n modern trading, there are different types of levels that traders use as reference points on price and time charts. Let's explore some of these levels:

- Horizontal Levels: Horizontal lines on a chart represent price levels. Traders often identify significant support and resistance levels where price has historically reacted, reversed, or consolidated. These levels act as psychological barriers and can influence future price movements.

- Vertical Levels: Vertical lines represent time intervals on a chart. Traders may use these lines to mark important events, such as economic releases, news announcements, or specific trading sessions. Vertical levels help in understanding the timing and duration of market movements.

- Diagonal Levels: Diagonal lines, including trendlines or channels, indicate the change in price over time. They reflect the speed or slope of price movements. Traders use trendlines to identify the direction of the market and potential entry or exit points.

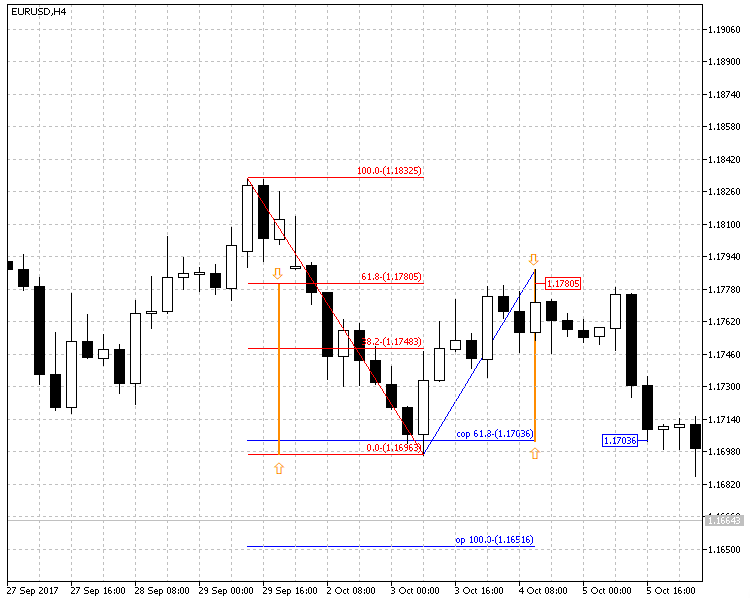

Other curved lines drawn by indicators or chart patterns can also fall under the category of diagonal levels. These lines capture the changing dynamics of price movements. Why do these levels work? One reason is that traders often buy and sell in markets with the goal of making profits. Additionally, periodic (oscillatory) systems inherently have a limited range of price oscillations, which can be observed in the markets. Moreover, people naturally like to make plans, and building plans based on known data is more reliable. For example, a simple yet effective trading strategy might involve buying an asset, holding it until its price doubles, and then selling it. Here, the "natural" price level is 100%. Traders may also consider protecting their capital by placing stop-loss orders if the price moves against their expectations. Some traders draw lines or bands on charts to mark the beginning and end of trends, assuming that the price will at least reach halfway toward the marked distance, given its initial movement. Traders place their orders at these levels to minimize risks. They prefer taking half of the potential profit rather than missing out entirely due to a sudden reversal. This thinking leads them to create a level at 50%. Each new or obvious idea based on common sense, supported by statistics and published findings, provides the basis for accumulating orders at specific zones. In most cases, these zones can be calculated, allowing traders to leverage the advantage provided by this knowledge.

