About System:

Arrows Available here (Free):

https://www.mql5.com/en/market/product/45900

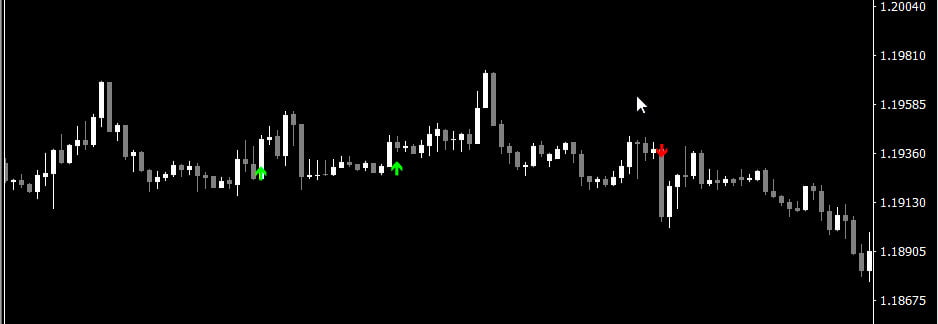

The Best Heiken Ashi System is a simple trading system: Heiken ashi smoothed and Vqzz/NRTR indicator multi-timeframe.

The system was created for scalping and day trading but can also be configured for higher time frames. As mentioned, the trading system is simple, you get into position when the two indicators agree.

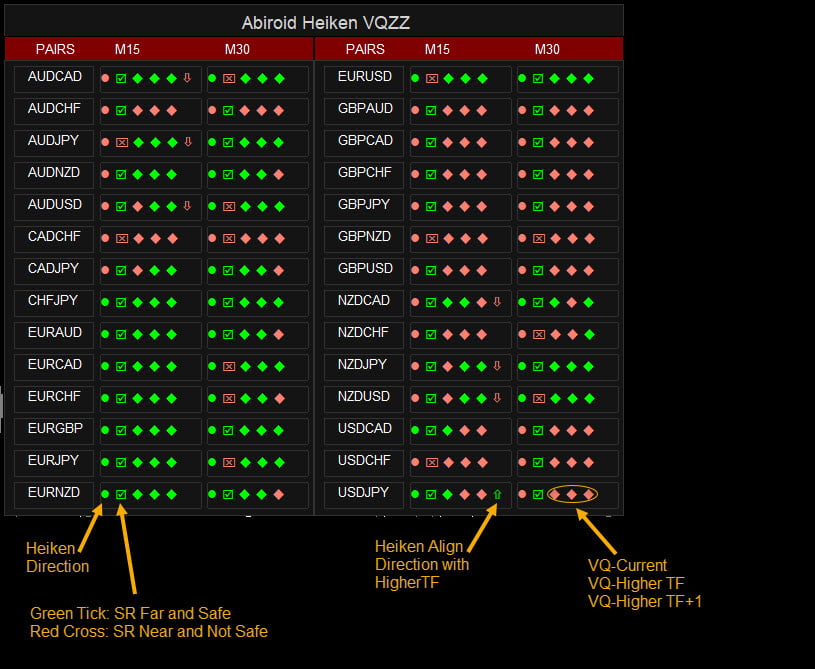

Scanner dashboard available here (Paid):

https://www.mql5.com/en/market/product/46269/

Based on strategy here:

Note: VQZZ is based on higher timeframes. e.g, H1 Timeframe will be based on H4.

So, while higher H4 is still forming, the last 4 candles on H1 will also be forming. And VQZZ might change colors.

If you want it to be fully Non-repainting, then use NRTR instead for trend detection.

Indicator Settings used:

Pivot Daily levels or Fibonacci levels for take profit and Support and resistance.

Wait Bars VQZZ After Heiken Switch: After Heiken Ashi has changed, number of bars to wait for VQZZ to align.

e.g.: If Heiken has turned green, wait for current TF VQZZ to turn green and at least one of the 2 Higher Timeframe VQZZ to turn green.

Buy Arrow appears when:

- Heiken Ashi green color.

