Why we can't trade without this indicator? (See Tutorial Video)

Precision Trading: Introducing Our MT5 Indicators for Optimal Market Insights

We have set a premium price for our MT5 indicators, reflecting over two years of development, rigorous backtesting, and diligent bug fixing to ensure optimal functionality. Our confidence in the precision and accuracy of our indicators is such that we regularly showcase them in real-time market conditions through daily content on our social media channels.

Our belief in trading simplicity, adhering to the principle of buying low and selling high (or vice versa), is echoed in our indicators' clear display of potential entry and exit points. We consistently provide daily content demonstrating our indicators in action. Additionally, we offer traders the opportunity to rent our indicators for $66 per month. This allows traders to test the indicator for one month with their chosen trading pair before committing to a yearly subscription.

We are committed to monitoring user feedback closely and making necessary improvements to our indicators should any bugs arise, ensuring that traders have access to the most effective tools for their trading endeavours.

Chart Clarity Dashboard MT5 - CLICK HERE TO BUY

Chart Clarity Dashboard MT4 - CLICK HERE TO BUY

Compatibility: Chart Clarity dashbaord works with all financial instruments currency pairs, indicies, equities, commodities and cryptocurrencies

The Chart Clarity Dashboard provides clear insights into price movements for various financial instruments like currency pairs, equities, cryptocurrencies, commodities, and indices. This dashboard displays detailed price information in real-time, making it easier for traders to make decisions quickly. It shows price movements down to the second, giving you essential data before you trade or analyze charts.

Chart Clarity Dashboard allows you to monitor price changes across all time frames and session. Changes in colour of numerical values indicate bullish or bearish momentum, showing whether the price is above or below the open price for the given timeframe.

The dashboard also saves daily activity as a CSV file within an internal folder on MT5, making historical data easily accessible for future analysis. Please refer to our attached YouTube video for valuable insights into the functionality and detailed breakdown of how the Chart Clarity Dashboard presents essential information, assisting traders view charts with clarity.

Key Features

- Analyze price action during the Asia, London, and New York trading sessions.

- Review price action for the current week, last week and last month.

- Track price action for the entire month down to the present second.

- Monitor price action hourly, across all trading sessions.

- View dynamic price action across all time frames and trading sessions in one place.

- View Candle close countdown timer specific to your trading time frame.

- Save daily trading activity in a CSV file for future reference or chart analysis.

- Experience real-time updates.

- Quickly visualize bullish or bearish momentum from market open, through colour representation of numerical values.

- Offers an intuitive interface for easy interpretation and analysis of incoming data.

- Displays fluctuations in trading activity throughout different hours of the trading session, identifying hours with concentrated trading activity.

- Visual representation of patterns in price action such as spikes, divergences or trends to to assist in making trading decisions.

- Can be used in conjunction with other technical indicators for comprehensive market analysis.

- Enables users to analyze historical price action to identify past trading patterns and trends for chart analysis.

- Allows users to personalize settings such as font colour, session selection, and time periods.

Numerical Value Colour Indication

- Blue Numerical Values - Bullish Momentum: Indicates the price is above the open or positive for the corresponding session or time-frame

- Red Numerical Values - Bearish Momentum: Indicates the price is below the open or negative for the corresponding session or time-frame, a (-) minus sign will appear next to the numerical value

Note: Any trading decision made should be based on independent analysis and a thorough understanding of fundamentals, rather than solely relying on the colour of numerical values.

Last Week/ Days

- Close Open: Difference between close & open price - Price gapping up or gapping down

- Open price: Opening price for the day

- Open High: Difference between open price & daily high

- Open Low: Difference between open price & daily low

- High Price: Highest price for the day

- Low Price: Lowest price for the day

- Close Price: Close price for the day

- Range: Difference between the highest and lowest prices of the day

Sessions

- Open: Opening price for the session

- High: Highest price during the session

- Low: Lowest price during the session

- Close: Close price for the session

- Open-Close: Difference between session open price & close price

- Range: Difference between the highest and lowest prices of the session

Hours

- Open High: Difference between open price & hourly high, within the respective session

- Open Low: Difference between open price & hourly low, within the respective session

- High Price: Highest price for the hour, within the respective session

- Low Price: Lowest price for the hour, within the respective session

- Open Close: Difference between open & close price for the hour, within the respective session

- Range: Difference between the highest & lowest prices for the hour, within the respective session

Time-Frames

- Open - Close: Difference between open & close price within the respective time frame

Extras

- Price: Current price of trading pair

- Time: Countdown timer for the next candle formation, within the respective time frame

- Save CSV: Save entire day's activity as a CSV file within an internal folder on MT5

*The attached GIF file showcases a 2.5-hour video of the Chart Clarity Dashboard in action, condensed into a few seconds