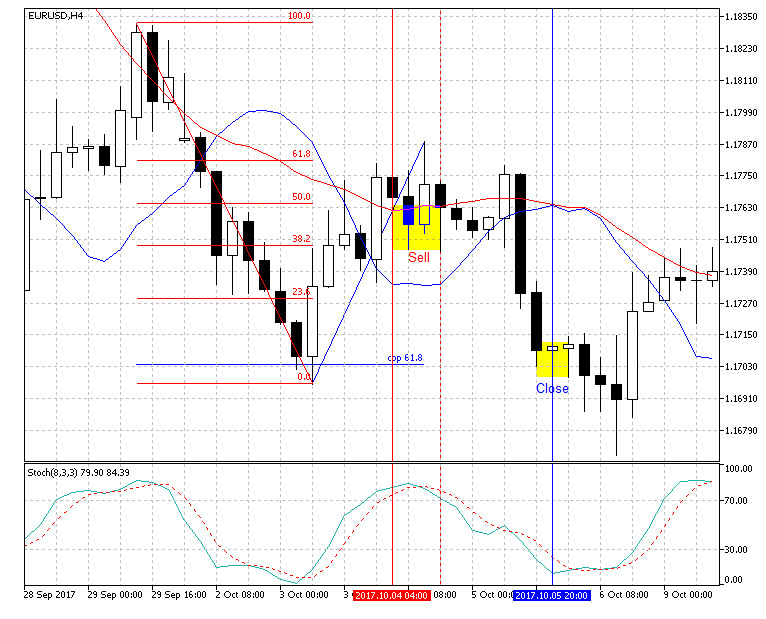

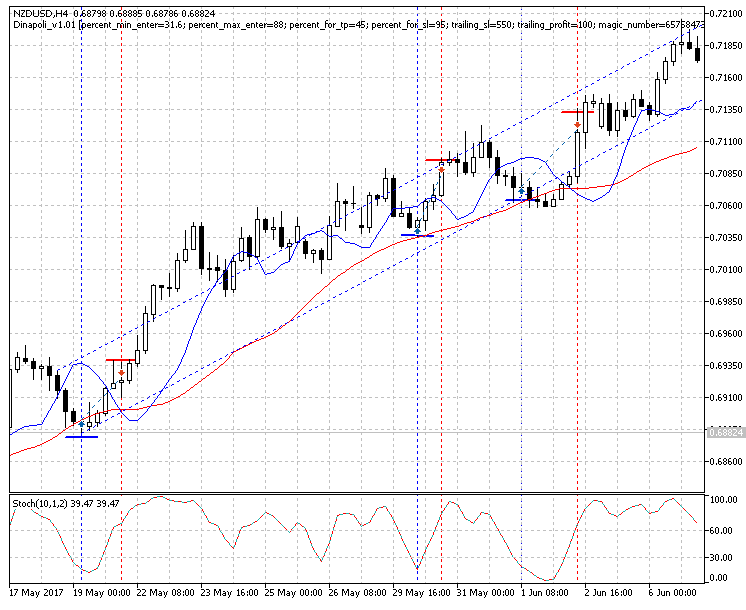

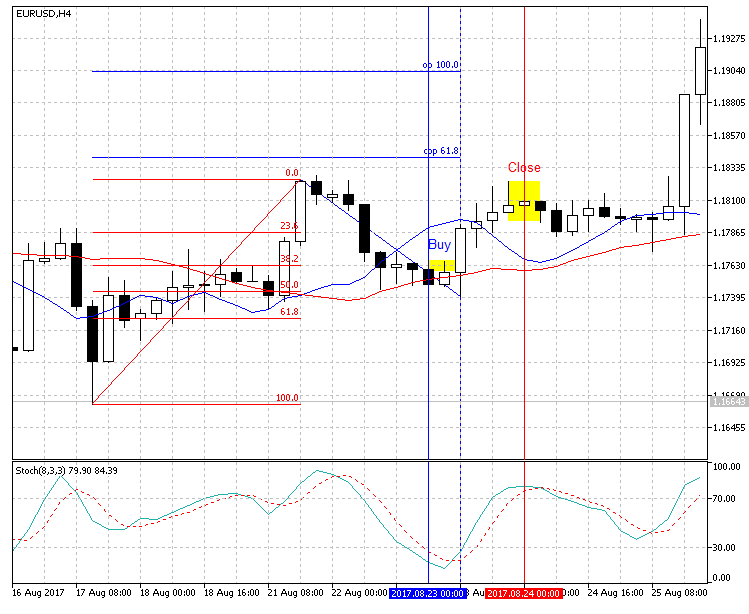

Expert Advisor New Era V Uses in its main trading base DiNapoli levels.

With the use of Dinapoli Levels, the Expert Advisor finds clearer entry and exit points: DiNapoli Levels provide clear signals for entering and exiting trades, helping you make informed trading decisions.

Improved risk management. These levels help you set stop losses effectively, contributing to better risk management in the forex market. Trend Identification. DiNapoli levels help traders identify market trends, allowing them to align trades according to the current market direction.