Test our product here

I’ve come across many trading strategies that boast seemingly flawless performance: high returns, high win rates, and minimal drawdowns. While these metrics might seem appealing to beginners, they often mask critical flaws. From a seasoned trader’s perspective, such “perfect” strategies often violate fundamental principles of trading. Worse, strategies that appear exceptional based on past performance can deliver disappointing—or even disastrous—results in live markets.

In this blog, I’ll share key fundamentals of trading strategies to help you recognize and avoid common pitfalls. My goal is to equip you with the knowledge to make smarter decisions and steer clear of the traps that many new traders fall into.

Different Types of Trading Strategy

For systematic trading strategies(using bot to execute trades), all of them fall into the following two kinds of strategies

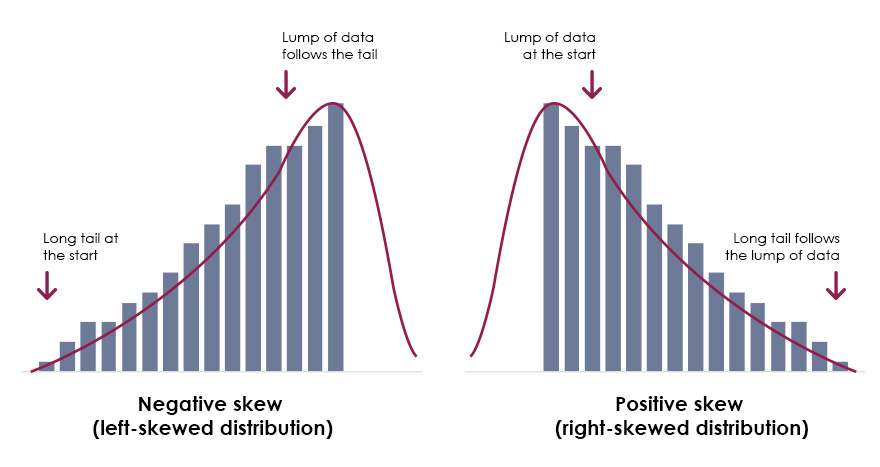

Positive Skew

A positive skew strategy is characterized by frequent small losses and infrequent large wins. As shown in the graph, the distribution features a long tail on the positive side, representing the potential for significant gains, while the majority of outcomes are clustered around small losses. These strategies typically have a low win rate but a high reward-to-risk ratio.

An example of a positive skew strategy is trend following, where the strategy aims to capture infrequent, large trends in an instrument over the course of a year. While losses may be frequent, the occasional large trend can more than compensate for them, making these strategies potentially very profitable in the long run.

Negative Skew

A negative skew strategy, on the other hand, is characterized by frequent small gains and occasional large losses. The distribution has a long tail skewed to the negative side, reflecting the risk of significant drawdowns. These strategies often have a high win rate, as small profits are accumulated consistently, but they carry the danger of infrequent but severe losses.

Examples of negative skew strategies include carry trades and spread betting. In carry trades, for instance, traders earn small, regular profits by taking advantage of interest rate differentials but are exposed to substantial risks during sudden market corrections or events of high volatility.

Summarised characteristics of strategies

| Positive Skew | Negative Skew |

|---|---|

| low win rate | high win rate |

| occasionally huge gains | occasionally huge losses |

| high reward-risk ratio | low reward-risk ratio |

Almost all trading strategies fall into one of these two types, and there is no such thing as a perfect strategy with a high win rate, high reward-to-risk ratio, and minimal drawdowns. This is a fundamental principle of trading strategies, and keeping it in mind can help you avoid many obvious scams.

So which strategy is better? The truth is, there’s no definitive answer. If you’ve analyzed enough trading strategies, you’ll understand that everything comes with a trade-off. To increase the win rate, you must compromise on the reward-to-risk ratio, and vice versa.

Positive skew strategies can deliver occasional massive wins, but they require significant patience and discipline to endure the frequent small losses encountered during regular trading days.

Negative skew strategies, on the other hand, provide frequent small gains in normal conditions but come with the risk of rare, catastrophic losses. Managing risk is particularly challenging with these strategies. A famous example is Long-Term Capital Management (LTCM), a hedge fund from the 1990s that relied heavily on negative skew strategies and ultimately collapsed during a financial crisis.

How to measure a strategy

With an understanding of strategy types, a natural question arises: How do we compare the performance of trading strategies? While high returns often grab our attention, it’s crucial not to overlook the underlying risks. In financial markets, return and risk are inherently linked. The fundamental principles of trading dictate that no strategy offers high returns with low risk, making risk measurement essential for evaluating any strategy.

To illustrate the importance of risk, consider the following returns:

strategy 1: [10, 8, 12, 10] strategy 2: [5, 25, 7, 3] strategy 3: [7, -2, 15, 20]

Each of these strategies yields an average return of 10%, but which one is better? Intuitively, many would choose Strategy 1 for its stability. This highlights a key metric for evaluating risk: the stability or uncertainty of returns. Humans are naturally risk-averse, and when it comes to money, we gravitate towards predictability and lower uncertainty.

