Demystifying Moving Averages:

A Guide for Forex Traders

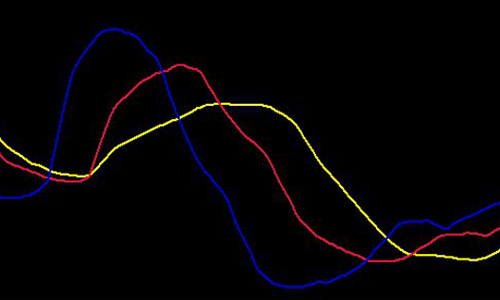

Moving averages (MAs) are a cornerstone of technical analysis in the forex market. By smoothing out price fluctuations, they help traders identify trends, gauge support and resistance levels, and make informed trading decisions.

Why are Moving Averages Important?

Imagine staring at a live forex chart – the price action can be erratic and difficult to interpret. Moving averages address this by creating a constantly updated average price over a chosen period. This smoothed line cuts through the noise, revealing the underlying trend and potential turning points in the market.

- Trend Identification: MAs act as a trend filter, highlighting the underlying direction (uptrend, downtrend, or sideways) by cutting through short-term price noise.

- Support and Resistance: A rising MA can indicate potential support, while a falling MA can signal resistance. Prices often find temporary pauses or reversals around these moving averages.

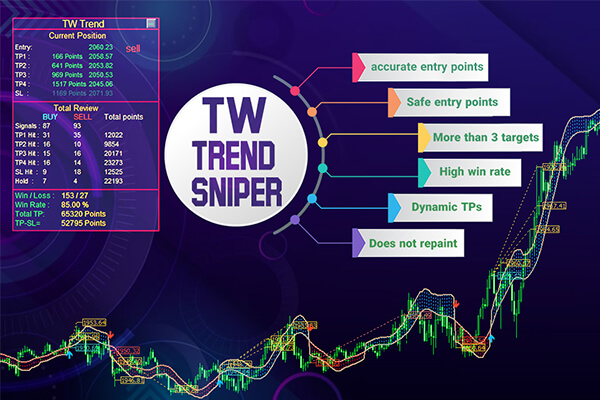

- Trading Signals: Crossovers between different MAs or the price itself can generate buy and sell signals. For example, a shorter MA crossing above a longer MA might suggest a bullish trend.

Types of Moving Averages and Their Applications:

There are several types of moving averages, each with its own calculation method and trading applications:

- Calculation:

SMA = (Price1 + Price2 + ... + PriceN) / N

- Application: The SMA is a good starting point for identifying trends. A rising SMA suggests an uptrend, while a falling SMA indicates a downtrend. SMAs are often used in conjunction with other technical indicators for confirmation.

- Calculation:

EMA (today) = (α * PriceToday) + [(1 - α) * EMA (yesterday)]

Here, α (alpha) is a smoothing factor (typically between 0.02 and 0.33) that determines the weight given to the current price. A higher alpha results in a more responsive EMA.

- Application: EMAs are preferred by many traders due to their faster reaction to price movements. They are useful for spotting trend reversals and generating trading signals.

3.Weighted Moving Average (WMA): Similar to the EMA, the WMA assigns weights to prices within the look-back period. However, unlike the EMA's exponential weighting, the WMA assigns a user-defined weight to each price, with more recent prices typically receiving higher weights.

- Calculation:

WMA = (Weight1 * Price1 + Weight2 * Price2 + ... + WeightN * PriceN) / (Weight1 + Weight2 + ... + WeightN)

- Application: WMAs allow traders to customize the emphasis on specific periods within the look-back window. For instance, a WMA with higher weights for recent prices can be used to identify short-term trends.

Advanced types of moving averages:

1.Smoothed Moving Average (SMMA):Similar to the SMA, the SMMA calculates the average price over a period. However, it applies a two-step averaging process for a smoother result.

- Calculation:

Calculate a simple moving average (SMA1) for the chosen period (n).

Calculate another SMA (SMA2) using the values from SMA1.

The final SMMA is often SMA2, providing a more refined trend view compared to the standard SMA.

- Application: Ideal for scalpers and short-term traders who want to minimize price noise and focus on very short-term trends.

2.Linear Weighted Moving Average (LWMA): The LWMA assigns weights to prices within the period, with more recent prices receiving higher weights. This creates a smoother transition between price movements compared to the WMA.

- Calculation:

LWMA (n) = [(Price(t) * 1) + (Price(t-1) * (n-1)) + ... + (Price(t-n+1) * n)] / n

n = number of periods

Price(t) = price at the current time (t)

- Application: LWMA is suitable for swing traders who want to capture trends while reducing the choppiness of shorter-term MAs.

- Calculation:

VWMA (n) = Σ (Volume(i) * Price(t-i+1)) / Σ Volume(i)

n = number of periods

Volume(i) = trading volume at time t-i+1

- Application: The VWMA is helpful for identifying trends supported by high trading volume, potentially indicating stronger market conviction.

- Calculation:(The calculation for KAMA is quite intricate and involves multiple steps. It's recommended to use software with built-in KAMA functions.)

- Application: The KAMA excels at identifying trends in volatile markets where traditional MAs can be less effective due to excessive whipsaws.

- Calculation:(The HMA calculation involves multiple steps and intermediate calculations. It's best suited for use with trading software.)

- Application: The HMA offers a clear trend view with minimal lag, making it valuable for identifying trend direction and potential entry/exit points.

- Calculation (1st EMA):

EMA1 (today) = [α * Price(today)] + [(1 - α) * EMA1(yesterday)]

- Calculation (DEMA):

DEMA (today) = [α * EMA1(today)] + [(1 - α) * DEMA(yesterday)]

α = smoothing factor

- Application: The DEMA is useful for identifying very long-term trends and filtering out even more short-term volatility. It's helpful for long-term forex traders with a positional approach.

- Calculation Formula (refer to DEMA formulas for calculation steps)

- Application: The TEMA is best suited for identifying very long-term trends with minimal noise. It can be a good tool for gauging overall market sentiment over extended periods.

8.Adaptive Moving Average (AMA): The AMA is a dynamic moving average that adjusts its smoothing factor based on market volatility. During volatile periods, the AMA emphasizes recent prices, while in calmer markets, it behaves more like a standard SMA.

- Calculation: The AMA calculation is relatively complex and involves multiple steps. Software platforms typically handle the calculations for traders.

- Application: The AMA is beneficial for traders who want an adaptable moving average that reacts to changing market conditions.

Remarkable point:

Remember, these are just a few examples, and there are many variations and combinations of moving averages. Experimenting and backtesting with different MAs will help you determine which ones suit your trading style and market conditions.

Choosing the Right Moving Average:

The best moving average for you depends on your trading style and goals. Here's a general guideline:

- Short-term traders: Shorter-lookback period EMAs or WMAs with a focus on recent prices can be helpful.

- Long-term traders: Longer-lookback period SMAs or EMAs with a smoother response can be used.

Happy trading

may the pips be ever in your favor!