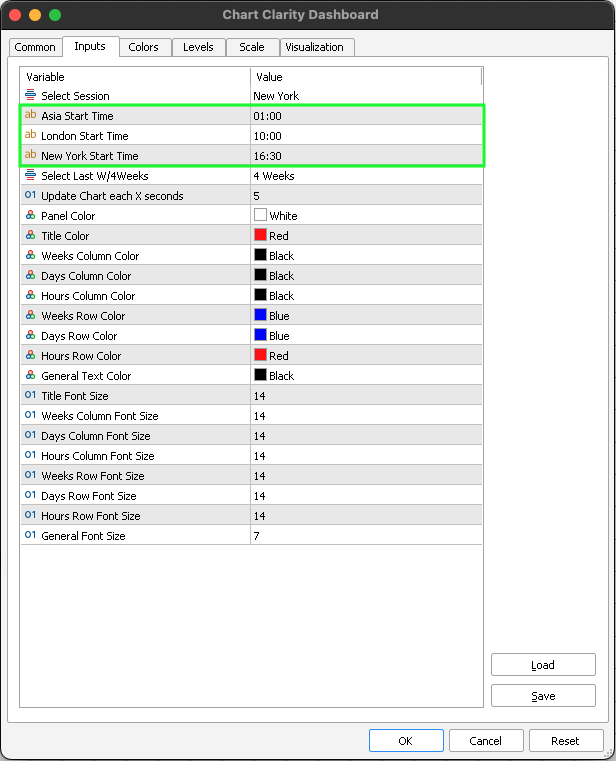

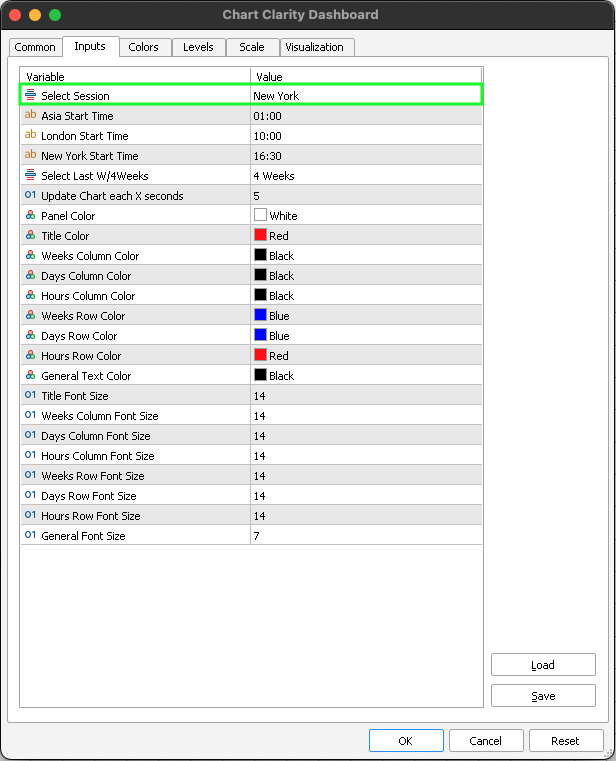

Chart Clarity Dashboard Settings

Select Session: You can opt to view data for three sessions: Asia, London, and New York. The indicator dynamically updates, displaying real-time data for the current day.

Asia Start Time: Adjust the timing for the Asia trading session manually, according to your country's time zone.

London Stat Time: Adjust the timing for the London trading session manually, according to your country's time zone.

New York Start Time: Adjust the timing for the New York trading session manually, according to your country's time zone.

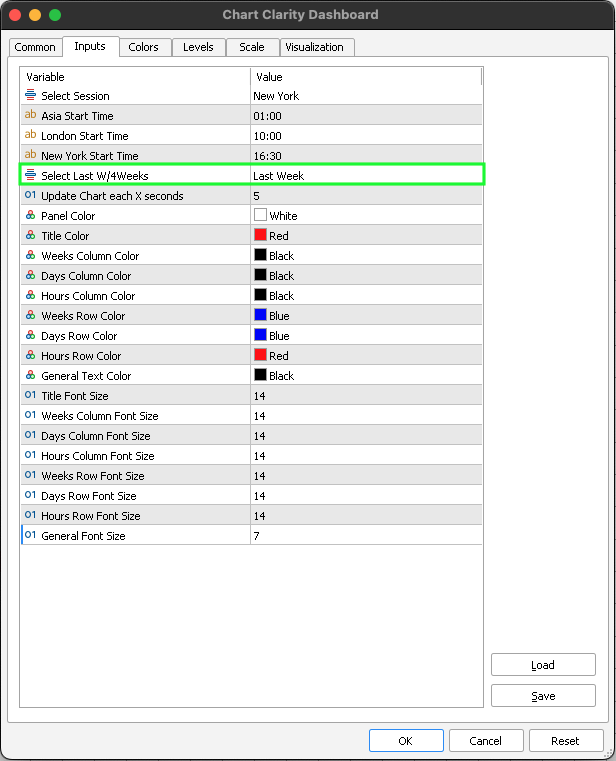

Select last week or 4 weeks: You have view to data for any trading pair for the past four weeks as well as individual daily data for the previous week, providing insights into price action and fluctuations.

Update chart each X seconds: The default setting for chart updates is configured to refresh every 5 seconds. This interval dictates how frequently the dashboard reveals new data. You can choose to decrease the update interval to 1 second for real-time updates.

Other settings: You can keep the remaining settings as default, they will not affect the indicator's performance or visual representation of the market data.

Chart Analysis: Preform chart analysis on a 4 weeks setting. The file saves automatically, allowing you to revisit it at any time for conducting your analysis.

Chart Analysis: Adjust the settings to last week, to analyse how your trading pair responded to earnings, news events and economic data throughout the previous week.

Day Trading Settings: If you trade in the New York session, ensure that your session setting is adjusted accordingly. You can navigate through sessions to conduct chart analysis, reviewing price action before trading in your selected session.

Session Time Zones: Adjust the timing for the Asia, London and New York trading sessions manually, according to your country's time zone. Verify the opening time of either session in your country and adjust the time to your preferred time zone based on your chart time. The adjustment ensures that the indicator accurately captures the price action data for the specified session.