To measure risk mathematically, we use variance and standard deviation. Here are the standard deviations for the strategies above:

strategy 1: 1.41 strategy 2: 8.77 strategy 3: 8.33

To combine risk and return into a comprehensive measure, we use the Sharpe Ratio.

The Sharpe Ratio measures how well an investment’s returns compensate for its risk. It compares the average return of an investment (above the risk-free rate) to its volatility (standard deviation of returns).

Simplifying this concept, we can use the return divided by the standard deviation to calculate the Sharpe Ratio for the strategies:

strategy 1: 7.07 strategy 2: 1.14 strategy 3: 1.20

Based on the Sharpe Ratio, Strategy 1 clearly stands out with its superior risk-adjusted return.

Now, suppose you could only choose between Strategy 2 or Strategy 3. The Sharpe Ratio suggests that Strategy 3 is slightly better. However, Strategy 3 also has a losing year, introducing additional uncertainty. This can be measured by drawdowns.

To account for drawdowns alongside returns, we use another metric: the Calmar Ratio.

The Calmar Ratio compares an investment’s average annual return to its maximum drawdown, providing a balance between risk and reward.

In this simplified example, Strategies 1 and 2 have no drawdowns, resulting in infinite Calmar Ratios. In real-world scenarios, however, drawdowns are inevitable, making this ratio reliable for comparing strategies

What is a Realistic Performance?

By now, we understand that there’s no perfect strategy—higher returns always come with higher risks. The best traders can do is explore diverse trading ideas to increase returns and use diversification to reduce risk. Even the most advanced trading strategies have limits.

Empirically, the Sharpe Ratio for active trading strategies rarely exceeds 2. Strategies performing above this threshold over extended periods are highly unlikely to be sustainable.

For example, Long-Term Capital Management (LTCM), a famous hedge fund in the 1990s, initially achieved nearly 40% annual returns with minimal drawdowns. However, it employed negative skew strategies, and a financial crisis ultimately wiped it out. While there were multiple factors behind LTCM's collapse, the takeaway is clear: no strategy can consistently outperform (Sharpe Ratio > 2) over the long term.

In general:

- A Sharpe Ratio > 1.0 is considered very good.

- Increasing returns always requires accepting more risk.

This trade-off is a fundamental constraint, akin to gravity for life on Earth.

Why do Some Backtests Look Too Good to Be True?

When browsing strategy marketplaces, you may encounter strategies with unrealistically high Sharpe Ratios. These "off-the-charts" results often have underlying issues:

Overfitting

Overfitting occurs when a strategy is overly tailored to historical data, capturing noise and randomness that won’t repeat in the future. It’s like memorizing answers for a specific test rather than understanding the subject. Such strategies perform exceptionally well in backtests but fail in live markets.

Imperfect Backtesting

Backtesting in platforms like MetaTrader has many limitations, including low-quality data, inaccurate tick values, and missing costs (e.g., swaps or fees). Even with these issues resolved, backtesting results should only serve as directional estimates—not exact predictors of live trading performance.

Ignoring Trading Costs

For active strategies, trading costs can consume over 30% of profits. Costs such as spreads, commissions, and slippage vary depending on leverage and brokers, and many backtests fail to account for these real-world expenses.

Unmanaged Risks

Even strategies with stellar paper results can be risky. Key questions to ask include:

- How is risk managed?

- Does it use negative skew strategies prone to catastrophic losses?

A strategy that appears "too good to be true" on paper could lack robust risk management.

How we Approach Strategy Development

At @Lookatus, we focus on idea-driven strategies grounded in well-researched trading concepts. To avoid performance-driven overfitting, we emphasize robust design and realistic testing. Our risk reduction approach includes:

- Strict stop-loss controls.

- Highly diversified portfolios across multiple markets.

- Risk-weighting based on correlation rather than performance.

During testing, we address backtesting limitations by:

- Using high-quality data.

- Implementing offline simulations to account for real-world costs.

- Evaluating instruments over extended periods (10+ years).

Summary

In this blog, we discussed the principles and characteristics of trading strategies, how to measure their performance, and the pitfalls to avoid. By understanding these fundamentals, you’ll be better equipped to identify failing strategies and make informed trading decisions. Remember: there is no perfect strategy—only informed trade-offs between risk and reward.

About Us

We are @lookatus, a dedicated team of traders and engineers committed to creating REAL profitable, systematic trading solutions. With a strong foundation in quantitative analysis and cutting-edge technology, our mission is to deliver reliable, data-driven trading systems that capitalize on market opportunities with precision and consistency. Beyond building advanced tools, we are passionate about empowering traders through practical education, equipping them with real, actionable insights to navigate markets intelligently and successfully.

Contact us at: haylookatus@gmail.com

Checkout our product here.