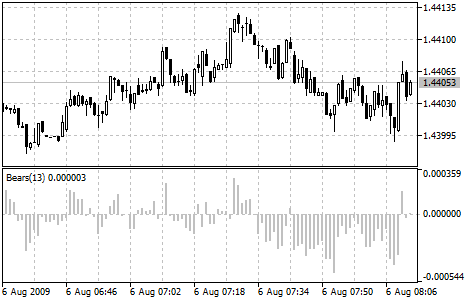

Everyday trading represents a battle of buyers ("Bulls") pushing prices up and sellers ("Bears") pushing prices down. Depending on what party scores off, the day will end with a price that is higher or lower than that of the previous day. Intermediate results, first of all the highest and lowest price, allow to judge about how the battle was developing during the day.

It is very important to be able to estimate the Bears Power balance since changes in this balance initially signalize about possible trend reversal. This task can be solved using the Bears Power oscillator developed by Alexander Elder and and described in his book "Trading for a Living: Psychology, Trading Tactics, Money Management". Elder based on the following premises when deducing this oscillator:

- moving average is a price agreement between sellers and buyers for a certain period of time,

- the lowest price displays the maximum sellers' power within the day.

On these premises, Elder developed Bears Power as the difference between the lowest price and 13-period exponential moving average (LOW - EMA).

Usage:

This indicator is better to use together with a trend indicator (most frequently Moving Average):

- if trend indicator is up-directed and the Bears Power index is below zero, but growing, it is a signal to buy;

- it is desirable that, in this case, the divergence of bases were being formed in the indicator chart.

Calculation:

The first stage of this indicator calculation is calculation of the exponential moving average (as a rule, it is recommended to use the 13-period EMA).

BEARS = LOW - EMA

where:

- BEARS - Bears' Power;

- LOW - the lowest price of the current bar;

- EMA - Exponential Moving Average.

In the down-trend, LOW is lower than EMA, so the Bears Power is below zero and histogram is located below zero line. If LOW rises above EMA when prices grow, the Bears Power becomes above zero and its histogram rises above zero line.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/15

Bollinger Bands ®

Bollinger Bands ®

The Bollinger Bands ® Indicator (BB) is similar to Envelopes. The only difference is that the bands of Envelopes are plotted a fixed distance (%) away from the moving average, while the Bollinger Bands are plotted a certain number of standard deviations away from it.

Alligator

Alligator

The Alligator Indicator is a combination of Balance Lines (Moving Averages).

BW-ZoneTrade

BW-ZoneTrade

The Indicator paints the bars according to the Trade Zones, as proposed by Bill Williams.

Commodity Channel Index (CCI)

Commodity Channel Index (CCI)

Commodity Channel Index (CCI) measures the deviation of the commodity price from its average statistical price.