- “VQZZ Trend Align Check” (Optional)

VQzz green bar on Current TF and is Aligned with current.

- “Heiken Trend Align Check” (Optional)

Higher timeframe Heiken should be Aligned with current.

- NRTR Check (Optional)

Blue NRTR Support line should be below price

- Use HTF Peak Trend

Next higher timeframe last 3LZZ Peak should indicate Up trend. Or you can use this Zigzag indicator to see multiple higher timeframes:

ZigZag_MTF.ex4- 1.0

All Vice-versa for Sell.

If price has already gone too far at BUY/SELL Arrow, then wait a few bars for a retracement back to Heiken Ashi price.

Then trade BUY/SELL once price starts moving back in direction of the arrow.

Or use BUY/SELL Limit to place trade at nearest Pivot Levels.

How the checks work:

- Find Heiken Change

- If “Trend Align Check VQZZ” true: Check if VQZZ Timeframes aligned with Heiken.

Original VQZZ uses next higher timeframe to get data for trend detection. So it can repaint the last few bars which match the higher timeframe.

Because we have smoothing set. But this arrows indicator uses VQZZ2.

eblnTrueMode: When set to true, VQzz2 will not repaint previous chart bars to “match” the data from the upper time frame.

If set to false, VQZZ2 will behave exactly like VQZZ original. And might repaint last few bars based on higher timeframe current bar’s changing trend.

Because VQZZ is based on higher timeframe values. So while Bar 0 is still forming on suppose H4… the last 4 bars of H1 will still be forming. And VQZZ might repaint.

Is eblnTrueMode is true, then it wont’ do any smoothing. Meaning it won’t repaint any past bars. But while Higher TF is still forming, the last few corresponding bars of lower TF vqzz will also still be forming.

“Num of TFs For VQZZ Aligned” If it’s 3, it will check current timeframe and 2 higher timeframes.

- If “Timeframes Aligned with Heiken” is All then it will check all timeframes

- If it’s Any: then it will check at least one of the higher timeframes is aligned with current timeframe

So, even if 1 is aligned, it will still send an Alert and Highlight the box.

- It will wait for “Wait Bars VQZZ After Heiken Switch” number of Bars for VQZZ to align. If still not aligned, that Heiken change signal is ignored.

- If “Trend Align Check Heiken” true:

Check if Heiken Ashi for Higher timeframes is aligned with current timeframe.

If “Num of TFs For Heiken Check” is 3, it will check current timeframe Heiken and 2 higher timeframes Heiken color.

- Use NRTR for Support/Resistance and to get current trend if NRTR Check true

- Use 3LZZ Semafor (or Zigzag) to find next higher timeframe (HTF) Peaks if true. So only get signals in direction of higher timeframe’s ongoing trend.

Exit position

When Heiken Ashi changes color or at the pivot points, quarters or Fibo levels. And kind of SR indicator. Pivots usually act like magnet level and price slows down and ranges near them.

Place initial stop loss at any SR level you usually use.

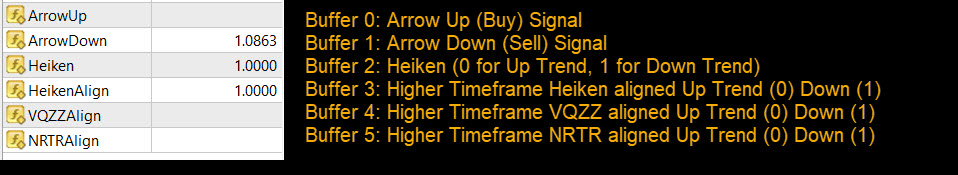

Buffers:

Empty value in buffer means: a signal is not there.

Trade Types:

Heiken Vqzz System only works on good volatility trending markets.

Use this indicator to find good volatility:

CHV_Histogram.ex4

Avoid trading when market is in low volatility or ranging:

Also avoid markets with sudden whipsaws, where price fluctuates too much and is unsteady. Or very choppy markets where price jumps suddenly and there are breaks between closing current bar and opening price of next bar.

This usually happens during a news event. So be careful and wait it out.