Join our fan page

- Views:

- 19986

- Rating:

- Published:

- 2013.01.25 15:25

- Updated:

- 2023.03.29 13:42

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

The real author:

Vadim Shumilov

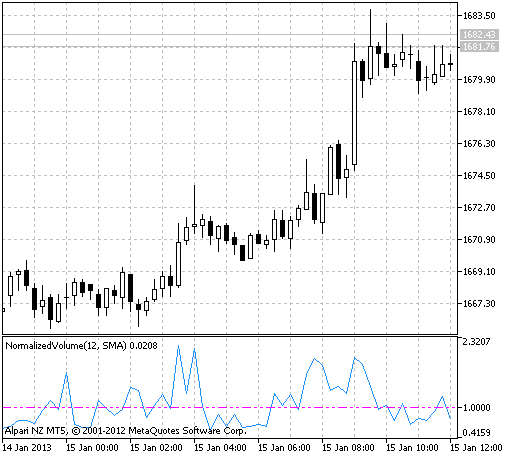

Normalized Volume is an indicator whose main purpose is to filter false signals which occur in the side movement of the market.

The basis of the strong side of the Normalized Volume indicator is a work with the volume and price, and a theory that occurrence of strong trend movements is, as a rule, supported by increase of the market volume. Therefore the Normalized Volumе indicator has low and high volume filtering.

The signal to open position occurs above the horizontal line "1", the price movement is strong enough and the breakthrough can be considered as true.

The principles of the Normalized Volume indicator are particularly useful in the breakthrough or rollback strategies, as they allow to go away from the unnecessary losses.

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging price series for intermediate calculations without using additional buffers".

Fig.1 The Normalized Volume indicator

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/1464

HawaiianTsunamiSurfer, a statistical look at determinant price explosions

HawaiianTsunamiSurfer, a statistical look at determinant price explosions

This system, based on Momentum indicator, assumes that very strong price movements are determinant. It consists in riding the appearing tsunamis, for instance, an important US Nonfarm Payrolls release. HawaiianTsunamiSurfer works well on AUDUSD, USDJPY and EURUSD.

Limit Stop Order Script

Limit Stop Order Script

The script for manual trade: when achieving the limit price the script sets stop order and logs out

bts

bts

Comparing the speed of a binary or a ternary search

Exp_ADX_Cross_Hull_Style

Exp_ADX_Cross_Hull_Style

The Expert Advisor is realized on the ADX_Cross_Hull_Style and UltraXMA indicators.