Maximizing Nexus Potential: Efficient Use of Privilege Sets and Backtesting Results

The Nexus expert advisor is designed to offer traders a wide variety of customization options, and Privilege Sets play a fundamental role in optimizing trading strategies. In this article, we’ll explore how to use Privilege Sets effectively, how to interpret backtesting results, and the value of Monte Carlo tests to ensure the robustness of configurations.

1. What are Privilege Sets?

Privilege Sets are predefined Nexus configurations designed to provide a more conservative approach, limiting risk and allowing precise control over the maximum number of open trades. These sets were developed with traders seeking a solid, low-risk trading strategy in mind. Each Privilege Set has a specific limit on allowed trades, ranging from 4 to 7, depending on the set. This limit helps reduce losses in adverse market scenarios, maintaining a sustainable and controlled strategy.

2. Analyzing Privilege Sets: Sharpe Ratio and Profitability

When evaluating the performance of each Privilege Set, Nexus uses several key indicators, including the Sharpe ratio and the Net Profit/Drawdown ratio, which can calculate up to 40 times the profit compared to balance reduction. Additionally, a custom analysis criterion evaluates the number, quality of trades, and drawdown periods to define the consistency of the set over time.

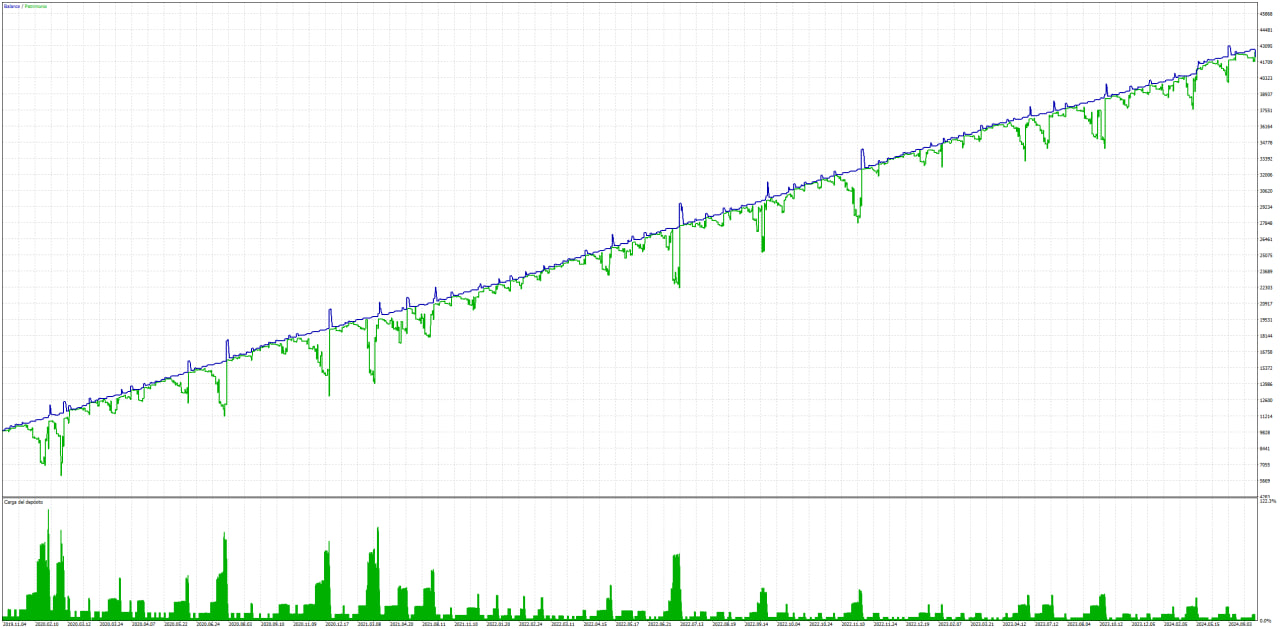

To ensure the robustness of these parameters, backtesting is conducted over periods of up to 10 years. By assessing results over such an extensive interval, traders can trust the stability and resilience of these sets, even under variable market conditions.

3. Backtesting and Optimal Configurations

Nexus is based on a backtesting methodology of five years of optimization and five years of real-time testing (walk forward). This process involves optimizing a set over a specific period and then testing it over a time frame that wasn’t used for optimization. If the results in both periods are consistent, the set is considered robust.

Backtesting is conducted with a fixed lot size of 0.01 per 1000 euros, ensuring that results are as consistent and stable as possible. Selected sets must show a minimum number of trades, a high Sharpe ratio, and consistent results in both optimization and testing periods. In this way, Nexus offers a balanced, market-adapted strategy at all times.

4. The Importance of Monte Carlo Tests

To evaluate configuration robustness, Nexus employs Monte Carlo tests, which consist of conducting thousands of simulations of possible outcomes based on historical data. Specifically, up to 5,000 variations of trades are performed using the random sampling method, providing a more accurate view of future expectations for the sets and the EA’s overall behavior.

These tests are essential because they allow traders to verify if a configuration is truly solid and consistent across multiple market scenarios. Unlike an ideal performance curve, Monte Carlo tests allow for verification of Nexus’s adaptability to changing conditions, helping to avoid over-optimization. Practically, the test shows how Nexus might react in a real account over the long term, assisting traders in making informed decisions.

5. Result Evaluation: Drawdown Periods and Decorrelation

A key factor in backtesting and Privilege Sets is Nexus’s ability to handle drawdown periods, during which the account balance doesn’t increase and may even temporarily decrease. In conducted tests, there was a drawdown period of up to 59 days, during which the balance didn’t grow, and the account took time to recover the initial value. This drawdown analysis helps manage expectations and prepares traders for future scenarios while maintaining confidence in the strategy.

Additionally, the Nexus EA works on decorrelating its sets, helping to avoid simultaneous losses on correlated assets. This translates into a portfolio design where, although some currency pairs may experience negative performance, others can compensate, providing stability to the overall portfolio.

Conclusion

The efficient use of Privilege Sets in Nexus is a fundamental tool for those looking to maximize profitability while minimizing risk. Backtesting and analysis through Monte Carlo tests help confirm the robustness of these configurations, providing traders with a balanced, market-adapted automated strategy. By understanding and leveraging the results of these analyses, users can effectively optimize Nexus and maintain a long-term trading strategy with greater confidence.

Maintaining a clear perspective on drawdown periods and set decorrelation is also essential, as it provides a realistic view of Nexus’s performance. With these tools and approaches, Nexus becomes a secure and robust automated trading solution for traders seeking to trade professionally.

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️ NEW MQL5 GROUP: https://www.mql5.com/en/messages/01c72081307dda01

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🗒 FULL USER GUIDE: https://www.mql5.com/en/blogs/post/759068