Principles of Trailing Stop in the Prop GT Expert Advisor: How to Maximize Profits

Trailing stop is a key tool for optimal risk management in trading on the Forex market. This tool not only protects the already accumulated profit, but also gives you the opportunity to increase it by adapting to the current market conditions. In this article we will study in detail how the trailing stop function in the Prop GT Expert Advisor allows traders to maximize their profits while providing reliable protection from possible losses.

Download Prop GT Expert Advisor

What is the Trailing Stop for?

Before we understand what the Trailing Stop is for, let's understand what it is. Trailing stop is a type of order for closing a trading position, which automatically moves to increase your profit if the market moves in your favor. Trailing stop can be compared to a smart shadow that follows the trader as he or she moves forward on the profit trail. If the trader moves forward, his shadow (trailing stop) stretches behind him, maintaining a certain distance. But if the trader stops or starts to retreat back, the shadow also stops and does not move back, thus protecting the distance passed from potential losses. This allows to automatically protect part of the accumulated profit, even if the market situation suddenly changes.

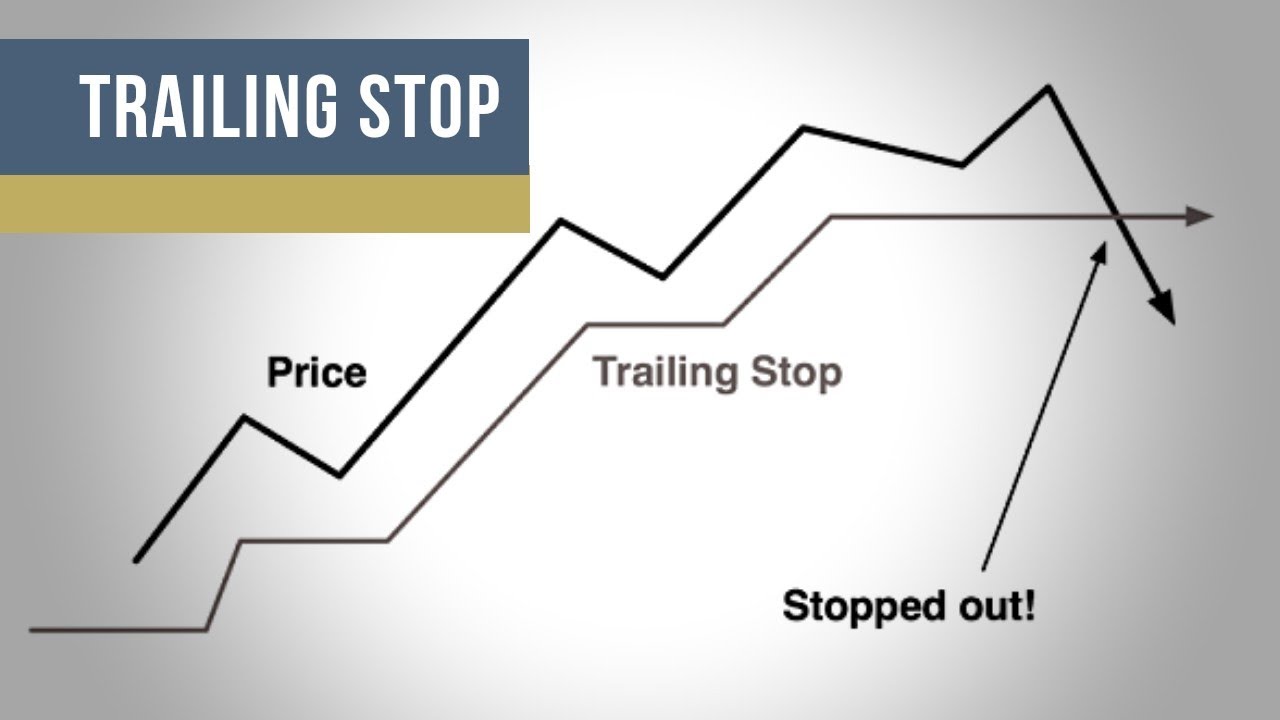

Fig.1. Trailing Stop

In Figure 1 you can see how Trailing Stop works with an open trade. When you set a normal StopLoss and TakeProfit, if the price turns sharply against you before reaching the TakeProfit, your trade may close at the StopLoss and you will lose your money. If you use a trailing stop, you will get part of the profit even if the market turns sharply against you. This approach allows you to minimize account drawdowns, which makes it possible to use Prop GT on Prop Firm accounts.

How does trailing stop help to fix profit in time?

An important function of Trailing Stop is its ability to fix profits in time, thus minimizing potential losses in case of unexpected market reversals. When a trader sets a trailing stop, he adjusts it in such a way that this order follows the market price at a given distance. If the asset price rises, the trailing stop moves up, maintaining the set distance to the current price and thus increasing the unrealized profit.

Example of Trailing Stop operation:

Let's assume that the Prop GT Expert Advisor has opened a position to buy the EURUSD currency pair at the price of 1.1000 and set a trailing stop at 30 pips below the opening point. If the price rises to 1.1050, the trailing stop will automatically rise to 1.1020, thus protecting 20 pips of profit. In case the price suddenly starts to decline, the trailing stop will be triggered at 1.1020, allowing the Expert Advisor to save some of the accumulated profit and prevent potential losses.

In conclusion, the Trailing Stop plays a key role in the risk management strategy of the Prop GT Expert Advisor. This tool not only helps to protect the accumulated profit, but also allows to maximize it, adapting to the current market conditions. Application of trailing stop on Prop GT accounts is especially important, as strict risk control and timely closing of positions can have a decisive impact on success in passing trading challenges. Thus, a trailing stop significantly improves trading efficiency, making it safer and more profitable.

Join our community of traders in Telegram chat @prop_ea, where you can see the results of users who are already using the Expert Advisor, get support on Prop GT related issues and be the first to know about new updates.